The cryptocurrency market is still northbound as Bitcoin sets new ATH every other week.The year has started with new records, the total cryptocurrency market cap exceeded trillion, with only 67.7% of the cap covered by Bitcoin. As Bitcoin dominance drops, yet the market cap increases, the so-called “altcoin-season” should be expected.For that being said, let’s take a look at some altcoins that are worth following these days.AavePhoto: Aave chart on TradingView.AAVE/USDT is following an ascending channel and remains bullish above the dynamic resistance of January 5. The pair tested the resistance as support and was heading upwards, though was stopped at 2.339.Since each impulse and correction waves contain a 3-wave ABC pattern, rather than a motive 5-wave, we could implement various

Topics:

<title> considers the following as important:

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Emily John writes Singapore Metro Store Adopts Stablecoins for Smooth Payments

Felix Mollen writes Dogecoin Price Outlook: Should You Keep DOGE and What About BTC Bull Token?

The cryptocurrency market is still northbound as Bitcoin sets new ATH every other week.

The year has started with new records, the total cryptocurrency market cap exceeded $1 trillion, with only 67.7% of the cap covered by Bitcoin. As Bitcoin dominance drops, yet the market cap increases, the so-called “altcoin-season” should be expected.

For that being said, let’s take a look at some altcoins that are worth following these days.

Aave

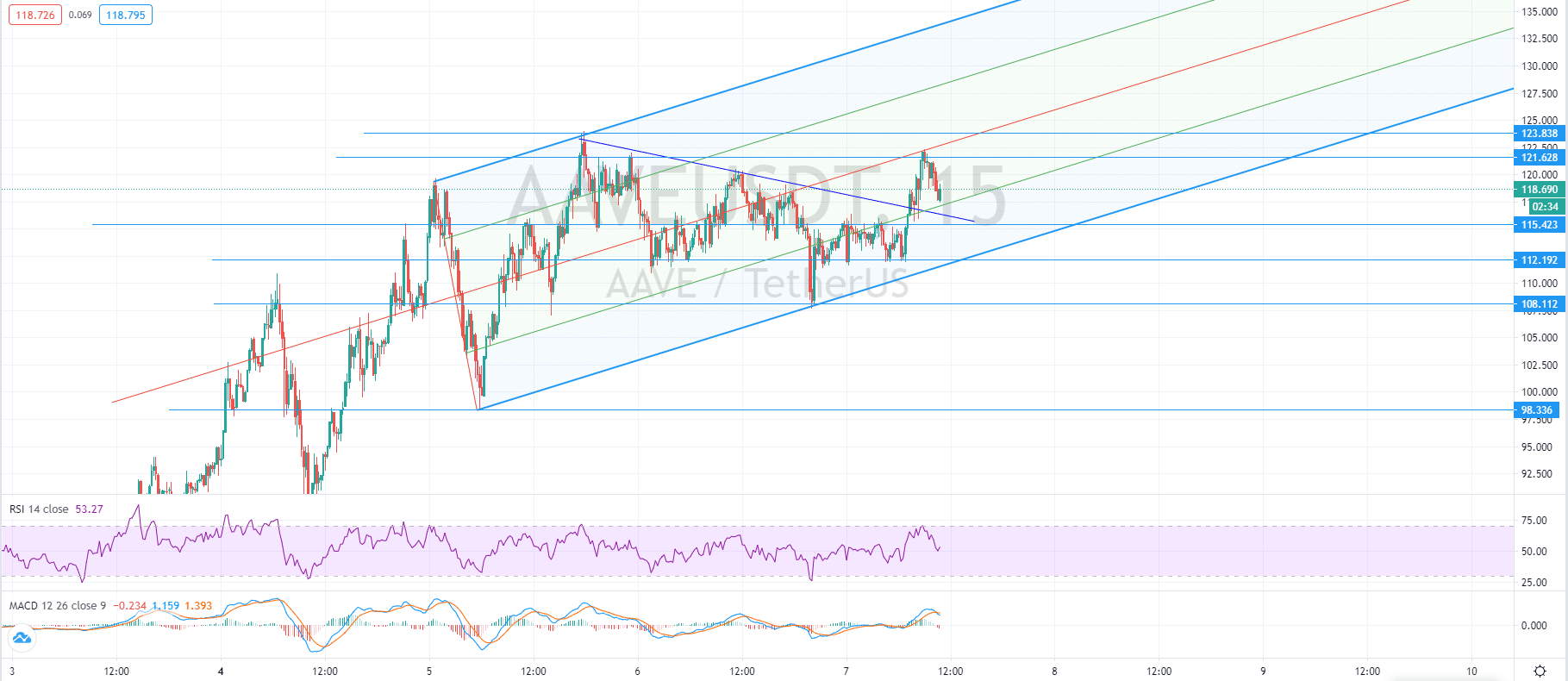

Photo: Aave chart on TradingView.

AAVE/USDT is following an ascending channel and remains bullish above the dynamic resistance of January 5. The pair tested the resistance as support and was heading upwards, though was stopped at $122.339.

Since each impulse and correction waves contain a 3-wave ABC pattern, rather than a motive 5-wave, we could implement various harmonic patterns to find the upcoming resistances.

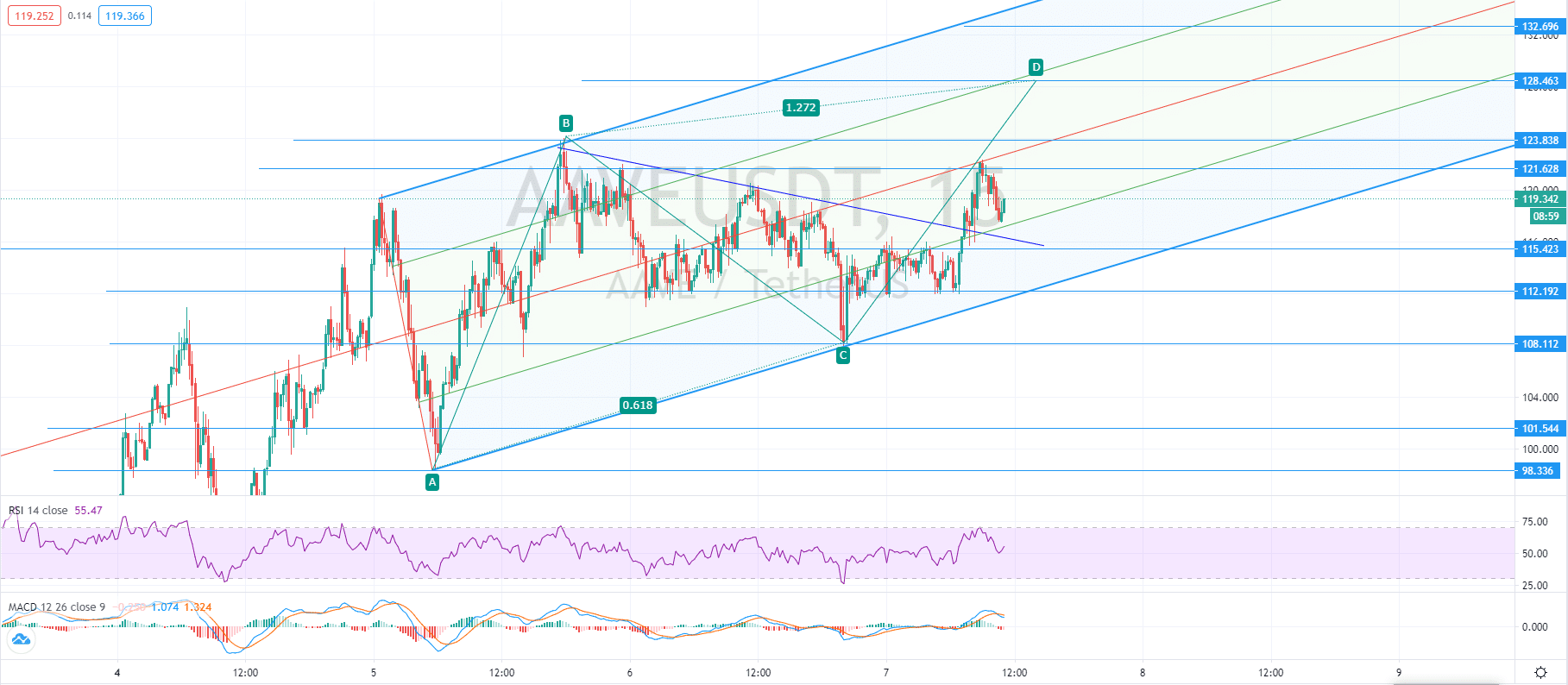

Photo: Aave chart on TradingView.

As seen on the chart above, when the resistance of $122.339 is overtaken, the next possible resistance is located near $128.463.

Stellar Lumens

Stellar Foundation has signed an important memorandum with the Ministry of the digital transformation of Ukraine, the protocol will be a foundation of the Ukrainian Digital currency. Since the release of the news, XLM/USD skyrocketed and gained an astonishing %148.

By the time writing of this article, XLM is traded above the important dynamic resistance of January 6’s motive wave. MACD on a 15-minute chart is about close above the signal line to confirm the uptrend, though since the dynamic support is penetrated twice and currently the candle is near the support, the true uptrend signal will be closing above the current level and breaking the $0.38465 resistance.

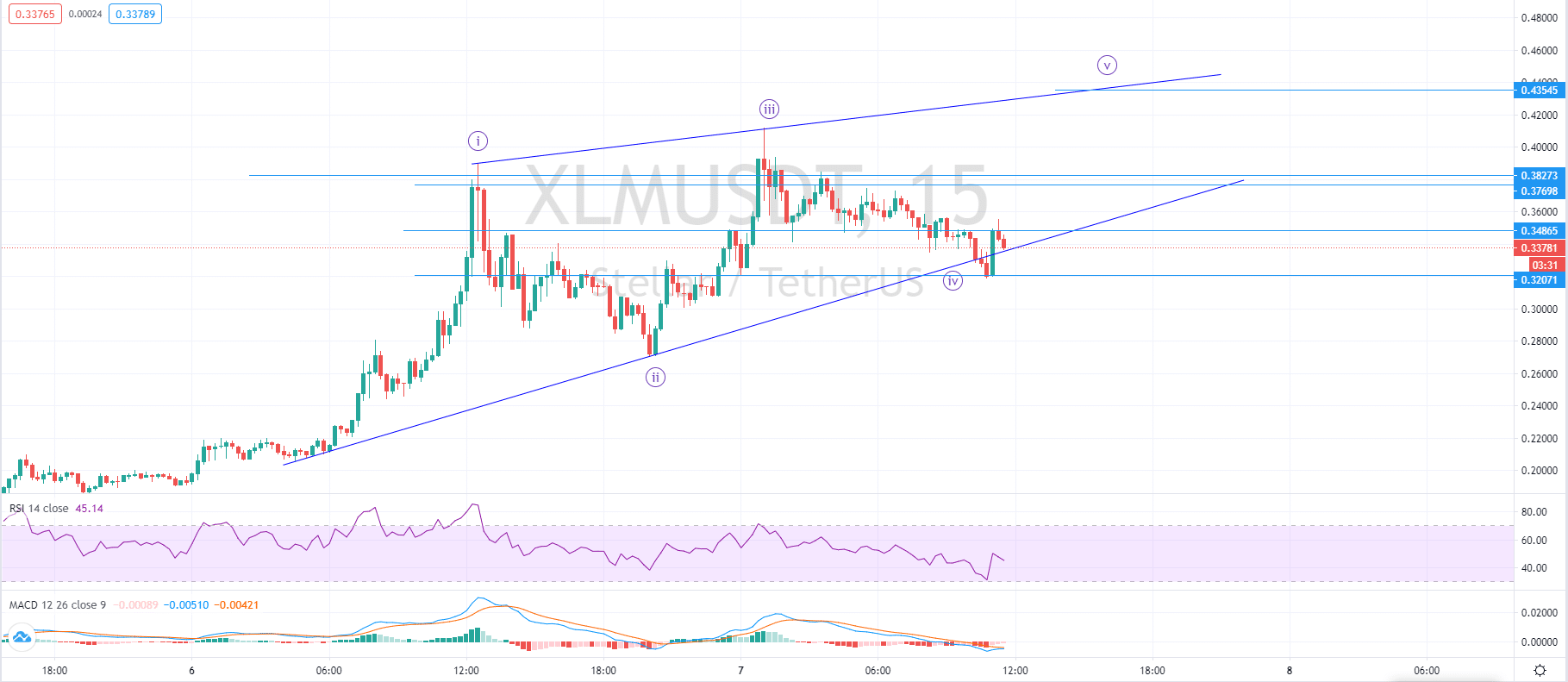

Photo: XLM/USDT chart on TradingView.

The pattern we are watching for this pair is an ending diagonal and according to the Elliott Wave principle, one last motive wave is expected.

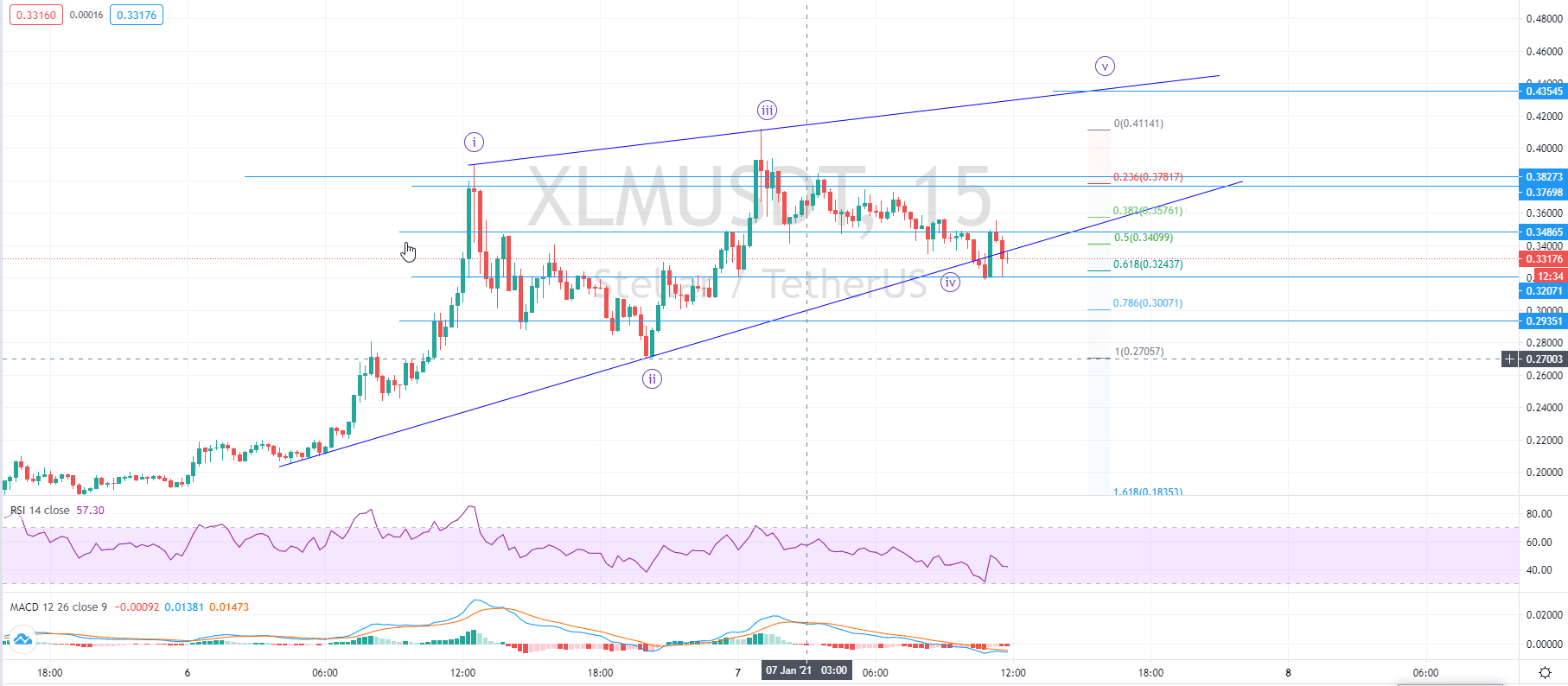

Photo: XLM/USDT chart on TradingView.

The support of $0.32200 is also important as it’s a 0.618 Fibo level of the previous motive wave (Wave 3), Stellar must remain above this level, otherwise, it might drop to $0.29350 support and this wave count will be invalid.

Bitcoin Cash

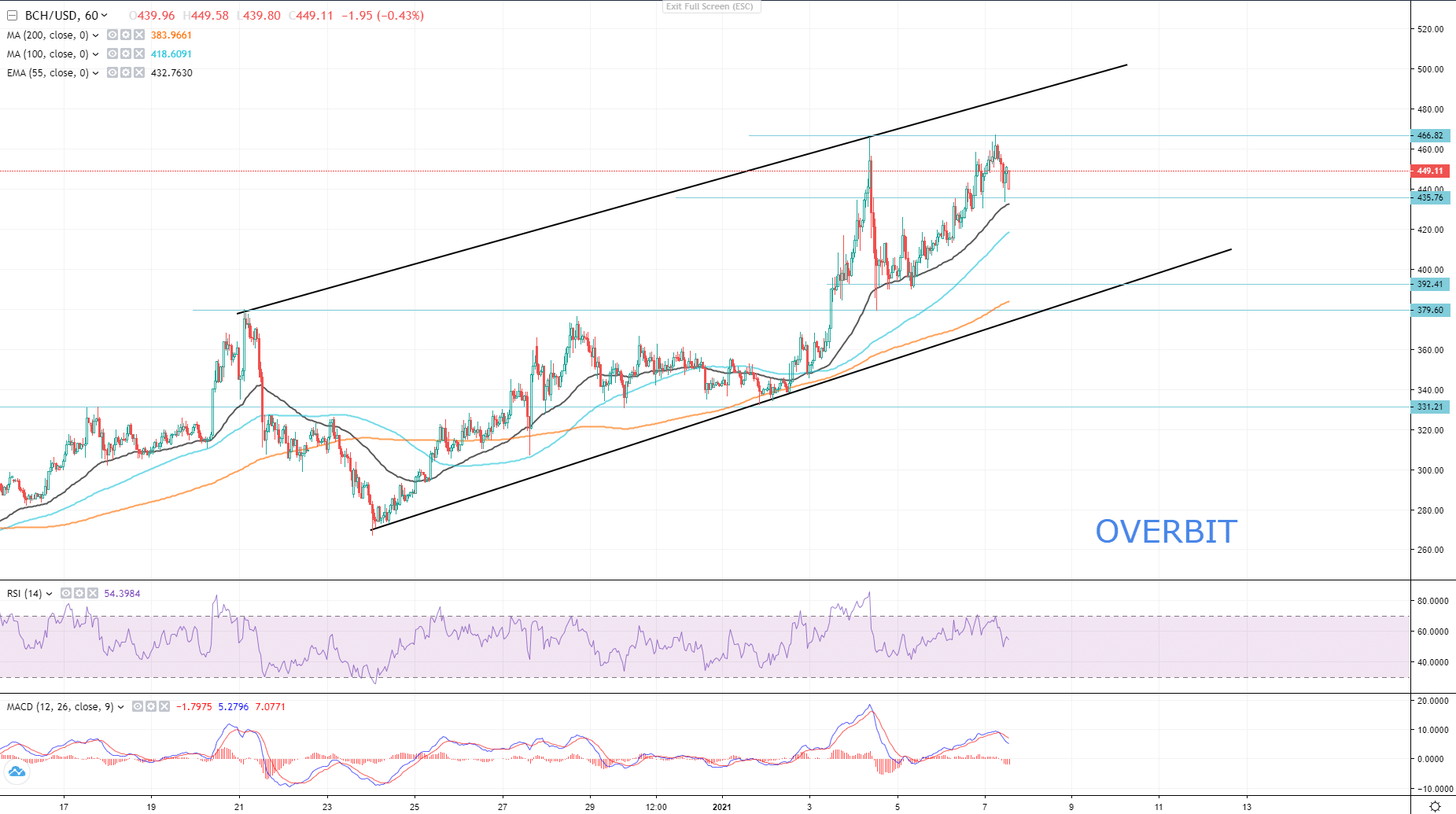

BCH/USD hit the last year’s high and retraced today, the pair is still following the uptrend channel and looks forward to breaking the year’s high.

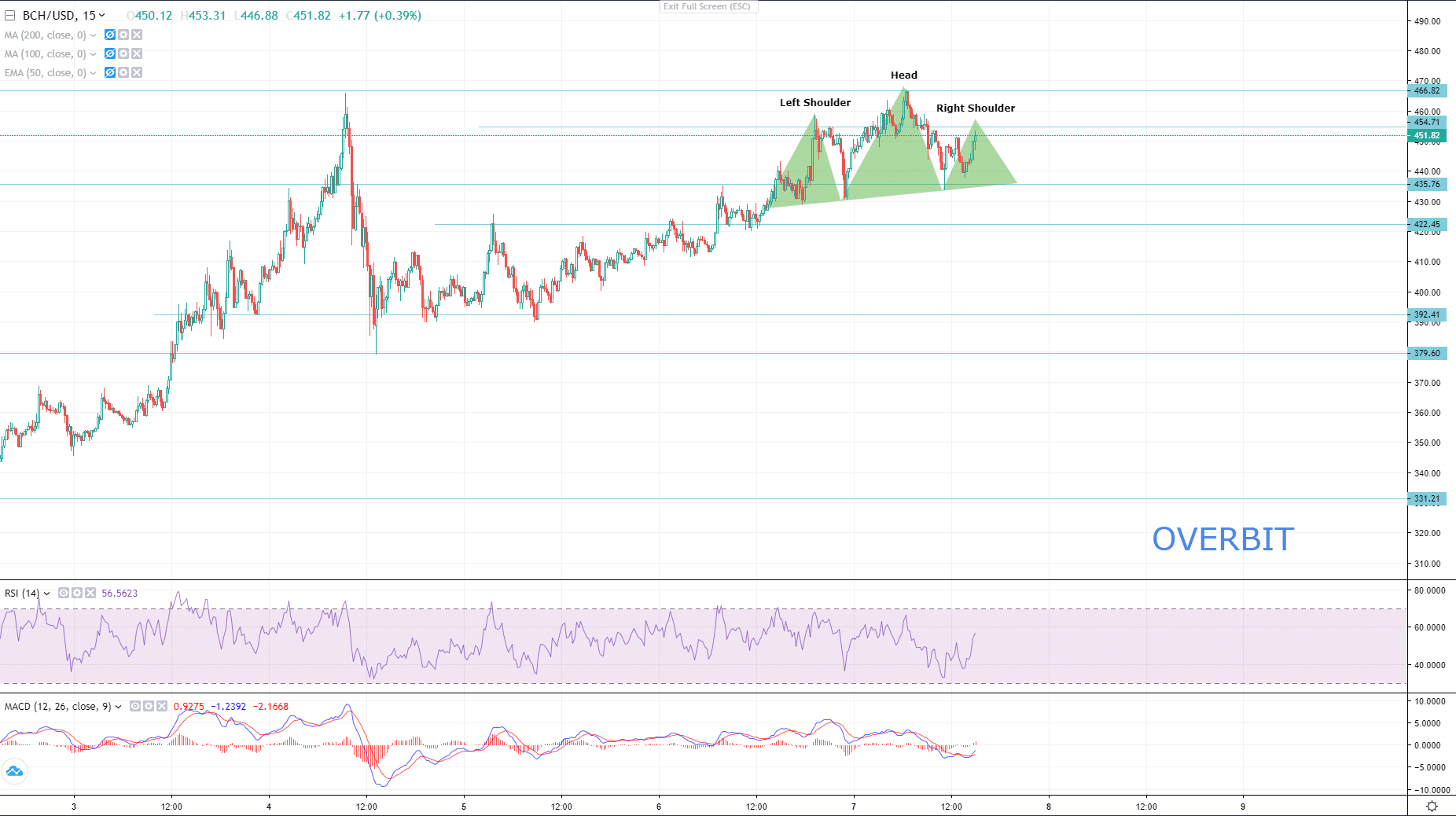

There is a possibility that the BCH/USD might continue the correction down to $433.75 and $392.41 below that if the pair doesn’t break the $466 resistance in the nearest time. That might be engineered by the Head and Shoulders pattern on a 15-minute chart of the pair.

The $435 support is important and if Bitcoin Cash breaks down that support, it will drop to the levels described above. Although if BCH keeps the pace and holds above and breaks the resistance of $466 it might as well continue the bullish run up to $481 and $494.

Senior Vice President at Overbit. Technical analyst, crypto-enthusiast, ex-VP at TradingView, medium and long-term trader, trades and analyses FX, Crypto and Commodities markets.