Despite the short-term adverse price developments for Ethereum, ETH whales have continued to accumulate. Data from Santiment revealed that the top non-exchange whale addresses had increased their holdings by over 80% in August alone.ETH Whales Increased Their HoldingsSimilarly to the ICO boom in 2017, Ethereum’s popularity surged in 2020 as its blockchain serves as the underlying technology behind the hottest trend this year – DeFi.ETH reacted with a massive YTD increase. Ether is up by 170% since the start of the new century and even painted a fresh 2-year high of nearly 0 before it slumped by 35%.The micro-scale price dips haven’t rattled Ethereum investors’ belief in the long-term prosperity of the project, according to data from the analytics resource – Santiment. Unlike the top 100

Topics:

Jordan Lyanchev considers the following as important: AA News, ETHBTC, Ethereum (ETH) Price, ethusd

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

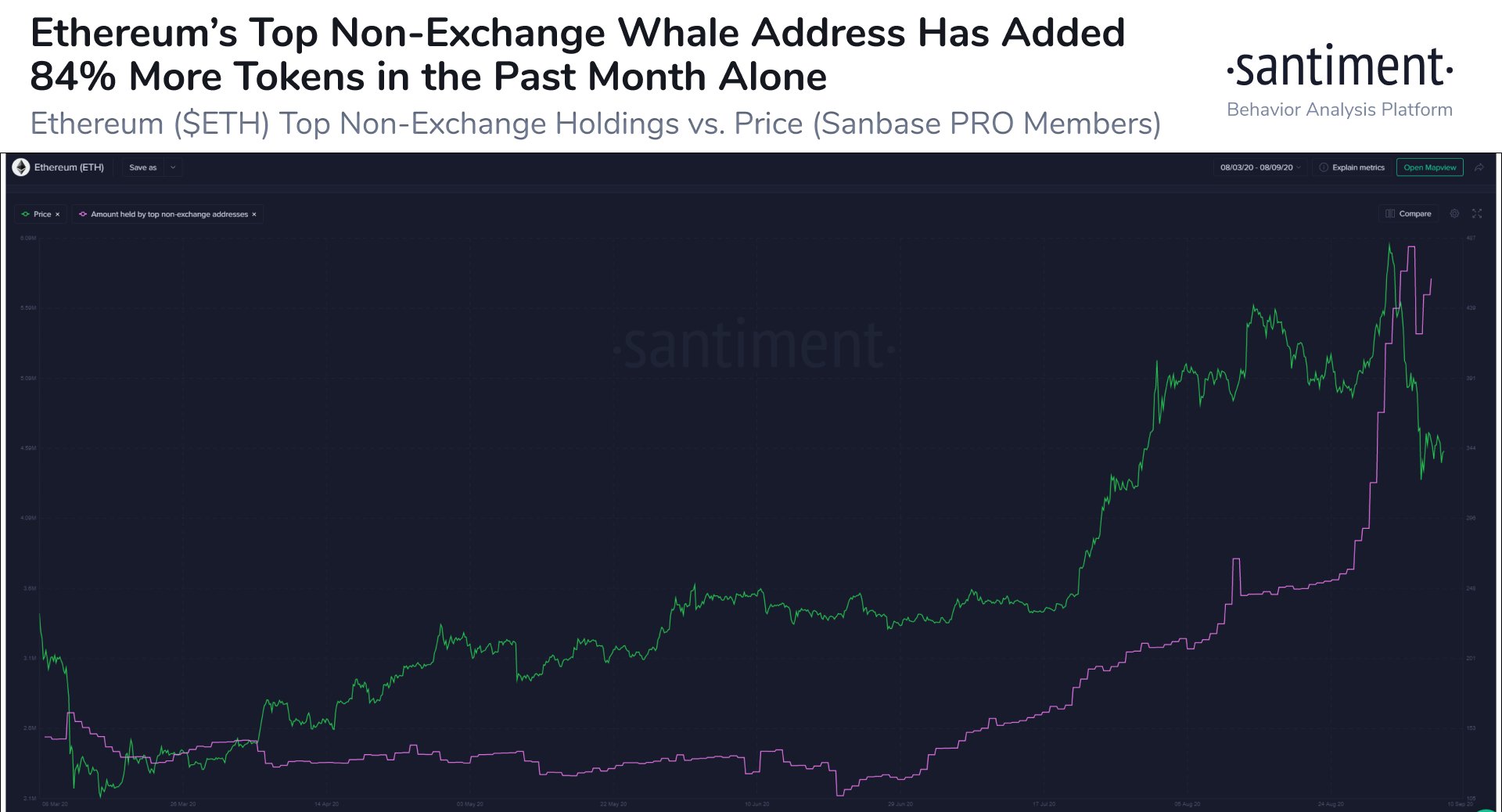

Despite the short-term adverse price developments for Ethereum, ETH whales have continued to accumulate. Data from Santiment revealed that the top non-exchange whale addresses had increased their holdings by over 80% in August alone.

ETH Whales Increased Their Holdings

Similarly to the ICO boom in 2017, Ethereum’s popularity surged in 2020 as its blockchain serves as the underlying technology behind the hottest trend this year – DeFi.

ETH reacted with a massive YTD increase. Ether is up by 170% since the start of the new century and even painted a fresh 2-year high of nearly $500 before it slumped by 35%.

The micro-scale price dips haven’t rattled Ethereum investors’ belief in the long-term prosperity of the project, according to data from the analytics resource – Santiment. Unlike the top 100 ETH exchange addresses who sold-off about $1 million tokens prior to the latest price drops, non-exchange whales have been continuously accumulating larger portions.

The graph above reveals that the top non-exchange ETH whales kicked it up a notch in August when they increased their holdings by 84%. Santiment concluded that “their bag jumped from 3.16 million to 5.80 million in this time span.”

Decreasing Fees On Ethereum Network

The exploding DeFi craze led to congestion on the Ethereum network. Adding the significant number of ERC-20 stablecoins and some large Ponzi schemes employing the blockchain, the result was record high fees of up to $15 per transaction that investors had to pay.

However, the situation seems to be reversing. The unusually high fees have decreased to $3,4 on average. Although the number is still too high, it’s a step in the right direction.

Moreover, developers have introduced an Ethereum Improvement Proposal (EIP), aiming to reduce the fees further. Dubbed EIP-1599, it proposes to increase Ethereum’s gas limit while settling an elastic base transaction fee, which is burned automatically.

The developers have already implemented the proposal on several test nets. However, they are unwilling to predict when it could reach a network-wide adoption. According to rough estimations, though, it may take up to six months for one coder to apply it if he works alone.