Over billion worth of stablecoins is currently stored on certain cryptocurrency exchanges. Such an extensive amount sitting on the sidelines begs the question if traders are simply waiting for a definitive bullish sign to reenter the market.Over B Worth Of USDT and USDC On ExchangesAs Cryptopotato reported earlier this month, most stablecoins’ have been increasing drastically in terms of market capitalization. This came during some of the worst trading days for the cryptocurrency market when most digital assets plunged by as much as 50%.At that time, traders rushed to turn their cryptocurrency holdings to stablecoins. Consequently, their total market cap grew in contrast to the rest of the market.The popular monitoring resource, TokenAnalyst, recently exemplified another area where

Topics:

Jordan Lyanchev considers the following as important: AA News, Binance, Stablecoins

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

Bitcoin Schweiz News writes Bitpanda vs. Binance: Welche Bitcoin-App ist die beste für die Schweiz?

Over $1 billion worth of stablecoins is currently stored on certain cryptocurrency exchanges. Such an extensive amount sitting on the sidelines begs the question if traders are simply waiting for a definitive bullish sign to reenter the market.

Over $1B Worth Of USDT and USDC On Exchanges

As Cryptopotato reported earlier this month, most stablecoins’ have been increasing drastically in terms of market capitalization. This came during some of the worst trading days for the cryptocurrency market when most digital assets plunged by as much as 50%.

At that time, traders rushed to turn their cryptocurrency holdings to stablecoins. Consequently, their total market cap grew in contrast to the rest of the market.

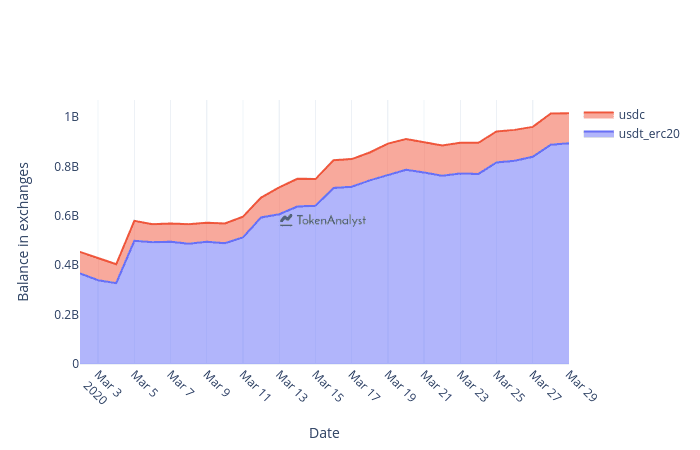

The popular monitoring resource, TokenAnalyst, recently exemplified another area where stablecoins have been rising. More specifically, USDT (ERC-20) and USDC stored on several cryptocurrency exchanges have exceeded the coveted $1B mark.

In March alone, which happened to be one of the most volatile months in a long time, USDT and USDC grew with approximately $600M. As one can see from the graph above, however, Tether continues to dominate with over 80% of the total share.

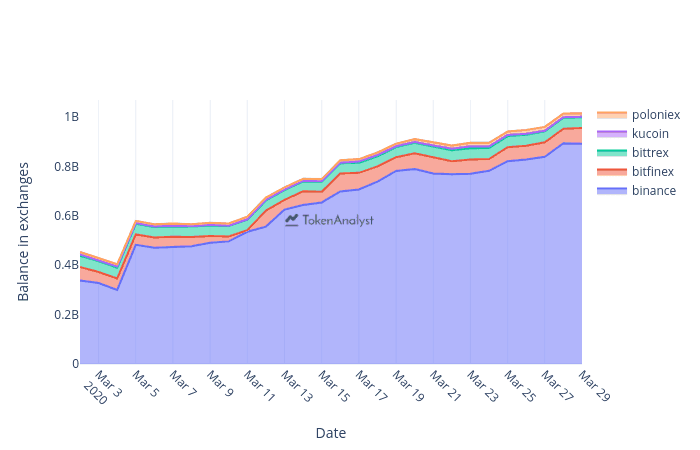

It’s also worth noting that TokenAnalyst examined data on five cryptocurrency exchanges. Those are Poloniex, Kucoin, Bittrex, Bitfinex, and Binance. The latter, being the leading platform by volume and users, has the most significant amount stored on it.

What Is That $1B Waiting For?

Traders who have allocated portions (or all) of their portfolios in stablecoins as a precaution due to the violent fluctuations could be waiting for bullish signals to reenter the market. If that is to happen, such a significant amount of over $1 billion could trigger rapid price movements with Bitcoin and the altcoins.

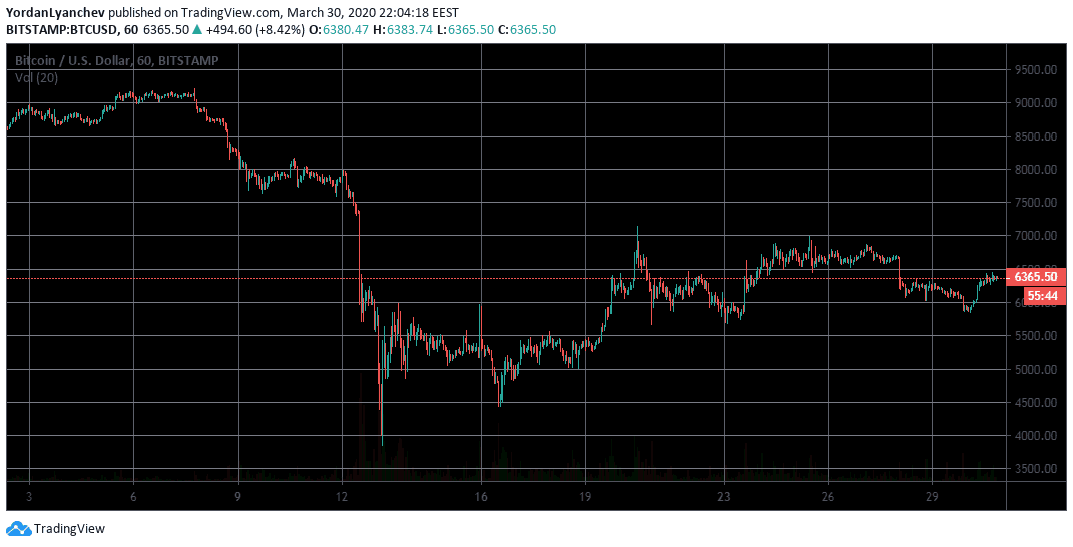

In a massively turbulent month, the primary digital asset seems healthy now, trading at $6,360. In the past 24 hours, it dipped to $5,850, but since then, it has gained over $500.

It’s now hovering around the first resistance level of $6,400, and if broken, the next ones are at $6,550 and $6,800. If, however, a descending price development is to occur, $6,000 is the first support, followed by yesterday’s low of $5,850.

Most alternative coins are in the green as well in the same timeframe. Ethereum is above $130, Litecoin is close to $40, Binance Coin over $12, and Bitcoin Cash is at $222.