David Marcus, CEO of Facebook's Calibra digital wallet service would rather have the Libra Association take the lead, if only to avoid Congressional hearings. | Source: AP Photo/Andrew Harnik An attempt by the co-creator of Facebook’s cryptocurrency to “debunk” the notion that Libra will not threaten the sovereignty of nations has been greeted with skepticism on Twitter. While defending Libra from recent accusations that it would take away the monetary sovereignty enjoyed by central banks, David Marcus doubled down to insist Facebook crypto will not create new money. This is because Libra will allegedly be backed by a basket of select currencies on a ratio of

Topics:

Mark Emem considers the following as important: Cryptocurrency News, david marcus, Facebook, Libra

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

An attempt by the co-creator of Facebook’s cryptocurrency to “debunk” the notion that Libra will not threaten the sovereignty of nations has been greeted with skepticism on Twitter.

While defending Libra from recent accusations that it would take away the monetary sovereignty enjoyed by central banks, David Marcus doubled down to insist Facebook crypto will not create new money. This is because Libra will allegedly be backed by a basket of select currencies on a ratio of 1:1.

He stated:

Libra will be backed 1:1 by a basket of strong currencies. This means that for any unit of Libra to exist, there must be the equivalent value in its reserve. As such there’s no new money creation, which will strictly remain the province of sovereign Nations.

By the power vested in Facebook’s Libra…

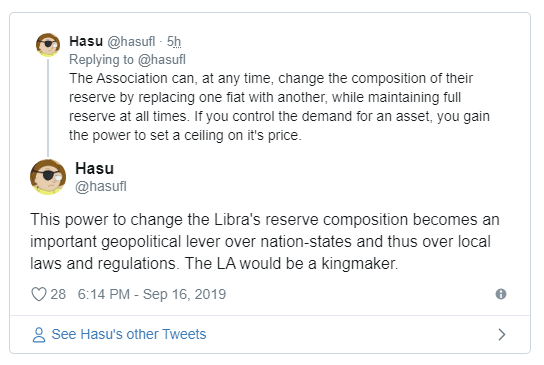

But while there was agreement that there will no new creation of money, some Twitter users noted that the Libra Association will still be able to exercise leverage over nations and thus effectively take away their monetary sovereignty.

According to cryptocurrency researcher tweeting under the handle @hasufi, the Libra Association will control the composition of their reserves. By virtue of this fact, the association will be able to change the ratio of the currencies it holds in reserve and by extension its demand and price. Thus, per @hasufi, Marcus’ claim that Libra won’t threaten the monetary sovereignty of nations is inaccurate.

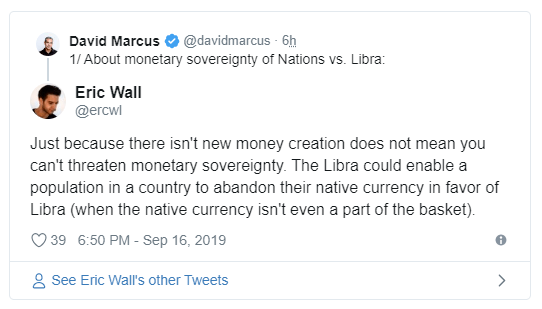

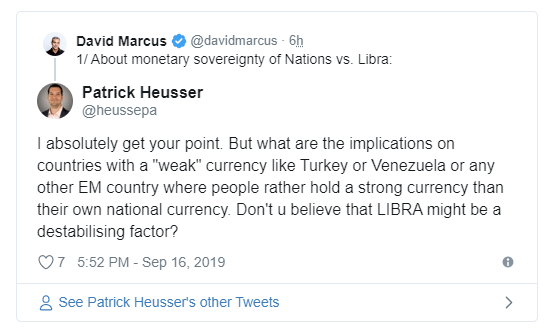

Another Twitter user also noted that Libra could have a destabilizing factor on countries with weaker fiat currencies. This is because hypothetically rational Libra users in countries with weaker currencies will prefer to hold currencies that store value better. As a result, Libra could potentially lead to entire populations abandoning their local currencies once it is launched, according to @ercwl.

Mass abandonment of weak currencies not possible currently

While it is possible currently to swap local currencies for foreign ones, capital controls, foreign exchange caps and other tools are limiting factors. But Facebook’s Libra would make it much easier as all the obstacles are removed meaning the flight from one weakening currency to a strong one will also happen much faster. Consequently, this would lead to the destabilization of some countries courtesy of the Facebook cryptocurrency.

This prediction is not far-fetched and there are currently two examples of emerging markets currencies that have greatly depreciated by triple digits against the U.S. dollar in the last couple of years.

In a five-year period starting August 2013, the Turkish Lira depreciated by approximately 226.71%. The Russian Ruble, on the other hand, fell by 105.20%.

Last modified (UTC): September 16, 2019 6:57 PM