Compound (COMP) could be nearing a local price top, soon after the Ethereum-based decentralized finance (DeFi) token recorded a 258% growth in ten days.And while “yield farming” has driven much of that growth, the Compound community has passed through a development proposal that would see incentives taken away from would-farmers.Local COMP Top Incoming?Blockchain analysts at Santiment predict Compound could be nearing a local top after the token took the top spot in their social media emerging trends list. The Santiment team tweeted on June 26:“As is our golden rule, when an asset like $COMP enters the top 3 on the @santimentfeed emerging trends list, it is generally indicative of an upcoming local top forming. We can see in this graphic that with every social volume spike, a sharp

Topics:

Greg Thomson considers the following as important: AA News, COMPBTC, compound, COMPUSD, defi, ETHBTC, ethusd

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Compound (COMP) could be nearing a local price top, soon after the Ethereum-based decentralized finance (DeFi) token recorded a 258% growth in ten days.

And while “yield farming” has driven much of that growth, the Compound community has passed through a development proposal that would see incentives taken away from would-farmers.

Local COMP Top Incoming?

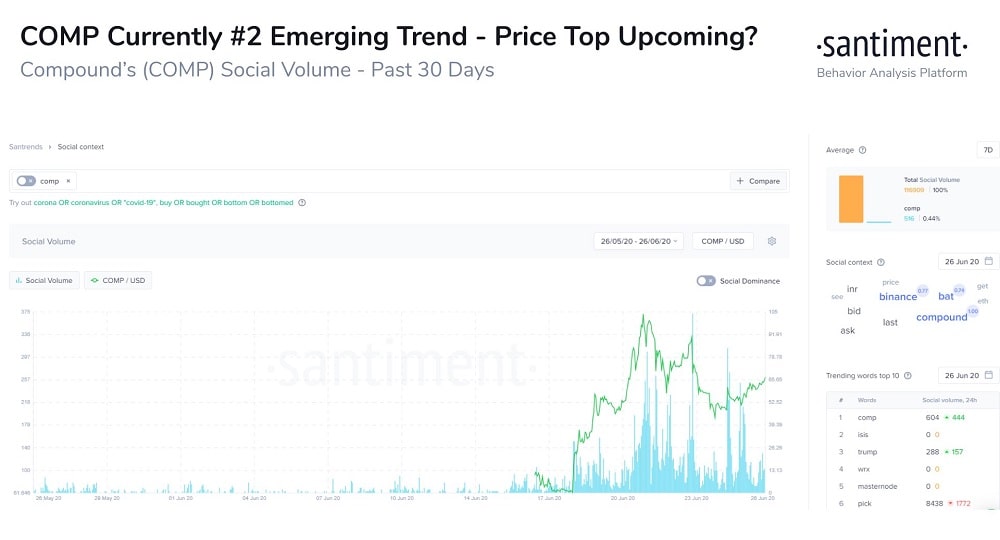

Blockchain analysts at Santiment predict Compound could be nearing a local top after the token took the top spot in their social media emerging trends list. The Santiment team tweeted on June 26:

“As is our golden rule, when an asset like $COMP enters the top 3 on the @santimentfeed emerging trends list, it is generally indicative of an upcoming local top forming. We can see in this graphic that with every social volume spike, a sharp directional change in price occurs.”

The value of COMP is on the rise, having recorded 19.7% growth in three days since June 24, according to data from CoinMarketCap. That followed a 41% drop over the previous three days since June 21.

Vote to Curb Compound Yield Farming

Compound awards users who lend and borrow on the platform with COMP tokens relative to the value of interest paid and received on loans. The process of optimizing trading strategies to garner the maximum profit from using Compound has become known as “yield farming.”

On June 25, a Compound governance proposal was passed by holders of the COMP token to slash the daily reward payout by 12.6%. The proposal was voted in by 98 token holders against 16, or 1,198,438 (86.37%) against 189,177 (13,63%) in total votes, and will see daily reward payouts reduced to 2,880 COMP tokens.

The change to the protocol also saw efforts made to make it more difficult to “farm” COMP, by increasing its reserve factor to 50% for three select tokens. Specifically, farmers who used Basic Attention Token (BAT), Augur (REP), and 0x (ZRX) on Compound will find it more costly to accrue the same amount of tokens as before. The proposal stated:

“This is an extreme situation caused by the COMP distribution. Currently, these assets are preferred for those who farming COMP, these carry high liquidation risk against the protocol; therefore increasing their Reserve Factor is needed to ensure the protocol safety.”

At the time of writing, the APY (annual percentage yield) rate for supplying BAT tokens to the liquidity pool remains at 12.99%. The cost of borrowing BAT tokens is as high as 32.41%, according to Compound.Finance.

Crypto EcoBlog

Crypto EcoBlog