The duo of Bitcoin and Ethereum has a unique price correlation that sees a slip in one asset rub of on the other and vice versa.The broader digital currency ecosystem is seeing a tremendous face-off between the bulls and the bears as price volatility wars stir an upshoot in some digital currencies, it has fueled a slip in others like Ethereum. While Bitcoin (BTC) is currently trading at a gain of 1.96% to ,705.44, Ethereum (ETH) is down by 0.12% to ,122.50.The EIP 1559 Upgrade Sentiment Losing SteamThe current price level of Ethereum is not so bad compared to the level the token about a month ago. However, the buyer sentiment of the cryptocurrencies by virtue of the London Hardfork upgrade or EIP 1559 attained last week appears to be waning off at present. The upgrade ushered in the

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

The duo of Bitcoin and Ethereum has a unique price correlation that sees a slip in one asset rub of on the other and vice versa.

The broader digital currency ecosystem is seeing a tremendous face-off between the bulls and the bears as price volatility wars stir an upshoot in some digital currencies, it has fueled a slip in others like Ethereum. While Bitcoin (BTC) is currently trading at a gain of 1.96% to $45,705.44, Ethereum (ETH) is down by 0.12% to $3,122.50.

The EIP 1559 Upgrade Sentiment Losing Steam

The current price level of Ethereum is not so bad compared to the level the token about a month ago. However, the buyer sentiment of the cryptocurrencies by virtue of the London Hardfork upgrade or EIP 1559 attained last week appears to be waning off at present.

The upgrade ushered in the payment of a base fee for Ethereum-based transactions as against the gas fee bidding system that results in skyrocketing fees over time. With the model to keep transactions on the block at half the capacity, the upgrade also has the inherent power to wade off the congestion on the Ethereum network. This will additionally influence the gas fee pricing positively.

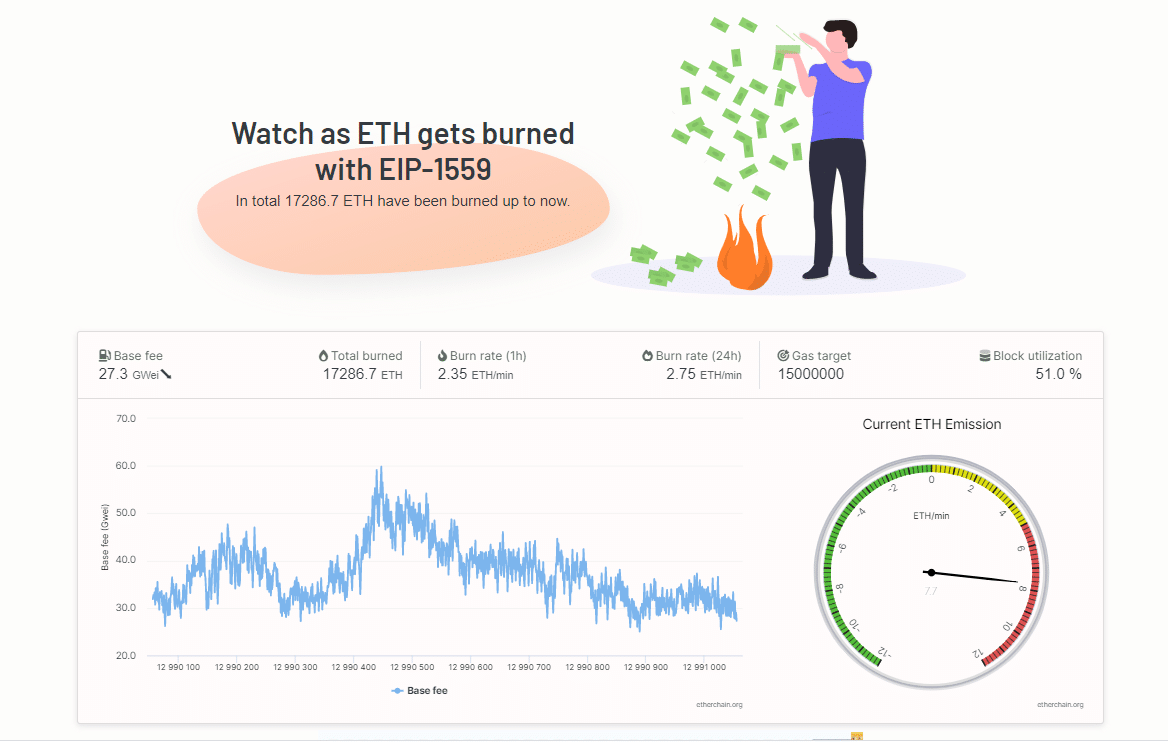

The highlight that stirred investors the more was the deflationary feature of the newly upgraded network. Since the upgrade happened, about 17,283 ETH has been burnt thus far according to data from Ether Chain.

Ethereum Burn Rate Source: Ether Chain

With a continuous token burning, the value of the existing Ethereum in circulation is all but increasing, and investors are likely to ride on these understanding to stack up on the coin and upturn the current sell-off impact in the market.

Ethereum Price Growth Using Bitcoin as Yardstick

The duo of Bitcoin and Ethereum has a unique price correlation that sees a slip in one asset rub of on the other and vice versa. While the bulk of the positive fundamentals recorded in the cryptocurrency ecosystem last week was fueled by Ethereum, BTC also rode the train, rising to a monthly high of $43,798.12 according to CoinMarketCap.

As the current actions of market bulls appear to be fueling the growth of Bitcoin in a rally that may mark a surge toward the $48,000 resistance point, the negativity being seen in ETH may be short-lived. This projection is drawn as data from CryptoWatch, a blockchain markets data aggregator shows the correlation between BTC and ETH for the past month has been high and positive.

It is not uncommon for crypto assets to exhibit a form of price decoupling, in which case the two coins may chart a different growth curve. However, the run in the price of Bitcoin and Ethereum and the fundamental events shaping both markets may do little or nothing in helping to usher in this price decoupling.

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.