Michael J. Saylor is an entrepreneur and business executive, who co-founded and leads MicroStrategy, a company which provides business intelligence, mobile software, and cloud-based services. But, read this, Michael Saylor tweeted in 2013: “Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.” And then, seven years later, he pinned the following tweet in his timeline: “Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.” Congrats for looking further into Bitcoin! He made a complete 180° change – because he read books about Bitcoin, learned more, and opened his mind. It’s not beneficial to be

Topics:

Bitcoin Schweiz News considers the following as important: BTC, ETH, LTC, Michael Saylor, microstrategy, Twitter

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Bitcoin Schweiz News writes Litecoin jetzt in der Telegram-Wallet verfügbar!

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Emily John writes Metaplanet Expands Bitcoin Holdings with .4M BTC Purchase

Michael J. Saylor is an entrepreneur and business executive, who co-founded and leads MicroStrategy, a company which provides business intelligence, mobile software, and cloud-based services. But, read this, Michael Saylor tweeted in 2013:

“Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.”

And then, seven years later, he pinned the following tweet in his timeline:

“Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.”

Congrats for looking further into Bitcoin! He made a complete 180° change – because he read books about Bitcoin, learned more, and opened his mind.

It’s not beneficial to be distracted by the price all day. If you don’t know anything about Bitcoin yet, you’ll have to believe everything others tell you about it. Become immune to FUD and FOMO by doing your own research.

For example, you can learn what the double-spending problem is, which Bitcoin ultimately solves. Or read the original Bitcoin white paper published by Satoshi Nakamoto in 2008.

Ultimately, Bitcoin (not “crypto”!) is eventually a more dominant store of value with superior monetary properties than other assets:

It is divisible, fungible, censorship-resistant, verifiable, portable, digital, open-source, global, impossible to counterfeit, permanent, programmable, decentralized, recognizable, fully predictable in its monetary inflation rate and provably scarce.

But that’s not all; Bitcoin is based on the immutable properties of mathematics rather than physical properties or trust in central authorities.

Bitcoin additionally fulfills the properties of money (not to be confused with the term “currency”):

- Medium of exchange

Bitcoin can be used as a medium of exchange for goods and services. - Store of value

Bitcoins can be held for a long time period and can also retrieve their value. It does change over time; however, most other forms of money also change in value due to fluctuating inflation rates. - Unit of account

Inherent in its design, Bitcoin is created as a unit of account. Bitcoin utilizes an exchange rate based on current currencies but has an independent unit of account.

All of these features combined are the reason why, in my opinion, Bitcoin will prevail.

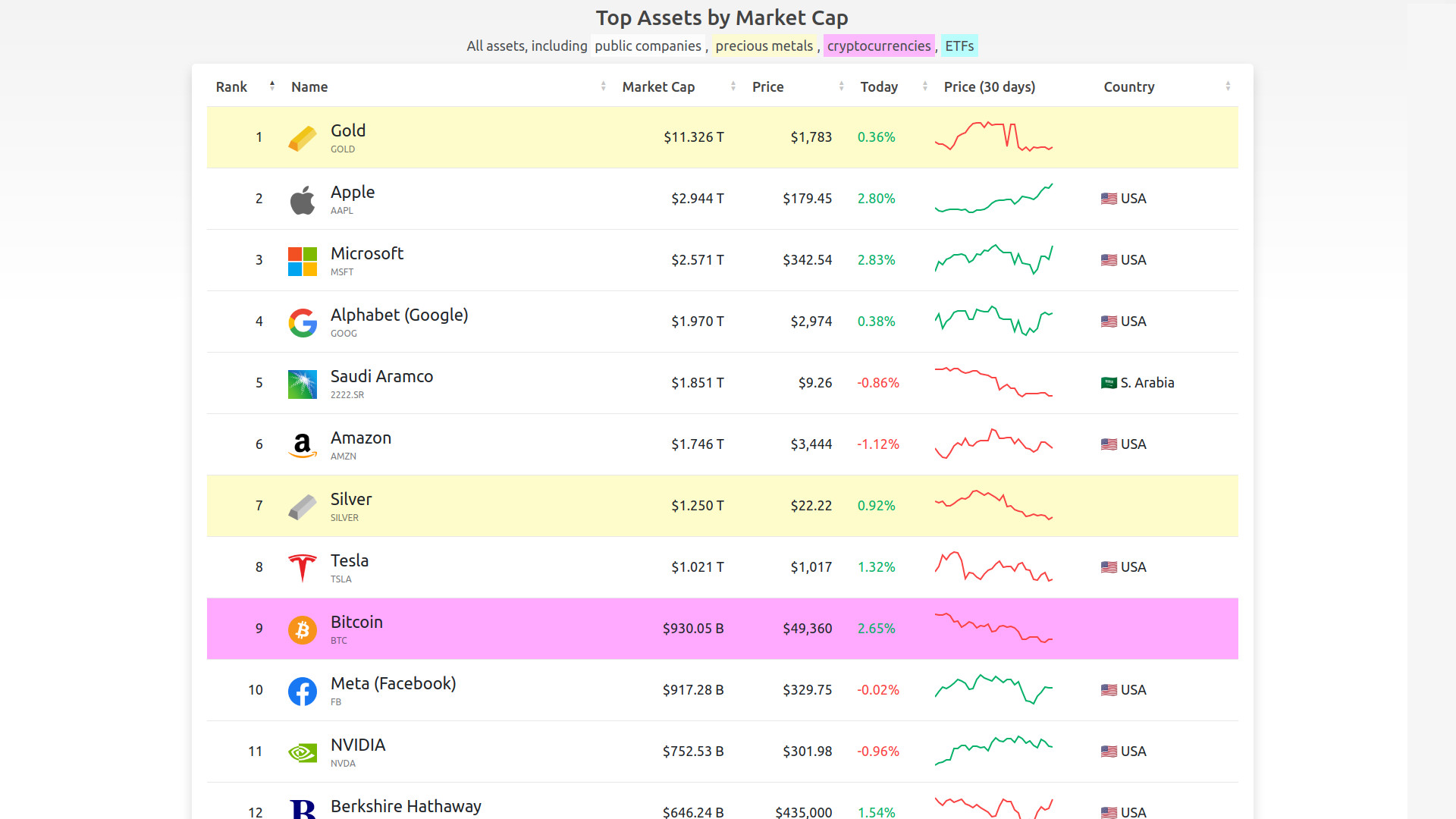

And by the way, it is already in the top 10 of all assets by market cap:

Prolly nothing.