The popular decentralized finance tracking resource DeFi Pulse has introduced a new tool to measure risks within the DeFi ecosystem. Developed in collaboration with the digital asset modeling platform Gauntlet, the instrument has already graded two “very safe” DeFi protocols – Aave and Compound. The Launch Of DeFi Pulse Economic Safety Grade The DeFi trend exploded in popularity in recent months, with numerous projects emerging offering alluring investment opportunities for users. However, the rapid development led to the launch of multiple unaudited protocols. This resulted in costly mistakes and hacks, and investors lost a lot of funds. While announcing the creation of the Economic Safety Grade tool, Gauntlet highlighted that proper risk assessment has lacked in the DeFi

Topics:

Jordan Lyanchev considers the following as important: AA News, aave, compound, defi

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

The popular decentralized finance tracking resource DeFi Pulse has introduced a new tool to measure risks within the DeFi ecosystem. Developed in collaboration with the digital asset modeling platform Gauntlet, the instrument has already graded two “very safe” DeFi protocols – Aave and Compound.

The Launch Of DeFi Pulse Economic Safety Grade

The DeFi trend exploded in popularity in recent months, with numerous projects emerging offering alluring investment opportunities for users. However, the rapid development led to the launch of multiple unaudited protocols. This resulted in costly mistakes and hacks, and investors lost a lot of funds.

While announcing the creation of the Economic Safety Grade tool, Gauntlet highlighted that proper risk assessment has lacked in the DeFi field. The risks were even higher for people outside of the cryptocurrency field who were looking into investing in DeFi protocols.

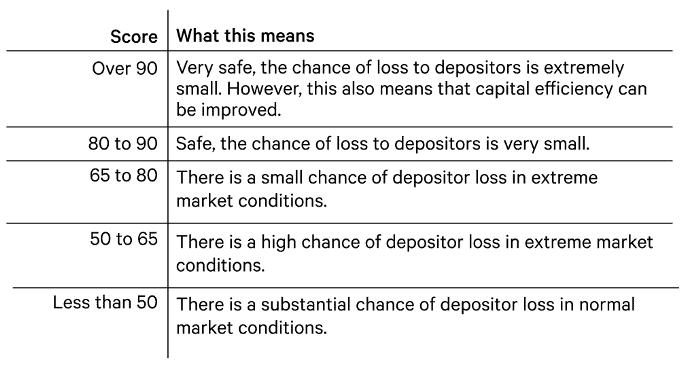

The grading tool will provide a final score ranging between 1-100 after examining several protocol features. Those include collateral volatility, relative collateral liquidity, user behavior, protocol parameters, and smart contract risks.

It’s worth noting that the tool has been launched in alpha, but it’s still in development. The smart contract risk assessment feature is not active yet.

“The DeFi Pulse Economic Safety Grade is created by running simulations utilizing data from centralized and decentralized exchanges combined with on-chain user data to estimate market risks.

Grades are focused on the risk of insolvency or, in other words, the risk to depositors.” – DeFi Pulse tweeted.

Aave And Compound Received The First Grades

After analyzing the historical liquidity and volatility data, the risk assessment tool has already graded two of the most popular DeFi protocols – Aave and Compound. Both have performed with high results above the “safe” zone at 90. Aave received 95, while Compound’s score was 91.

Gauntlet explained that they also estimated “the risk of the system for users borrowing a stablecoin against this collateral type.” The stablecoin borrowing on Aave accounts for about 70%, while on Compound, the percentage is at 90.

The next project to be reviewed is MakerDAO, which has 100% stablecoin borrows.