Bitcoin’s most significant green candle happened on December 7, 2017, when traders started the day at 090 and pushed the token to 390 in 24 hours. That would be the first time a bullish candle broke the 900 line —an event that new investors are experiencing today. December 7 of 2017 can also be remembered as the perfect argument for those who claimed BTC was a bubble, as the token also registered a wick of 697 that day, its most significant growth ever with a 00 surge. 2017 and 2020 Are Similar… But Different Today, Bitcoin is flirting with the ,000 mark. Its peak during the last 24 hours stands at 977. That’s an 11.49% growth from the day before, putting the cryptocurrency at a mere 20% below its ATH. That places bitcoin as the cryptocurrency with the

Topics:

Felix Mollen considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Bull Run, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin’s most significant green candle happened on December 7, 2017, when traders started the day at $14090 and pushed the token to $17390 in 24 hours. That would be the first time a bullish candle broke the $15900 line —an event that new investors are experiencing today.

December 7 of 2017 can also be remembered as the perfect argument for those who claimed BTC was a bubble, as the token also registered a wick of $19697 that day, its most significant growth ever with a $5600 surge.

2017 and 2020 Are Similar… But Different

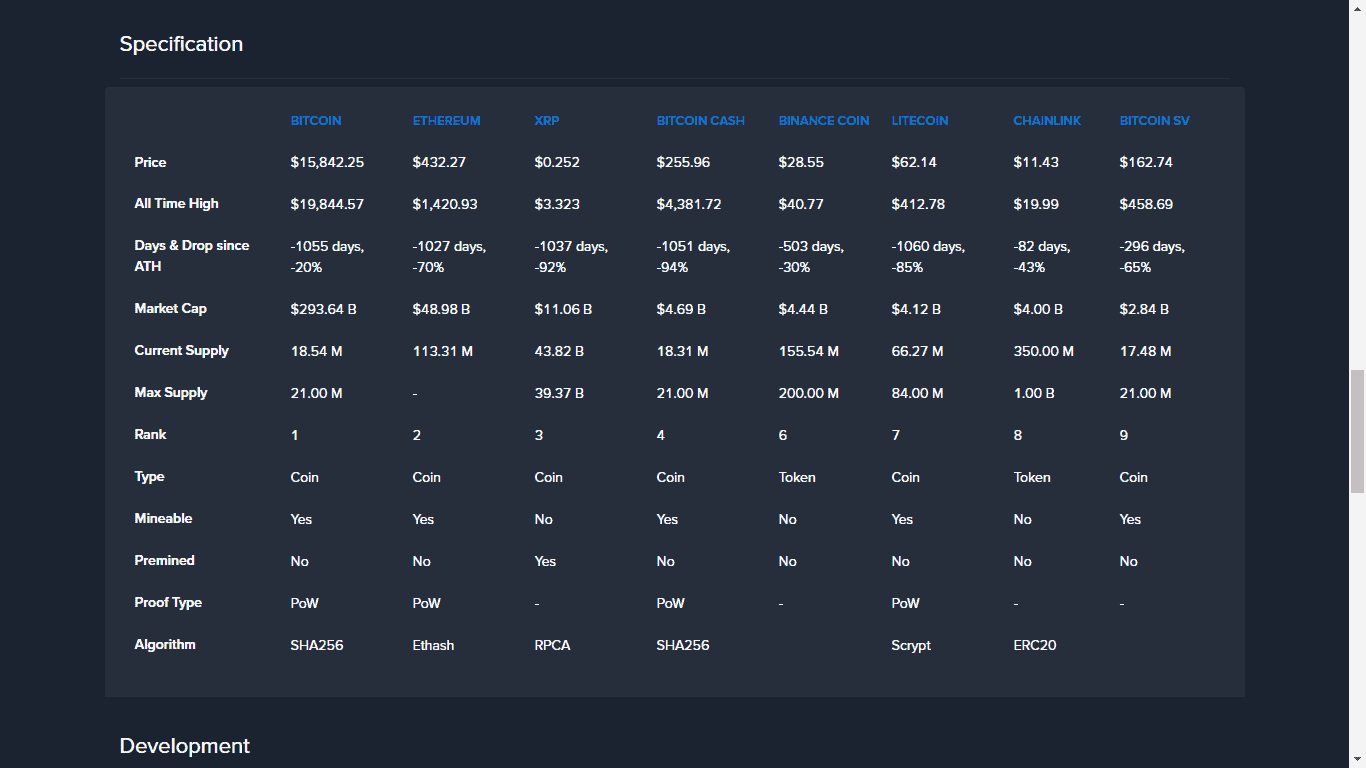

Today, Bitcoin is flirting with the $16,000 mark. Its peak during the last 24 hours stands at $15977. That’s an 11.49% growth from the day before, putting the cryptocurrency at a mere 20% below its ATH.

That places bitcoin as the cryptocurrency with the best recovery since its ATH, surpassing any other competitor by a large percentage.

But there’s a key difference: In 2020, no one – or almost no one – is talking about bubbles, and the reason is simple: Bitcoin isn’t behaving like one.

Unlike the accelerated growth it experienced during 2017, Bitcoin’s rise this year has been more easygoing, more mature, and more resistant to both FUD and FOMO. Long gone are the days where a hacked exchange or a politician’s speech were enough to crash the markets.

And the Bitcoin fundamentals also seem to support traders’ optimism. There is greater regulatory clarity, more institutional investors are jumping in, and large financial firms have legitimized Bitcoin as a reliable asset and a good investment. The world’s economies are going through a crisis that has established Bitcoin’s reputation as a hedge asset, and it has played a major role in its price appreciation.

Is Bitcoin Near a New ATH?

It’s hard to predict if Bitcoin could mirror 2017’s hype and reach a new ATH. Generally, an ATH is a robust psychological barrier in any market. Still, analysts and famous traders believe Bitcoin may be at least close to touching the line of the $20K.

For example, Mati Greenspan was quite excited when Bitcoin broke the resistance in the bullish channel:

Such a beautiful thing right here.#Bitcoin strong breakout out of that double resistance we’ve been watching, snapping the upward channel and obliterating psychological resistance in one fell swoop.

Charts don’t get much more bullish than that. pic.twitter.com/xAlNoVV9xp

— Mati Greenspan (tweets ≠ financial advice) (@MatiGreenspan) November 5, 2020

Also, 10T Holdings co-founder Dan Trapiero gave some credit to the stock-to-flow model which has been widely criticizes as innacurate. If this model tells the truth, Bitcoin could be very close to having a six-figure price tag.

Also, eToro’s Brad Michelson compared what is happening in 2020 with the crypto hype of 2017:

If this doesn’t feel like 2017 to you I don’t know what will. https://t.co/xhWAFOVEBC pic.twitter.com/ESz8oKgsnb

— Brad Michelson (@BradMichelson) November 6, 2020

So perhaps there’s a reason to be bullish, but please learn from 2018 and never invest what you cannot afford to lose.