A recent report exploring the Q3 2020 developments in the decentralized finance ecosystem confirmed the narrative that it was the best quadrant for the entire field.Additionally, it highlighted Ethereum’s massive role as the underlying technology but also broached several potential competitors, including TRON and EOS.Confirmed: DeFi Exploded In Q3 2020The analytics company Dapp Radar posted its quarterly report on the DeFi progress this week. It described Q3 2020 as the “best quarter for the DeFi ecosystem.” By examining the data, it seems like the obvious conclusion.Although DeFi is not a 2020 invention, it boomed in popularity in the middle of this year. What catalyzed the most significant growth was the yield farming trend.As the graph above demonstrates, DeFi was steadily increasing in

Topics:

Jordan Lyanchev considers the following as important: AA News, defi, EOSBTC, eosusd, ETHBTC, ethusd, TRON, TRXBTC, TRXUSD, uniswap

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

A recent report exploring the Q3 2020 developments in the decentralized finance ecosystem confirmed the narrative that it was the best quadrant for the entire field.

Additionally, it highlighted Ethereum’s massive role as the underlying technology but also broached several potential competitors, including TRON and EOS.

Confirmed: DeFi Exploded In Q3 2020

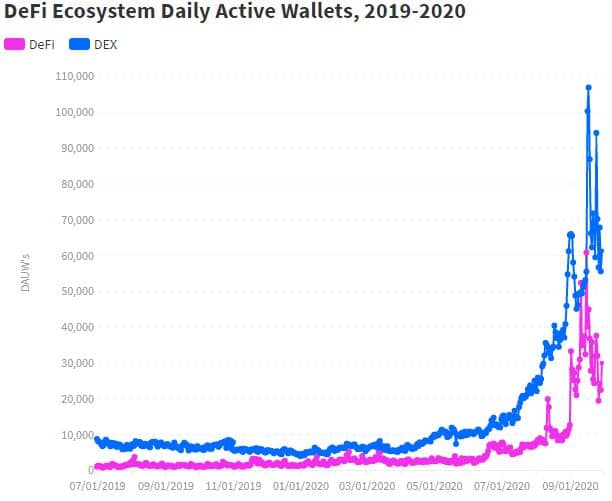

The analytics company Dapp Radar posted its quarterly report on the DeFi progress this week. It described Q3 2020 as the “best quarter for the DeFi ecosystem.” By examining the data, it seems like the obvious conclusion.

Although DeFi is not a 2020 invention, it boomed in popularity in the middle of this year. What catalyzed the most significant growth was the yield farming trend.

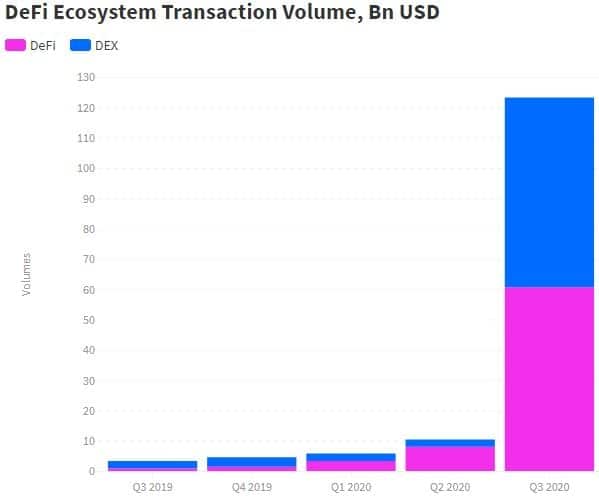

As the graph above demonstrates, DeFi was steadily increasing in transaction volume quarter by quarter from the middle of 2019 to the middle of 2020. In Q3 2020, however, the transaction volume exploded from about $10 billion to $123 billion.

Similarly, the total value locked in different DeFi protocols also experienced massive growth. It skyrocketed by 380% from the end of Q2 2020 and topped $10 billion in September 2020.

According to the Dapp Radar estimations, Uniswap, MakerDAO, and Curve hold most of the TVL. Additionally, the paper asserted that Uniswap attracted even more attention following the release of its governance token UNI.

Ethereum (Still) Dominates, But Competition Comes

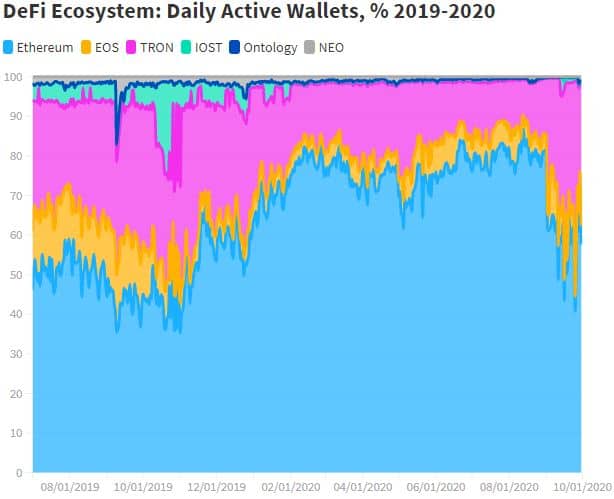

Somewhat expectedly, the report highlighted Ethereum as the most widely used network for several DeFi features. Apart from being responsible for 96% of the transaction volume, Ethereum also accounted for more than 57% of the daily active wallets.

However, as the Ethereum network saw significant utilization, it became congested. Consequently, the transaction speed decreased while the fees surged. At peak moments, “transaction costs were more than 400 Gwei,” the report noted.

As a result, networks like EOS and TRON took advantage and swiped some of Ethereum’s market share. Although EOS was responsible for only 5% of the daily active wallets, the role of Justin Sun’s TRON proliferated and accounted for about 35% during Q3 2020.

Other networks with a less substantial presence were IOST, Ontology, and NEO. Despite registering triple and even quadruple-percentage increases compared to Q2, they accounted for only 3% of all daily active wallets.