The gap between Bitcoin’s hashrate and its mining difficulty has led to a miners capitulation – which could result in a major Bitcoin price dump.As pointed out by trader and popular YouTuber TheMoon, large discrepancies between hashrate and mining difficulty have typically resulted in a sudden departure of Bitcoin miners in the past. This, in turn, has historically been followed by a significant BTC price drop.Seen below is a chart analysis that points out the crossover between the moving averages of Bitcoin’s hashrate and mining difficulty.Source: TheMoon, YouTube.TheMoon points out the historical trend which saw Bitcoin regularly fall in value – for a brief period – following its block reward halvings. This can be explained by the fact that many smaller miners drop out of the mining

Topics:

Greg Thomson considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Hash Rate, Bitcoin-Halving, btcusd, btcusdt, The Moon Carl

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The gap between Bitcoin’s hashrate and its mining difficulty has led to a miners capitulation – which could result in a major Bitcoin price dump.

As pointed out by trader and popular YouTuber TheMoon, large discrepancies between hashrate and mining difficulty have typically resulted in a sudden departure of Bitcoin miners in the past. This, in turn, has historically been followed by a significant BTC price drop.

Seen below is a chart analysis that points out the crossover between the moving averages of Bitcoin’s hashrate and mining difficulty.

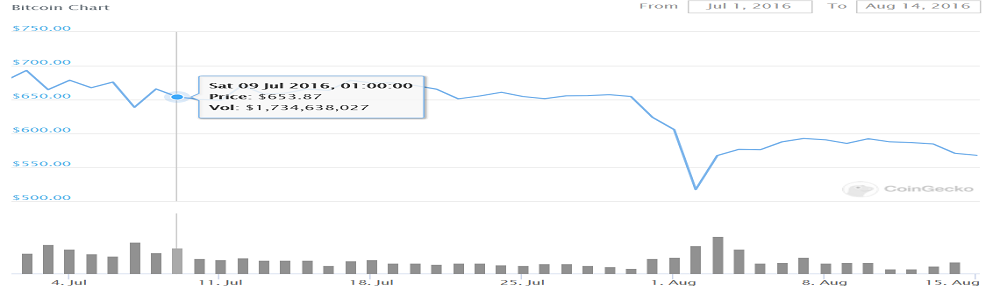

TheMoon points out the historical trend which saw Bitcoin regularly fall in value – for a brief period – following its block reward halvings. This can be explained by the fact that many smaller miners drop out of the mining race when their rewards are cut in half.

This was witnessed in 2016’s block reward halving, which took place on July 9 of that year. The price of Bitcoin lost 21% in the three weeks following the halving event – from $654 to $517. If history repeats itself, then we can expect Bitcoin to drop to $6750 following a 2020 halving price of $8,550.

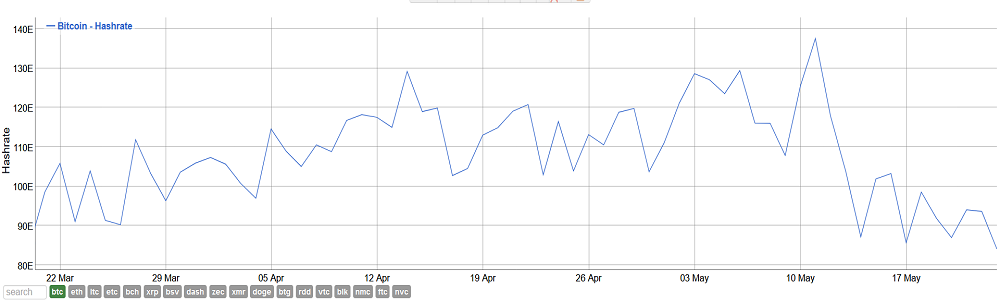

Bitcoin’s mining difficulty is updated every 2,106 blocks – which is roughly every two weeks. That contrasts with its hashrate, which is updated and tracked daily. It’s between the gaps in these statistics that many of Bitcoin’s miners fall.

According to data from Bitinfocharts, Bitcoin’s hashrate has fallen 38% since the date of the block reward halving.

Meanwhile, data from BTC.com shows that Bitcoin’s mining difficulty was reduced by just 6% in the same period. In 11 days from now, BTC’s mining difficulty will be reduced by 6% again, possibly leaving the door open for some outpriced miners to return, but not many.

The gap between hashrate and mining difficulty remains wide. As The Moon pointed out on May 24, the prospect of a BTC price drop remains well within the range of historical probability.

However, while this signal is a strong one, it may not be worth acting on just yet. According to The Moon:

“I’m not gonna sell just based on this on-chain indicator. I think that technical indicators need to be the priority. On-chain indicators can be used as a backdrop, and used in confluence with technical indicators.”