Regulators consider adding some cryptocurrencies to the list of registered securities. This especially true when it comes to PoS and DpoS-based blockchains, with the staking reward model. The annual report made by OCIE says that crypto-related operations will be observed and studied with caution. The crypto companies already in the SEC‘s registry will experience additional checks too.The OCIE is thriving to deliver the best integrity and security to the U.S. markets and economy. The investors already lost hundreds of millions in dirty ICO schemes.Image source: BitMexPeople don’t want to lose money anymore, trusting shiny websites, famous names and undeliverable promises. Instead, people want to possess all the necessary information about the venture, before investing any penny.If you

Topics:

Jeff Fawkes considers the following as important: Blockchain News, Companies, Cryptocurrency News, Jay Clayton, News, ocie, pete driscoll, polybius, sec, securities and exchange commission

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Emily John writes SEC Ends Yuga Labs Probe with No Charges

Regulators consider adding some cryptocurrencies to the list of registered securities. This especially true when it comes to PoS and DpoS-based blockchains, with the staking reward model. The annual report made by OCIE says that crypto-related operations will be observed and studied with caution. The crypto companies already in the SEC‘s registry will experience additional checks too.

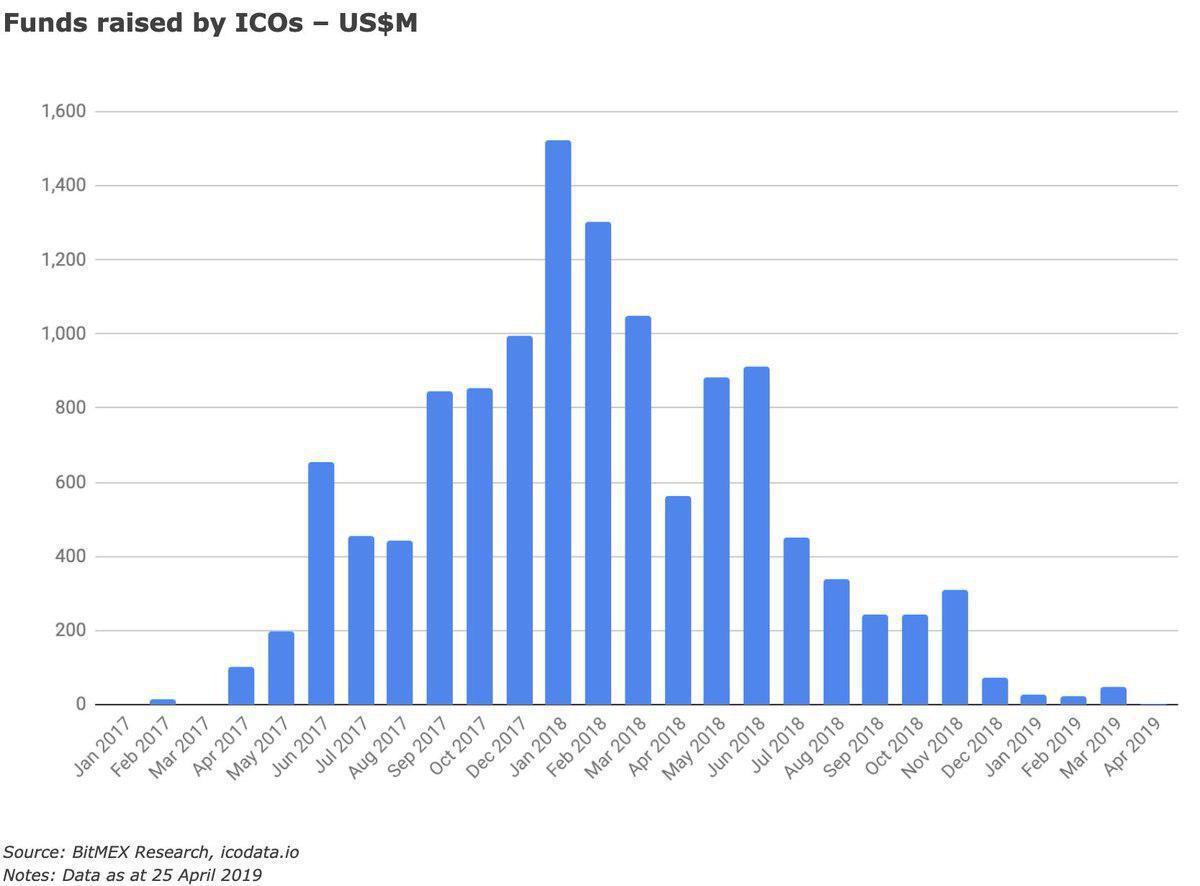

The OCIE is thriving to deliver the best integrity and security to the U.S. markets and economy. The investors already lost hundreds of millions in dirty ICO schemes.

Image source: BitMex

People don’t want to lose money anymore, trusting shiny websites, famous names and undeliverable promises. Instead, people want to possess all the necessary information about the venture, before investing any penny.

If you blindly invest in cryptocurrency startups, you always lose. It’s a very tricky sphere, with many hidden possibilities, networks and money flows. Pete Driscoll, the OCIE director, says that the market is evolving, as well as the investor’s risks:

“OCIE continually works to adjust its examination focus areas to target these risks and publishes its annual priorities to communicate where we see the potential for increased risk and related harm. We hope that this transparency helps firms evaluate and improve their compliance programs, which ultimately helps protect investors”

OCIE identified the risks posed by self-regulatory organizations, brokers, investment funds and LLC’s, and other such firms. The SEC chairman, Jay Clayton, says that regulators have done great work and identified strategic goals for the safety of the market participants.

SEC Will Protect Retail Investors, Check Markets and Infosecurity

The focus on the protection of the usual people who work in the cryptocurrency field is one of the main priorities for the agency. It will seek to check so many intermediaries working with retail investors on an everyday basis. This means extensive checks in the anonymous crypto exchange market. Will it stand against the almighty regulators to preserve anonymity? Only time can tell.

This area will include investigations into the quality of products, such as the fees market, conflicts of interest and more. The OCIE will then focus on the broad market infrastructure: clearing firms, unusual trading systems, transfer agents and more. Special attention goes to the security model of middle businesses. The OCIE will pay special attention to the technical part.

Brokers, Advisors, Fund Managers and the AML Regulations

All types of registered firms will have to pass in-depth tests, including the investment advisors, the RIA’s, the mutual funds and the exchange-traded funds. Brokers, dealers, and municipal advisors’ registrations will be put under review, as well as their preparations for the new regulatory frameworks, including the AML measures.

Unlike classic ICO scam schemes, the regulated municipal entity will provide the investors with one of the main things needed on the ICO market: fiduciary duty. A fiduciary duty is something very important when it comes to issuing money, coins, tokens, obligations, and other financial tools.

The famous Junseth’s Podcast host asked the ICO startup Polybius representative about their fiduciary duties back in 2017, when the ICO hype was only at its beginning. The representative had nothing to say about it, which is the first sign that something is wrong with the company.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.