The hype of the crypto markets after Square announced a million investment in Bitcoin catapulted the token above the psychological barrier of k, sparking a general optimism among BTC bulls… But the bears are also rubbing their hands as they wait for a price correction. According to data from the Bitcoin metrics company, Santiment, the activity of bears in Bitcoin-focused trading channels has surpassed the peaks of 2 months ago, especially after Bitcoin broke the barrier of the .4k. “Short” calls on social media. Source: SantimentWhat Does This Means and Why Does It Matter? This could have many lectures, but the most obvious one is that bears are trying to make sense of the markets, and the sudden spike has hit the bearish sentiment because it is not really

Topics:

Felix Mollen considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Shorts and Longs, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The hype of the crypto markets after Square announced a $50 million investment in Bitcoin catapulted the token above the psychological barrier of $11k, sparking a general optimism among BTC bulls… But the bears are also rubbing their hands as they wait for a price correction.

According to data from the Bitcoin metrics company, Santiment, the activity of bears in Bitcoin-focused trading channels has surpassed the peaks of 2 months ago, especially after Bitcoin broke the barrier of the $11.4k.

What Does This Means and Why Does It Matter?

This could have many lectures, but the most obvious one is that bears are trying to make sense of the markets, and the sudden spike has hit the bearish sentiment because it is not really “organic” but was caused by a single event instead of a normal evolution of the markets. During the last couple of weeks, Bitcoin has been trading sideways with no major dominance of either bulls or bears.

In trading, there are 3 important types of analysis:

- The technical analysis focuses on the evolution of prices independently of the asset being studied.

- The fundamental analysis is based more on the project’s characteristics to determine whether its price is above or below its real value.

- The sentiment analysis explores investors’ mood to decide whether they have positive or negative expectations for the near future.

Santiment’s study fits into the third category and seems to point to a growing interest in capitalizing on profits. That is, BTC hodlers would be looking for the best time to sell their tokens, considering that Bitcoin is now above significant resistance.

Bitcoin Traders Could Be Trying to Understand The Markets

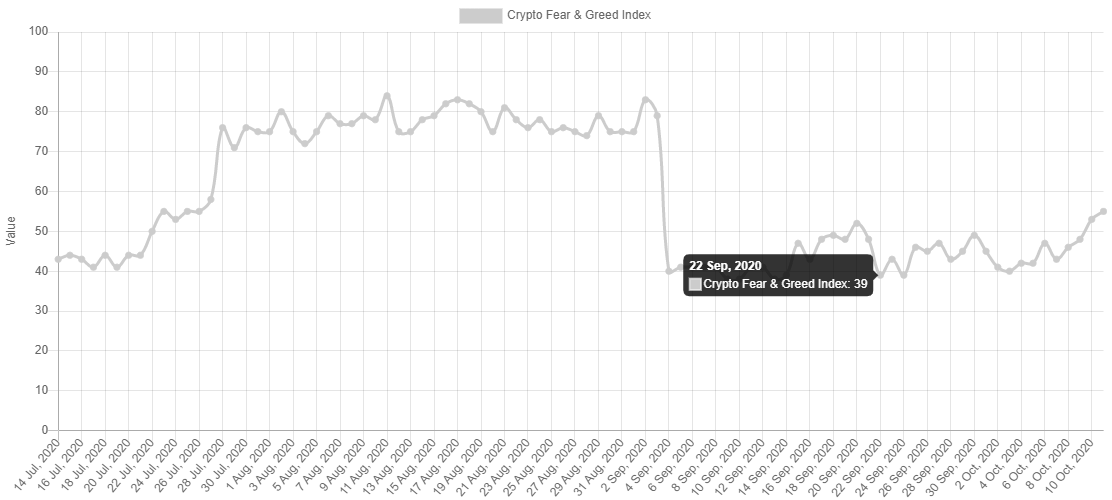

However, this doesn’t mean that the market has magically shifted into a bearish mood. The Crypto Fear & Greed Index developed by Alternative.me shows that the market is slightly greedy, with an average that exceeds the scores of September when nervousness took over the markets.

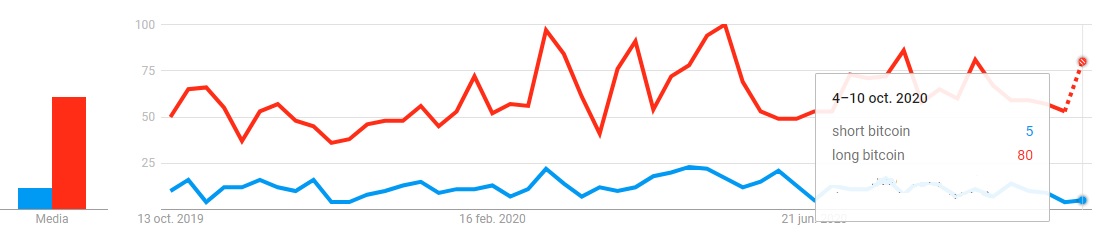

On a similar note, Google seems to indicate that people are more interested in the keyword “long bitcoin” than “short bitcoin,” and the first one is expected to grow over time.

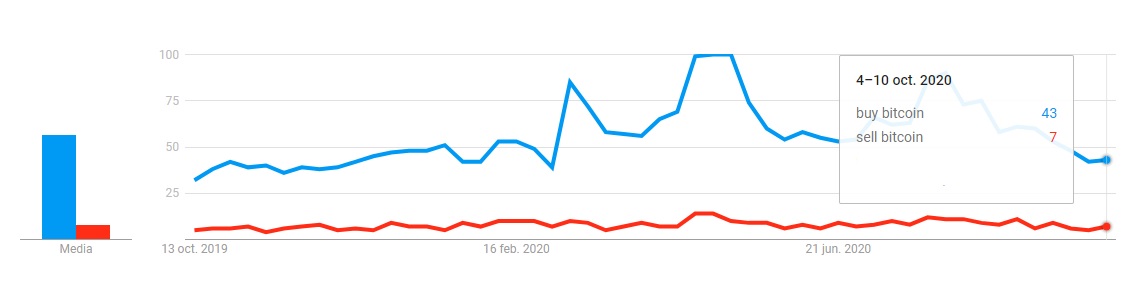

Yet, suppose we study the keywords “buy bitcoin” vs. “sell bitcoin” (something that a more amateur person might look for). In that case, we can see that the interest in buying bitcoin has decreased so far this month, but still exceeds the interest in selling.

As usual, there is nothing set in stone in the crypto-verse, so it is essential to do extensive research before making any kind of conclusion. Although the price development shows a BTC still in the green, the bears may be lurking, waiting for their opponents to get tired of climbing the hill before taking over the markets by making a good profit.