In a suddenly galvanizing rally, Bitcoin’s price shot to the ,700 mark last night. Open interest has soared and is now at a 1-month high. Bitcoin traders are opening long positions and this trend was pointed by Willy Woo as well.At .3 Billion, Bitcoin Futures Open Interest Tops 1 Month HighAlso, a noticeable trend is a rise in aggregated open interest (OI) on different bitcoin futures trading platforms. Yesterday the figure touched a one-month high of .3 billion as per Skew.Bitcoin Futures Aggregated Open Interest at 1-Month High, Source: SkewOpen interest in futures trading represents the number of active contracts held by traders and investors. This amounts to open positions that have not been settled or closed out.Along with open interest, aggregated daily volumes for bitcoin

Topics:

Himadri Saha considers the following as important: AA News, Bitcoin (BTC) Price, bitcoin futures, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

In a suddenly galvanizing rally, Bitcoin’s price shot to the $11,700 mark last night. Open interest has soared and is now at a 1-month high. Bitcoin traders are opening long positions and this trend was pointed by Willy Woo as well.

At $4.3 Billion, Bitcoin Futures Open Interest Tops 1 Month High

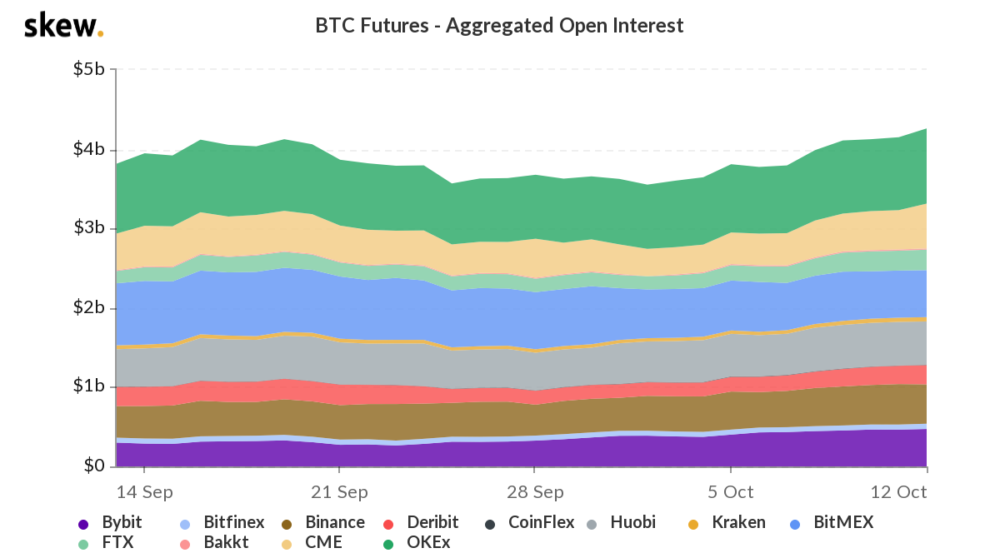

Also, a noticeable trend is a rise in aggregated open interest (OI) on different bitcoin futures trading platforms. Yesterday the figure touched a one-month high of $4.3 billion as per Skew.

Open interest in futures trading represents the number of active contracts held by traders and investors. This amounts to open positions that have not been settled or closed out.

Along with open interest, aggregated daily volumes for bitcoin futures are also on the rise. Traders seem to be tracking the development of strength in BTC’s on-chain fundamentals, Square’s recent $50 million BTC purchase, and depreciation of strength in the US Dollar. Which in turn is leading them to open massive long positions.

Solid session to kick off the week yesterday #bitcoin spot $400mln+ BTCUSD pic.twitter.com/ExcNINt1SQ

— skew (@skewdotcom) October 13, 2020

BTC Investor Activity Is High, Increased Buying Is Driving Up Price

One on-chain indicator that also explains the rise in futures open interest, and the overall appreciation in ‘long sentiment’ is Willy Woo’s NVT ratio. According to Woo, it is the ratio of bitcoin investor activity to BTC’s market capitalization.

A few hours ago he mentioned that the NVT ratio is at Black Thursday crash levels and has a lot of room to grow in the very near future. And that it’s a pretty strong indication to be bullish on BTC. On being asked how relevant is the bitcoin NVT ratio in current market conditions, Willy said:

As more volume continues to trend off chain into layer-2, NVT drifts higher as investment activity becomes invisible to the chain. I tried many methods, the best was simple long term moving averages to track the new zones of buy and sell. It works if the L2 trend is gradual.

And why is this a time to be bullish? Woo says that’s because the NVT ratio is low, which inadvertently corresponds to a ‘strong investor activity’.

In early and mid phases of a bull market NVT signals very strong investor activity (low NVT) as price continues to climb. You keep buying, as it’s this activity that is driving up price. It starts to weaken (high NVT) as we approach the top of the bull market.