Place/Date: - April 7th, 2020 at 1:54 pm UTC · 2 min read Contact: Vivien Choi, Source: OKEx March was a record-breaking month for the crypto market and exchanges. OKEx, the world’s largest cryptocurrency spot and derivatives exchange, topped the derivatives market in March, according to the Exchange Review March 2020 report by CryptoCompare, the global leader in digital asset data. With month-on-month volume increased to 1 Bn, OKEx has demonstrated steady growth in the past months.Source: CryptoCompareJay Hao, CEO of OKEx, said:“The crypto market has been undergoing an unprecedented time, particularly the recent bitcoin slump and the global impact brought by the coronavirus. Given the drastic changes in consumers’ internet browsing behaviors, we observe their investment strategies

Topics:

Svetlana Soroka considers the following as important: cryptocompare, cryptocompare exchange review, okex, okex news, okex platform, Press Release

This could be interesting, too:

Guest User writes Join the Future! ZacroTribe (ZACRO) Presale Opens Soon at %related_posts%.01!

Guest User writes The Future of Financial News Presale is Here: Secure Your ZACRO Tokens for a New Era of Decentralized Insights

Guest User writes The Wait is Almost Over – ZacroTribe (ZACRO) Presale Launching at %related_posts%.01!

Chainwire writes SingularityNET and Privado ID Partner to Establish Decentralized AI Agent Trust Registry

Place/Date: - April 7th, 2020 at 1:54 pm UTC · 2 min read

Contact: Vivien Choi,

Source: OKEx

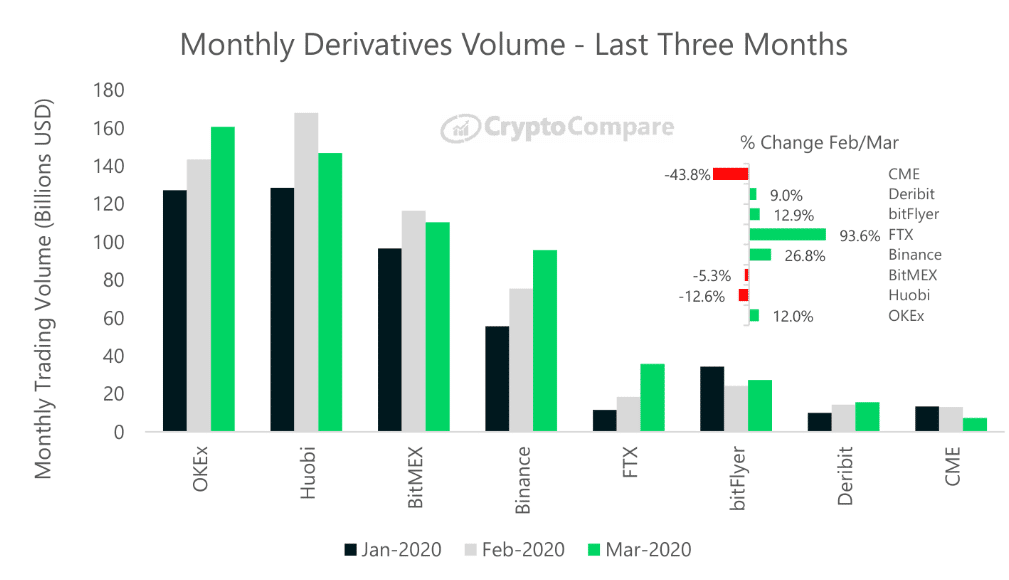

March was a record-breaking month for the crypto market and exchanges. OKEx, the world’s largest cryptocurrency spot and derivatives exchange, topped the derivatives market in March, according to the Exchange Review March 2020 report by CryptoCompare, the global leader in digital asset data. With month-on-month volume increased to $161 Bn, OKEx has demonstrated steady growth in the past months.

Source: CryptoCompare

Jay Hao, CEO of OKEx, said:

“The crypto market has been undergoing an unprecedented time, particularly the recent bitcoin slump and the global impact brought by the coronavirus. Given the drastic changes in consumers’ internet browsing behaviors, we observe their investment strategies and portfolio are showing new patterns. Our team has started to investigate and study the new set of data, so as to get prepared for the future. I think exchanges need to re-evaluate the market, and it will be a new stage of the game when the current storm is over.”

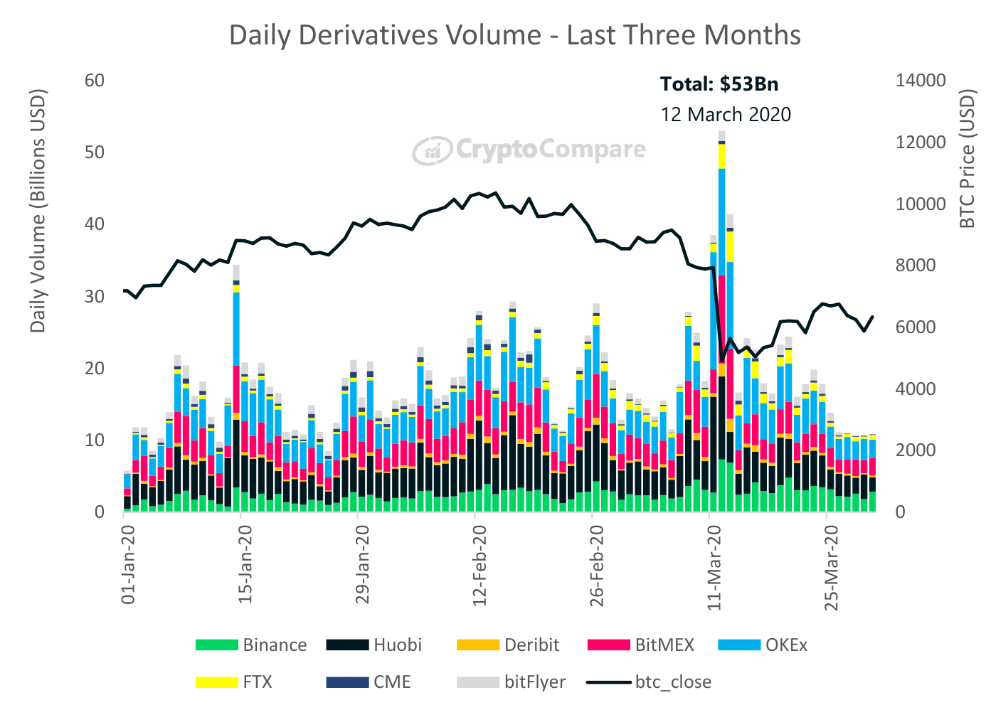

Crypto exchanges hit an all-time-high in daily transaction volume of $53 Bn on 12 March 2020, the day when the bitcoin price crashed. According to a tweet of Hao, the trading platform processed approx. 300k orders/sec during the volatile period and the trading service was delivered stably. What’s more, OKEx also claimed to maintain a record of zero clawback throughout the market crash.

Source: CryptoCompare

About OKEx

The world’s largest and most diverse cryptocurrency marketplace, OKEx is where global crypto traders, miners, and institutional investors come to manage crypto assets, enhance investment opportunities, and hedge risks. We provide spot and derivatives trading, including futures, perpetual swap, and options, of major cryptocurrencies, offering investors great flexibility in formulating their strategies to maximize gains and mitigate risks.