A popular cryptocurrency researcher recently pointed out that the stablecoin issuer Tether has blacklisted 39 Ethereum-based addresses holding over million of USDT.Interestingly, the information surfaced soon after another report indicating that the CENTRE Consortium has admitted doing the same to a USDC address with 0,000 worth of the stablecoin.M In Stablecoin Addresses BlacklistedBy using Dune Analytics, Horizon Games researcher Philippe Castonguay created a dashboard tracking the number of blacklisted stablecoins addresses. Firstly, the dashboard displays blocked addresses by the company behind the most widely-used stablecoin – Tether.According to the information, Tether started blacklisting addresses in November 2017. The total number accounts for 39 at the time of this

Topics:

Jordan Lyanchev considers the following as important: AA News, Stablecoins

This could be interesting, too:

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

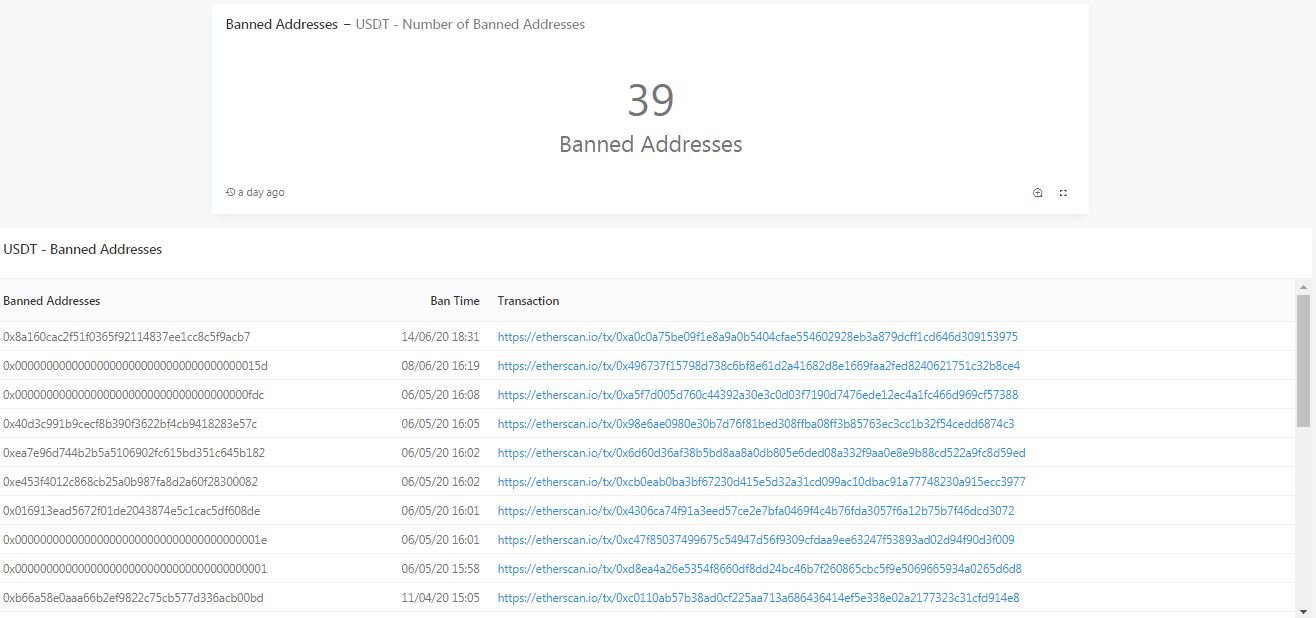

A popular cryptocurrency researcher recently pointed out that the stablecoin issuer Tether has blacklisted 39 Ethereum-based addresses holding over $46 million of USDT.

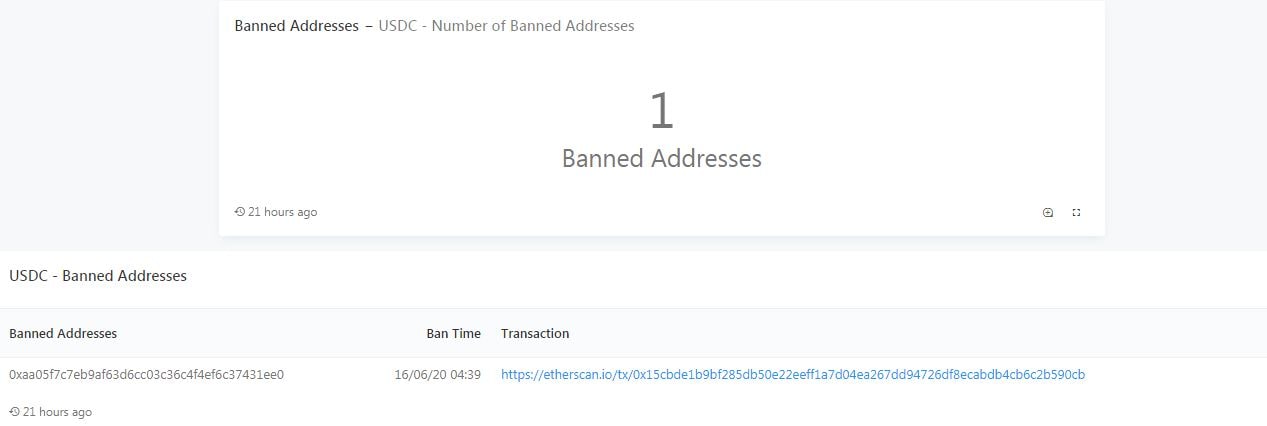

Interestingly, the information surfaced soon after another report indicating that the CENTRE Consortium has admitted doing the same to a USDC address with $100,000 worth of the stablecoin.

$46M In Stablecoin Addresses Blacklisted

By using Dune Analytics, Horizon Games researcher Philippe Castonguay created a dashboard tracking the number of blacklisted stablecoins addresses. Firstly, the dashboard displays blocked addresses by the company behind the most widely-used stablecoin – Tether.

According to the information, Tether started blacklisting addresses in November 2017. The total number accounts for 39 at the time of this writing. The majority of those addresses – 24 – have received a ban in this year alone.

The total value contained in all addresses exceeds $46 million, while a more in-depth look into the 2020 blacklisted ones reveals an amount of $5.5 million. Since blacklisted means that these addresses cannot redeem, send, or receive any of the USDT, this substantial amount is practically unusable.

In Castonguay’s dashboard also appears one blocked USDC address. According to the ban time listed, it happened on June 16th, 2020, and contains $100,000 worth of USDC.

Law Enforcement And Centralization

The entity issuing the USDC stablecoin, the CENTRE Consortium, admitted that it blocked that particular address in response to a law enforcement request.

“CENTRE can confirm it blacklisted an address in response to a request from law enforcement. While we cannot comment on the specifics of law enforcement requests, CENTRE complies with binding court orders that have appropriate jurisdiction over the organization.” – said a company’s spokesperson.

While Tether is yet to publish an official response, Arcane Assets CIO Eric Wall believes that the company blocked those assets for precautionary reasons:

“Most other freezes seem to have been made on Ethereum account either for precautionary reasons (possibly identified as scams/ponzis) or in error/to protect others from making errors. Three addresses were unfrozen after the freeze.”

He later corrected himself, noting that the bans were lifted from four addresses, instead of three.

Nevertheless, these events highlight the centralization power of cryptocurrencies owned by single entities, which is a direct contradiction to the decentralized nature of the field. Similarly, massive institutions like the Bank of America or PayPal can ban customers from using their services, sometimes without providing a proper reason.