Roobee is an investment platform which aims to allow retail investors to spend as little as in a broad variety of investment products which usually come with a high threshold. These include, but are not limited to IPOs, stocks, investment funds, cryptocurrencies, real estate, and others of the kind. The presumption behind the team’s concept and the main drive for the project is that the asset management industry is currently on the brink of monumental changes. Hence, they hold that in the near future a large number of people would be able to invest in a range of assets without the significant thresholds which are currently preventing them from doing so. As such, Roobee’s team develops a robust ecosystem, garnering a fully-fledged approach in order to fit all within the same basket.

Topics:

Felix Mollen considers the following as important: Evaluations

This could be interesting, too:

Roobee is an investment platform which aims to allow retail investors to spend as little as $10 in a broad variety of investment products which usually come with a high threshold. These include, but are not limited to IPOs, stocks, investment funds, cryptocurrencies, real estate, and others of the kind.

The presumption behind the team’s concept and the main drive for the project is that the asset management industry is currently on the brink of monumental changes. Hence, they hold that in the near future a large number of people would be able to invest in a range of assets without the significant thresholds which are currently preventing them from doing so.

As such, Roobee’s team develops a robust ecosystem, garnering a fully-fledged approach in order to fit all within the same basket. Let’s have a closer look at the projects core, including main features, go-to-market strategy, tokenomics, and everything of essence.

The team has already come up with a working business model and a private mode working MVP after having allocated $15 million through a test system.

Apart from that, Roobee has had two successful rounds of IEO funding, which saw it raising a total of $3.3 million up to date. It received a $4.5 million investment from a prominent cryptocurrency whale trader named “200mln trader”.

Roobee is now about to have its third round of fundraising through an IEO on the Liquid exchange. It will take place on September 18th and it aims to raise a total of $3.81 million.

What Is Roobee?

Roobee brings forward a blockchain-based investment software platform that takes advantage of transparent records and Artificial Intelligence (AI). Its goal is to help people make smart investment decisions and allow them to spend as little as $10 in innovative investment products ranging from cryptocurrencies, investment funds, IPOs, stocks, real estate, and many more.

Roobee makes a solid case that ordinary retail investors, in their majority, lack the access to traditional investment instruments and, in most cases, can’t meet the high entry thresholds. As such, it provides a viable alternative with entries reduced to as little as $10, allowing virtually everyone to make use of their spare capital.

Main Features

Roobee’s ecosystem is compounded by several key components, all of which contribute to the project’s entirety. These include:

Roobee Network

Roobee’s network is a blockchain-based solution that boasts a solid architecture combining a permissioned blockchain model dubbed RoobeeChain. It’s based on the public network of Ethereum, as well as on Hyperledger Fabric. The only concern here is outside of Roobee’s control, as the Ethereum’s network is currently clogged and is working on close to maximum capacity. Its purpose is to guarantee the issuance of digitalized assets, transparent reporting, and to provide an environment for distributed execution of smart contracts that govern the handling of the assets.

Network Actors

These represent all those who partake in Roobee’s ecosystem. Naturally, these include the Roobee investment platform, its users, investment product providers, and auditors. The auditors are a critical part of the RoobeeChain because they act as the final validators of the transactions and verify the authenticity and the accuracy of the information recorded on the blockchain. The plan of the team is to have a rewarding system for actors and to create an educational platform which will explain how to joina and how to support the network.

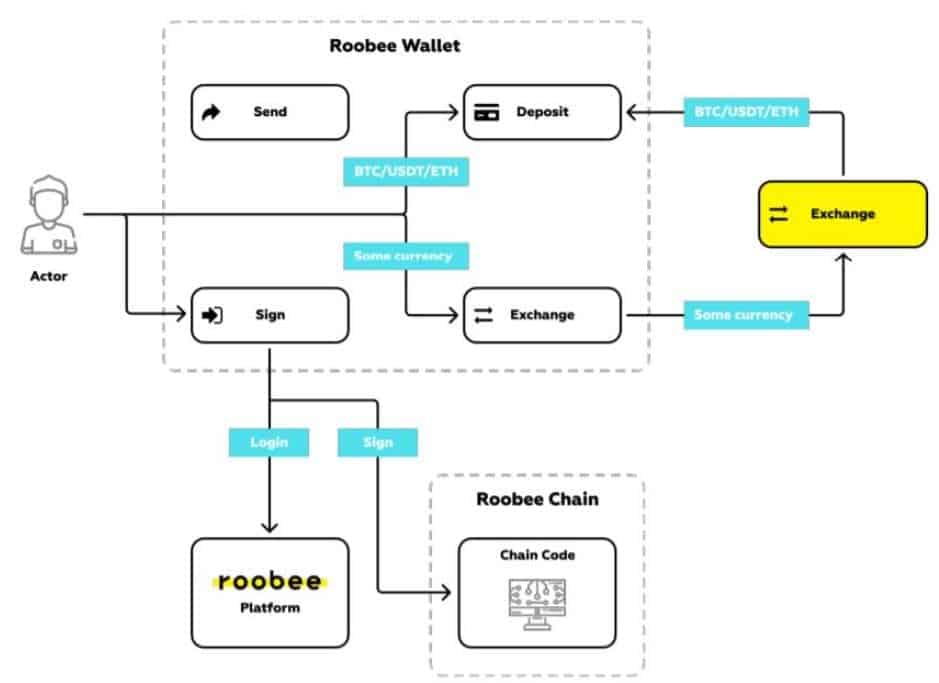

Roobee Wallet

At first, Roobee’s wallet will be non-custodial. It is intended to provide users with a rather simple cryptocurrency exchange. It will use multi-sig technology and APIs for different exchanges.

Roobee ID

Roobee ID represents an open-source library which interacts with the RoobeeChain without having to trust third parties. It’s a part of the HyperLedger Fabric KPI. It stores private keys and it allows signing transactions in a secure and decentralized manner. It also provides a solution for the tedious KYC/AML procedures because once transacted to RoobeeChain with a validated KYC/AML data, Roobee ID minimizes the number of requests and checks for access to all of the investment products on the platform.

Asset Digitalization

This is perhaps one of the most important features of Roobee’s blockchain – to handle digitalized assets. All of the actions performed with the user’s digital assets have to be signed with his private key using Roobee ID.

Other features of the Roobee ecosystem which deserve a mention include:

- Roobee Investee

- Roobee Score

- Roobee Fin

- Roobee Market

- Roobee Liquid

- Roobee Community

All of these provide for a well-integrated ecosystem which guarantees a fully-fledged approach to investing in traditional and cryptocurrency markets.

Advantages Vs. Competitors

Roobee comes with a few interesting key points which could set it apart from the competition. The points can be summarized as it is.

It’s worth noting that the project already closed an investment round with a whale investor who is also a trader and who invested a total of $4.5M in the project. He goes by the name of “200m_trader.” The original announcement of this investment was published on CCN back February 2019.

Successful Funding Rounds

Right off the bat, the project has already gone through a few different initial exchange offerings which enabled it to raise a substantial amount of money, as well as to get the word going among the cryptocurrency community.

Roobee raised $900,000 in two rounds on the Bitforex exchange platform in two separate rounds, both of which have closed fairly quickly.

The project also raised a total of 300 BTC in an IEO on the EXMO exchange, further increasing its funds pool, as well as getting more interest in the project.

Well-Developed Fully-Fledged Ecosystem

As you can see in the above section, the team has gone above and beyond to develop all the tools necessary for investors to engage in the project’s ecosystem. By becoming a one-stop-shop for both traditional and cryptocurrency retail investors.

Renowned Team of Experts

One thing that makes serious impression is that Roobee’s team is not only renowned but also relevant and appropriate. The people who are involved in the project are accomplished professionals in their respective fields, but they also have relative experience. All of them have a skill set and knowledge which can help the project move forward and achieve its goals.

Go To Market Strategy

Roobee plans to attract new users using two different ways. The first one is by direct advertising and it’s probably not very surprising. However, the money that the project has already raised should help its endeavors in this regard, as the entire thing is well-funded.

The second strategy they want to implement is through indirect attraction. This means that they will continue to develop their community of investors.

In terms of marketing, the whitepaper outlines a few different channels that will be used. These include:

SEO

The project will do a lot in the field of SEO so people who are attracted to the project will be well-targeted and relevant. The company also plans to launch an internal investment blog to warm up search engines and to provide additional value to the audience.

Social Media Marketing

The team claims that this is one of its strengths. The Twitter page of Roobee already has around 5,500 followers which is not massive but it’s also not to be disregarded. The Telegram group also has more than 4,500 people on it.

In addition, the team also plans to leverage other methods of digital advertising, which include:

- Email Marketing

- Banner Advertising

- Advertising Through Opinion Leaders and Bloggers

- CPA Marketing

- Video Marketing

- Retargeting

- Google Advertising

- Advertising and Sponsorship At Conferences

IEO And Previous Round Terms

As we mentioned above, Roobee has successfully closed two rounds of funding through Initial Exchange Offerings.

IEO on Bitforex

This round saw the project raising a total of $900,000. It was divided in two. The first part raised $750,000 in less than an hour, while the second round raised $150,000 and it was closed in 20 minutes.

The total supply of ROOBEE tokens for the sale was 90,000,000 ROOBEE tokens and they were sold at a price of $0.01. The minimum purchase limit was $10, while the individual cap was $10,000. There were also some bonuses:

- More than $1500 – 5%

- More than $3000 – 7%

- More than $7000 – 10%

IEO on EXMO Exchange

This round of fundraising saw the project raising a total of 300 BTC on the EXMO exchange. Again, the price per ROOBEE token was set to $0.01. The IEO started on the 4th of June and ended on the 7th of June. The limit order for an individual account was again $10,000.

IEO On Liquid On September 18th

Roobee will have an IEO on Liquid on September 18th. The total amount of tokens to be sold is 300,000,000. The minimum investment is 1,000 ROOBEE tokens. The price per one token is set to 0.00000126BTC or $0.0127. There are interesting bonus layers which the users can take advantage of. These include:

SILVER Status from $2000

These will recieve 30% on success fees charged by Roobee for 6 months and six months on the online investment educational platform with leading experts from the world of investments.

GOLD status from $4000

Up to 40% discount on success fee charged by Roobee service for 9 months. Access for 9 months to online investment educational platform with leading experts from the world of investments. Free gold tickets by Roobee and partners for private events and conferences around the world for 12 months

PRIME Status from $8000

Up to 50% discount on success fee charged by Roobee service for 9 months. Access for 12 months to online investment educational platform with leading experts from the world of investments. Free prime tickets by Roobee and partners for private events and conferences around the world for 18 months

Token Use

The project issues the so-called ROOBEE token. It’s an ERC20-standard token which is based on Ethereum’s network.

According to the whitepaper, the token will allow the users with the following functionalities:

- Access to additional investment modes

- Reduced transaction costs for the users on the platform

- Self-rebalancing their portfolios

- Gaining access to additional products on the Roobee Market

- Accessing the Roobee educational platform

- Getting premium status on the platform.

As such, it’s clear that the ROOBEE token is not a security but rather a utility token, which should make regulatory compliance easier. The token doesn’t grant any participation in the company or its assets. It doesn’t represent a loan obligation and is not considered to be securities in any jurisdiction.

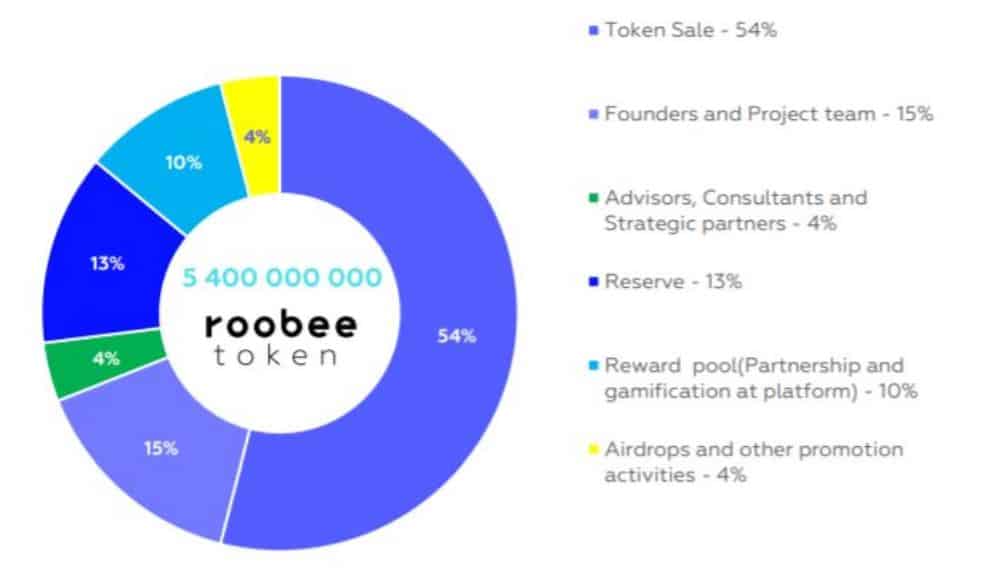

The project will issue a total of 5,400,000,000 ROOBEE tokens. No additional emission will be possible. It’s a mintable token.

In terms of token distribution, the following graph visualizes it the best:

Team Members and Advisors

It’s safe to say that Roobee has done a good job in creating a diversified and specialized team of renowned and experienced members. The executive personnel of the company brings in critical experience, as well as appropriate skills in traditional finance, FinTech, and blockchain-based technologies. The advisory board is refined, to say the least, including specialists with knowledge and connections in all the right fields.

Team Members

Amine Berraoui (CEO) – Amine is the Chief Executive Officer of Roobee. He brings extensive experience in the field of finance. He’s served as the Managing Director and Head of FX and Flow at the Royal Bank of Scotland for three years, as well as the MD and Head of FX Sales at Deutsche Bank. He has also worked with other major banking giants such as ABN Amro Bank, Citibank, and others. His experience in the field of traditional finance will help Roobee’s goal to bring innovative investment instruments to the hands of the ordinary investor.

Vladi Siganevic (CMO) – Vladi is the Chief Marketing Officer of Roobee. He has over 15 years of experience in digital marketing and is also managing Creamfinance Czech, a company with more than $35M of revenue and $20M of raised capital. Going forward, Vladi’s experience in digital marketing, especially in the field of finance, should help Roobee reach its target audience and accomplish its preliminary goals.

Oleg Gaidukov (CTO) – Oleg is the Chief Technology Officer of Roobee. His background is quite extensive, having occupied executive positions in various fintech companies such as Keymano, Boomstarter.Network, and others. He also served as the Head of Telecommunication and Enterprise Networks at Tier-1 EU Bank Banca Intesa. His experience in the space and his technical knowledge will contribute to Roobee’s goals from a sheer technological perspective.

Denis Kaizer, Head of Blockchain R&D – Denis has graduated from the Novosibirsk State Technical University and has a Master’s degree in Economics. He is a recognized Solidity developer with experience in crypto-related companies such as Forseti and Cryptoworld. He is also a Decentralized Apps (DApps) architect. His experience in the field of blockchain will help the project bring its structure to life

Key Advisors

Albert Sagiryan, Investment and Financial Markets Advisor – Albert is a partner in the international investment fund GEMCORP Capital, an FCA regulated fund. He’s also a former Managing Director at Goldman Sachs and JP Morgan. Going forward, his role in the project is nothing but obvious as his connections and experience can surely help Roobee achieve its ambitious goals of bringing innovative investment products to the masses.

Daniele Azzaro, AML/Security Advisor – Daniele has upwards of 15 years of consulting experience for global moguls such as Lloyds, Barclays, and The Royal Bank of Scotland. He’s also a member of the Association of Certified Anti-Money Laundering Specialists (ACAMS), and his advisory on KYC/AML procedures will surely benefit Roobee achieve regulatory clarity and oversight.

Serj Azatyan, Strategic Partner and Advisor – Serj has graduated from Harvard Business School. He has also co-founded Inventure Partners, an early-stage venture capital firm with a broad portfolio of lucrative investments. His expertise and connections can help Roobee bring in financial stability and the funds necessary to secure the project’s proper development.

Partners And Investors

In terms of partnerships, Roobee is working with the following companies to improve different aspects of its product:

Binance- Binance is the world’s leading cryptocurrency exchange. Roobee works with Binance on guaranteeing the liquidity to the Roobee platform.

BitGo- BitGo is one of the largest Bitcoin processors and it’s a leader in security, custody, and compliance. With over $15B in monthly transactions, BitGo is a well-known authority. Roobee works with BitGo on its safe storage solutions.

Sum & Substance- Sum And Substance is a leading KYC/AML provider. The team works with the company to guarantee KYC/AML compliance on its platform.

Inventure Partners- This is a strategic partner of Roobee. It is an innovative investment firm which has a broad portfolio of projects such as Gett (GetTaxi). .

Blockize- Blockize is a blockchain-focused, full-circle enterprise service platform. Roobee works with it to expand its business outreach in different markets.

HyperLedger – Created by the Linux Foundation, HyperLedger Fabric is supported by the majority of players in the market, including Intel and IBM. Roobee works with the company on creating their permissioned blockchain using the HyperLedger Fabric framework.

SmartDec- This is a well-known security company in the field of blockchain and Roobee works with it to audit its smart contracts.

Roadmap

The roadmap of the project is pretty ambitious. Summing it up, it look slike this:

Q4 2017 -> Project ideation.

Q1 2018 -> Securing $4.5M USD investment

Q2 2018 -> Formulating the core team of developers and managers

Q3 2018 -> Allocating $15M to various investment products to test the idea

Q4 2018 -> Licenses for storage and exchange of crypto in the EU

Q1 2019 -> 300,000 people investment community

Q2 2019 -> Roobee MVP, beta versions, Roobee Marketplace, launch of crypto-based products

Q3 2019 -> Roobee mobile app (beta), signature of agreements with brokers, public testing

Q4 2019 -> ETF and Shares products launch, Roobee 0.8 launch, licensing applications in EU, launch of first operational market for testing

Q1 2020 -> Beta release of Roobee’s decentralized wallet, beta version of Roobee blockchain, PoC with bank of NeoBank, signing agreements

Q2 2020 -> Fully compatible beta blockchain release, phase 1 of market expansion, cooperating with institutional investors, launch of real-estate products

Q3 2020 -> Live version of Roobee blockchain, live version of Roobee Wallet, venture fund products

Q4 2020 -> Live version of Roobee platform, signing new broker agreements

Q1 2021 -> Roobee Liquid, market expansion, annual report and audit, commodities and debts products

Q2 2021 -> Roobee Terminal, decentralized marketplace for private asset managers

Conclusion

Stage of the Project

Working private MVP for special focus-groups of users in private mode. Well written whitepaper.

Score: 8.3

Project Potential

Even though the trading software market is a vast market with the potential of billions of dollars revenue there is an outstanding number of competitors. To stand out, Roobee will have to partner with the most well-known companies in the industry, to offer the most advanced financial products and to have a large budget for marketing. So far it seems like they are on the right track with extensive coverage on the media, partners such as Binance and BitGo. Regarding their products, allowing low barrier of 10$ to invest can significantly extend their audience.

Another challenge they will have to face is how to attract network actors, and this is not an easy task that every new decentralized network has to face, according to Roobee they will have a rewarding system program for actors and also educational platform, that will explain people how to join the network.

Score: 8.5

Community

It seems like the Roobee team gave a lot of effort to develop an extensive community:

- Artem Popov is a co-founder of “10 dollars of Buffet”, a Russian investment community with total audience more than 300K members.

- Wikipedia page that covers the project.

- 5.6K likes on their Facebook page but not a lot of discussions and comments.

- 1 Page on Bitcointalk.com

- 5.4 followers on Twitters

- Endless amount of mentions on tier-1 sites such as Yahoo, Bloomberg, Reuters, etc.

Score: 9.2

Token Use:

The Roobee token is defined as a utility token inside the Roobee platform; it will give many privileges to its holders such as additional investments modes, discount on transactions cost, other premium products, etc. There is a clear positive correlation between the success of the platform to the price of the token.

Score: 8.5

Backend Technology:

Roobee will create a permissioned blockchain, based on the HyperLedger Fabric platform. Their current GitHub account is minimal with only 37 commits. Also they are exploiting IBM’s cutting edge cloud and blockchain technologies.

Score: 8.5

Team and Advisory Board:

Roobee introduced a highly equipped team with experts in the right fields of finance, marketing, technology, and blockchain. Regarding the advisory board, Roobee managed to partner with influential figures in some of the public investment funds. Also, one of the most significant challenges in trading platforms is money laundering, for that Roobee recruited Daniele Azzaro which is a world-class anti-laundering expert. Beside this we don’t see any tier-1 blockchain figure on their team.

Score: 8.9

Whitepaper

Well explained whitepaper which gives clear details about the business, technology, team, and strategy of the company

Score: 9.1

Token Sale Terms

Roobee already conducted two successful IEOs were they raised 3.3 M USD for 6% of their tokens for a price of 0.01 USD per one token. In the next IEO Roobee is planing to raise additional 3.81 M USD for 5.56% of their total supply for a price 0.0127 USD per token. According to their whitepaper they will eventually sell 54% of their total supply. Roobee team has announced that the tokens that will be sold in the future token sales will be sold for the same price (0.0127$ ) and the ones who will not be sold will be burn.

In the current price the total market cap will be concluded into 61.1M USD which is pretty high for those days.

Score: 8.0