To da moon? Bitcoin Average Transaction Fees Per a BanklessTimes.com report, average BTC transaction fees were around .5 on February 10, 2023. But these had jumped to .56 on May 10, 2023. The primary reason behind this drastic increase is the introduction of Ordinals onto the Bitcoin Network. Ordinals are a new integration into Bitcoin’s blockchain, supporting the creation of non-fungible tokens (NFTs) and BRC-20 tokens. The latter is central to the creation of meme coins. NFTs and meme coins have become increasingly popular amongst investors and traders. That has resulted in a growing demand for their transactions on the BTC network, consequently pushing up transaction costs. BanklessTimes‘ CEO noted: „Ordinals are driving up demand for

Topics:

Bitcoin Schweiz News considers the following as important: BTC, coinbase, fees, Transaction Fees, TX

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Emily John writes Metaplanet Expands Bitcoin Holdings with .4M BTC Purchase

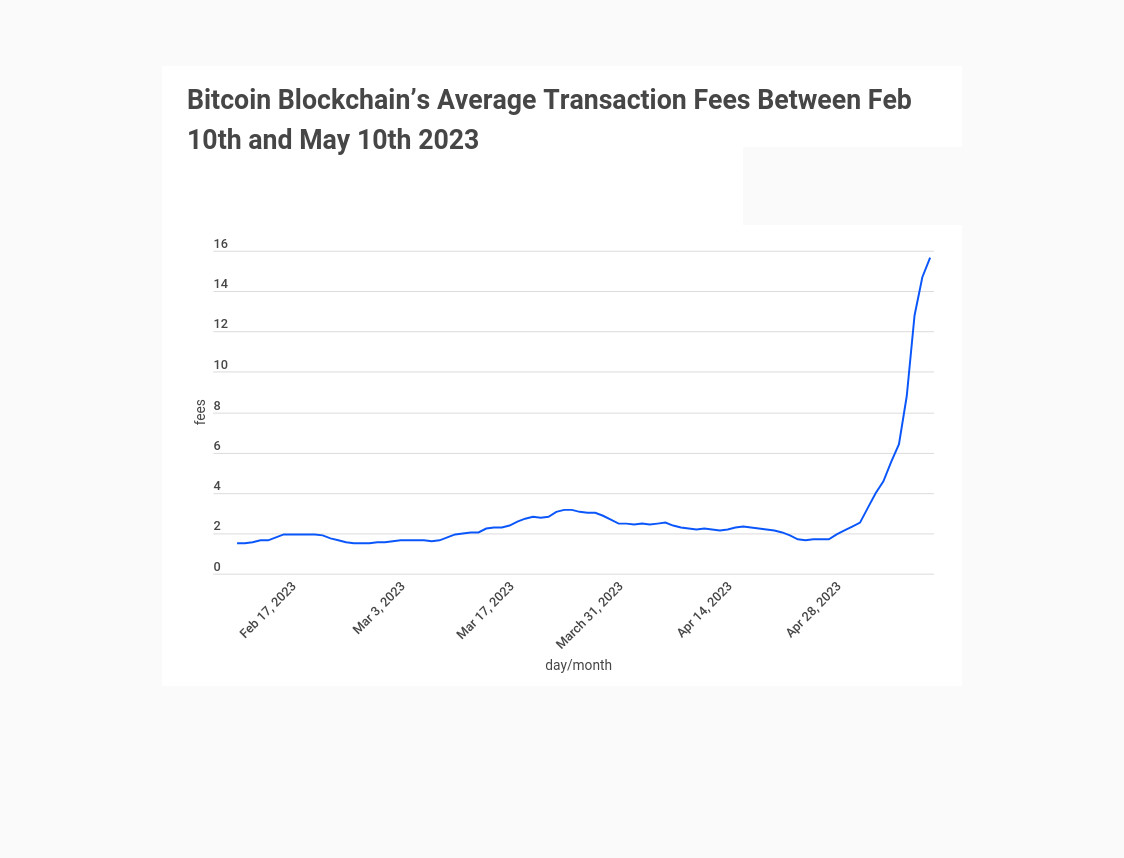

Per a BanklessTimes.com report, average BTC transaction fees were around $1.5 on February 10, 2023. But these had jumped to $15.56 on May 10, 2023.

The primary reason behind this drastic increase is the introduction of Ordinals onto the Bitcoin Network. Ordinals are a new integration into Bitcoin’s blockchain, supporting the creation of non-fungible tokens (NFTs) and BRC-20 tokens. The latter is central to the creation of meme coins.

NFTs and meme coins have become increasingly popular amongst investors and traders. That has resulted in a growing demand for their transactions on the BTC network, consequently pushing up transaction costs.

BanklessTimes‘ CEO noted:

„Ordinals are driving up demand for transactions and pushing up prices on the Bitcoin network. And while that’s great news for miners, it isn’t so for small-scale transactors. The rise in NFTs and BRC-20 is straining the blockchain due to its limited block size and scalability issues.“

BanklessTimes CEO, Jonathan Merry

Bitcoin Average Transaction Fees

What Does the Future Hold?

If this trend continues, it could lead to serious implications such as centralization of mining power due to higher profits from larger block rewards or even a decrease in overall usage of Bitcoin due to its expensive nature compared with other blockchains like Ethereum or Litecoin.

It remains to be seen how long these high transaction fees will remain. But one thing is certain; If left unchecked, these high transaction fees could further centralize mining power and limit user access to certain services within the cryptocurrency space.

Thus, developers and miners must ensure that Bitcoin remains accessible to all users regardless of their financial capabilities or geographical locations. As the industry searches for long-term solutions, experts have urged the Bitcoin network to address high transaction fees.

Merry states that lowering transaction fees would improve Bitcoin’s reputation and increase its use case and appeal.