The coin pulls back below %excerpt%.12 after increasing by 8% in a week.After a slight breakdown, sellers are now eyeing the 12000 SAT level.CRO remains bullish on the mid-term despite 4% drops overnight.CRO/USD: Price Consolidating After DropKey Resistance Levels: %excerpt%.1193, %excerpt%.126Key Support Levels: %excerpt%.113, %excerpt%.105CRO/USD. Source: TradingViewAfter breaking last week’s high at %excerpt%.1193, Crypto.com recorded a new high around %excerpt%.126 on Tuesday before the price dropped to where it’s currently changing hands near %excerpt%.113 support area – which may hold for a while before it breaks down or rebound.The price is currently down by 2%. Despite that, the bullish trend remains valid on a mid-term but it is important to note that the market appeared overbought on the daily chart.However, CRO is currently

Topics:

Michael Fasogbon considers the following as important: CROBTC, CROUSD, crypto.com, Price Analysis

This could be interesting, too:

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Bitcoin Schweiz News writes Trump Media kooperiert mit Crypto.com für ETFs auf Truth.Fi

Emily John writes Crypto.com Joins Accor ALL for Crypto Loyalty Boost

Mandy Williams writes Crypto.com Joins Forces With Germany’s Deutsche Bank to Offer Banking Services

- The coin pulls back below $0.12 after increasing by 8% in a week.

- After a slight breakdown, sellers are now eyeing the 12000 SAT level.

- CRO remains bullish on the mid-term despite 4% drops overnight.

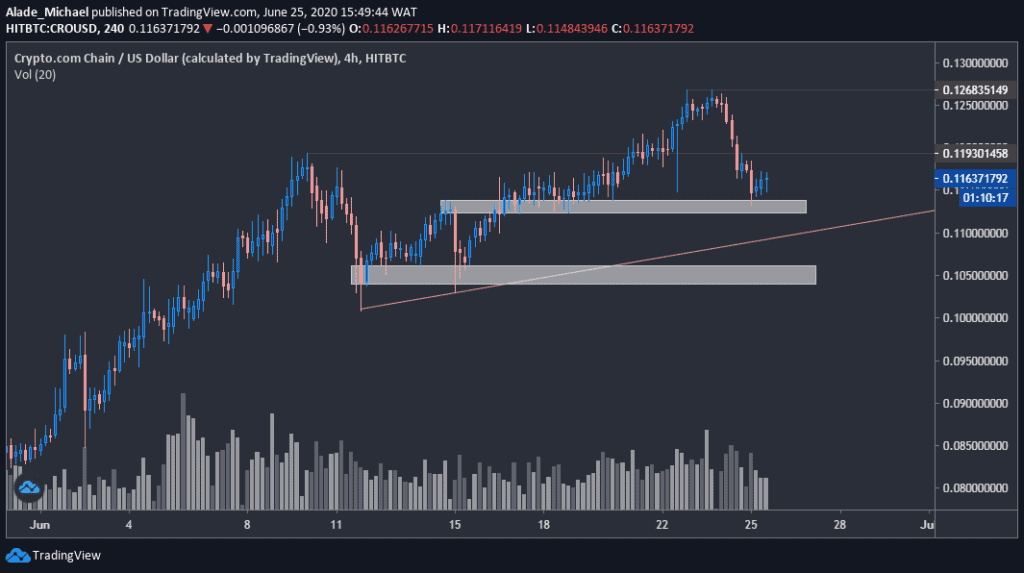

CRO/USD: Price Consolidating After Drop

Key Resistance Levels: $0.1193, $0.126

Key Support Levels: $0.113, $0.105

After breaking last week’s high at $0.1193, Crypto.com recorded a new high around $0.126 on Tuesday before the price dropped to where it’s currently changing hands near $0.113 support area – which may hold for a while before it breaks down or rebound.

The price is currently down by 2%. Despite that, the bullish trend remains valid on a mid-term but it is important to note that the market appeared overbought on the daily chart.

However, CRO is currently undergoing a small consolidation. However, the price would need to fall below the monthly low around $0.1before a reversal can be considered for this trend. If not, the price would continue to increase until the bulls exhaust momentum.

Crypto.com Price Analysis

Crypto.com is currently facing the $0.113 support area, the first grey area on the 4-hours chart. If the support breaks and the red rising line fails to produce a rebound, the second support area at $0.105 would be the next selling target. Slightly below this, support lies at $0.1 (the monthly low).

For a strong rebound, there’s a close resistance at $0.1193 (last week’s high) before the price increases further to the current weekly high of $0.126. A break above this level may confirm a continuation of the bullish trend.

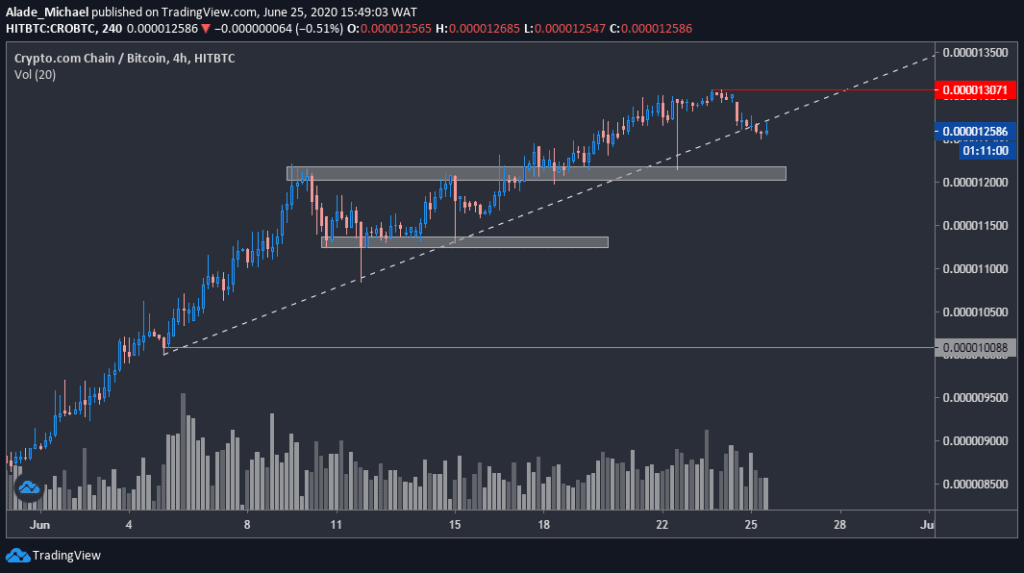

CRO/BTC: Price Near 12000 SAT Level

Key Resistance Levels: 13071 SAT, 13500 SAT, 15000 SAT

Key Support Levels: 12000 SAT, 11250 SAT, 10000 SAT

This week, Crypto.com resumed bullish actions after struggling around the 12000 SAT level for about 10 days. After increasing by 8% to reach 13071 SAT level yesterday, the price lost 1.85% to where it’s priced at 12560 SAT level.

As can be seen in the above chart, trading activity has been very low for the past three days. Technically, the bulls are getting weaker. A selloff may come into play if buyers fail to show further commitment.

The latest slight break below the white ascending line indicates a potential bearish sentiment, which may become noticeable if the price continues to drop. CRO would need to climb back above this trend line to sustain the bullish trend.

Crypto.com Price Analysis

If the buyers try to regroup again, they would need to retain yesterday’s high of 13071 SAT level, then push further to around 13500 SAT level. The price may even reach 15000 SAT level if demand continues to increase.

But looking at the current drops, the price may dip further into the initial grey spot at 12000 SAT (last week’s high) in the next few hours. It could plunge into the second grey spot at 11250 SAT if supply increases. The last defense line for bulls is around 10000 SAT level, where the grey horizontal line lies.