Where are the best places to invest in 2020? In this article we will give you the top 5 directions. This includes where to invest your money online or offline this year, how to “buy time,” and receive interest even when you are not working. We will also show you where to invest in 2020 in order to receive monthly income, how best to do it, as well as provide several important recommendations from professionals in this regard.SecuritiesSecurities have long been a common source of investment. Many people dream of being co-owners of Apple, Microsoft or Gazprom, which then allows them to be part of the stock market. It is enough to buy a share of one of these companies, as then you already own a small part of it and can receive dividends from your stock ownership. In the event of an increase

Topics:

Svetlana Soroka considers the following as important: bitsmax, bitsmax news, bitsmax platform, Investing, Press Release

This could be interesting, too:

Guest User writes Join the Future! ZacroTribe (ZACRO) Presale Opens Soon at %related_posts%.01!

Guest User writes The Future of Financial News Presale is Here: Secure Your ZACRO Tokens for a New Era of Decentralized Insights

Guest User writes The Wait is Almost Over – ZacroTribe (ZACRO) Presale Launching at %related_posts%.01!

Chainwire writes SingularityNET and Privado ID Partner to Establish Decentralized AI Agent Trust Registry

Where are the best places to invest in 2020? In this article we will give you the top 5 directions. This includes where to invest your money online or offline this year, how to “buy time,” and receive interest even when you are not working. We will also show you where to invest in 2020 in order to receive monthly income, how best to do it, as well as provide several important recommendations from professionals in this regard.

Securities

Securities have long been a common source of investment. Many people dream of being co-owners of Apple, Microsoft or Gazprom, which then allows them to be part of the stock market. It is enough to buy a share of one of these companies, as then you already own a small part of it and can receive dividends from your stock ownership. In the event of an increase in the value of shares, they can be sold, and a good profit recorded.

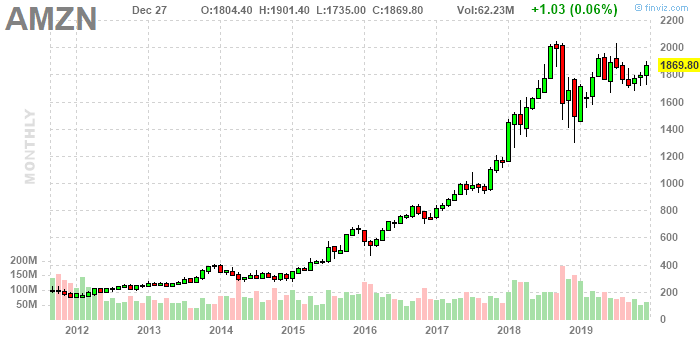

Everyone can invest in profitable stocks. The procedure of actions is simple (no more complicated than buying toothpaste in a store), and after a dozen such actions, anyone can feel comfortable trading the stock market. As an example, consider the stock of Amazon:

Over the past year, several securities have added almost 100% to their price, and this is not the first time for such dynamics. If this seems to you to be an isolated case, then take a look at Tesla, Google and other well-known companies.

Venture Funds

Investing in venture projects is extremely profitable but also very risky. To begin with, we will note that a venture fund is an investment project aimed at introducing innovations in the form of start-ups or existing enterprises.

The scheme of work of venture funds is as follows: investors can be individual participants or companies and banking structures. Their investments not only take the form of money, but also commitments (an obligation to invest a sum of money when it will be needed, for a specific period of time). Part of the fund is also made of contributions by founders of the venture fund. The fund then distributes money to the companies included in its portfolio and develops them over the stated period, usually 5-10 years.

Real Estate

Perhaps the most traditional way to generate income is to buy real estate. It is extremely difficult to single out something new in this area. Nevertheless, we will note the main points. For example, real estate income can be of two types: rental payments, or resale of real estate object at a higher cost. The most common is the first option. Many people buy apartments and rent out them in order to receive stable income.

One can purchase not only residential but also commercial facilities. The latter are an order of magnitude more expensive than apartments and require special approach to selection, since they are intended for business. Most often, such an option is suitable for people who do not want to greatly increase their capital, but rather just save it, since an apartment for $40 thousand (outside of capital) can bring in $200 a month, while in the stock market the same amount could bring in 10 times or more. With trust management at a foreign exchange market, this figure could increase by an even greater degree.

The main problem for investing in real estate is the starting capital, which should be quite large. For example, the average cost of commercial real estate in Moscow is 407,700 rubles per 1 square meter (according to the Domofond.ru research project). Given that the standard commercial rental will have an area of about 100 square meters. m., you will need an amount of $1 million USD to cover the cost. The potential income from investments in real estate is about 10-15% per year in rent, and for a residential investment it will be about 5-8%.

When buying a new building for resale, profits may reach 30-40%, in general; across all properties, the annual increase is about 5-10%.

Start-ups

Start-up companies have long been the center of attention for investors. This direction can bring quite a large profit over time, as evidenced by the stories of Facebook, Microsoft, and others. Their investors, after a dozen years, managed to make a profit in the thousands of percent.

If you think that an IPO of a startup on an exchange is a good opportunity to invest a small amount of money, then you may be wrong.

Firstly, an IPO signifies an already very high cash flow at the company, which means that you need to invest in startups before they reach IPO phase, and at their very early stages.

Secondly, an IPO does not guarantee stock growth; on the contrary, in the first year after an IPO, the stock of most companies falls in price.

The amount that can be earned at startups is in hundreds, and sometimes thousands, of percent. On the other hand, investing in young companies is risky, as they may not be successful in the end and cause loss.

Investing in startups is good on themed exchanges:

Cryptocurrencies

Investing in cryptocurrencies is the most powerful financial trend in the world over the past 50 years. Today, many people compare the rise of this asset class to the gold rush, and according to a survey, more than 50% of investors would prefer to invest in Bitcoin instead of gold. More than 76% of cryptocurrency holders are confident in “whale forecasts” which predict that the cost of bitcoin in the next few years will reach $250,000 per 1 BTC.

Many billionaire investors and even the creators of cryptocurrencies themselves call this trend a bubble; however, it is apparent that no one can stop its growth. Even states seeking to adapt to this avalanching trend and develop their own currencies based on the blockchain system of decentralization.

It is difficult to forecast the future with certainty, but at the moment, even grandmothers are learning about Bitcoin, and the price of this new money continues to rise. If you do not want to acquire an electronic wallet or delve into the essence of this new technology, you have the option of just investing in different cryptocurrencies via exchange brokers. This method is very affordable and does not require large expenses. In addition, brokers offer leverage, which can increase your profits by a significant degree.

In addition to brokers, 2019 saw a rise in fully automated platforms based on neural networks. This means the analysis of coin prices, charts, ICO/IEO is not performed by brokers but artificial intelligence. Unlike with people, the chance of neural network error tends to be zero. Additionally, a blockchain-based neural network – unlike a trader – will not be able to lie to you or fool you.

Case Study

You may not understand cryptocurrencies completely; in which case there is always the option to make a deposit and get from 2 to 5% per day in this passive mode. It is agreed that bank deposits compared to such incomes seem ridiculously small.

One such automated platform did not appear long ago; however, already more than $700,000 has already been invested in the platform and this amount is growing every day. This feat is not too surprising as everyone wants to receive passive income with such interest, which makes investing in it the most promising of all directions.

This platform is fast developing and every day the number of accepted cryptocurrencies and payment systems is growing. The company behind it also effectively uses network marketing to attract investors; that is, you can make money on the platform without investing money, but only through inviting friends. The main advantage of the platform is that contracts can be opened in just about any size, and that any inhabitant of the planet can invest in it. Unlike other such platforms, you do not receive money at the end of the investment period but receive accruals every day for a year which you can immediately withdraw or reinvest for more profits.

Conclusion

Every year, there are more and more directions for investment. Each investor – if they want to make a profit and become a professional – must follow a number of simple rules, including diversification and risk calculation. Taking all of this knowledge into account, do not neglect the recommendations and advice from successful investors who have already proven their skills in practice.