Ethereum’s native token, Ether (ETH), has dipped by more than 60% year-over-year, trading below ,300 last week. Nevertheless, the plunge has not discouraged crypto investors from buying the token. According to data presented by CryptoPresales.com, the number of unique addresses holding more than one ETH has jumped by 20% year-over-year, reaching 1.58 million last week. Investors with 1 ETH Increase Exposure, Small Investors Lose Ground The crypto analytics platform, Glassnode, showed Ether’s latest price dip was more interesting to crypto investors searching for a bigger investment chunk. In October last year, the number of unique addresses holding more than or equal to 1 ETH reached 1.32 million. Ethereum’s price stood at close to ,500 at that time. By March, the number of Ethereum

Topics:

Bitcoin Schweiz News considers the following as important: ETH, Ether

This could be interesting, too:

Bitcoin Schweiz News writes Bitcoin-Studie der Hochschule Luzern: Schweizer setzen auf Revolut, Swissquote und Binance

Christian Mäder writes Bitcoin-Studie Hochschule Luzern: Schweizer lieben Revolut, Swissquote und Binance

Godfrey Benjamin writes Digital Asset Investment Products Print Record Inflow of .2B

Steve Muchoki writes Ethereum (ETH) Price Suffers Low Bullish Momentum amid Shrinking Demand for Whale Investors

Ethereum’s native token, Ether (ETH), has dipped by more than 60% year-over-year, trading below $1,300 last week. Nevertheless, the plunge has not discouraged crypto investors from buying the token.

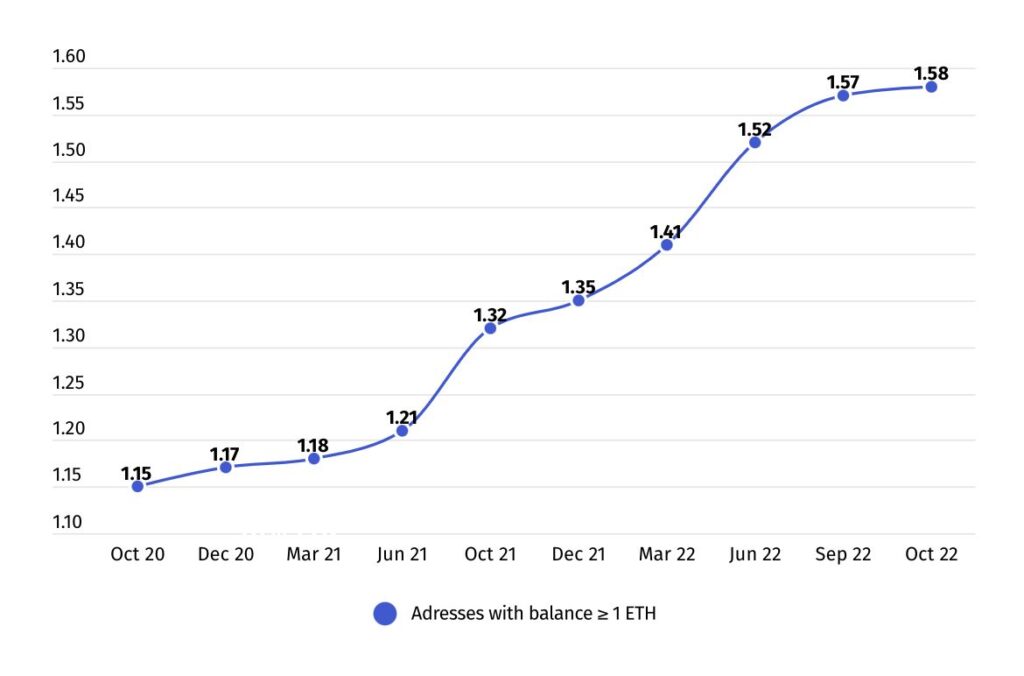

According to data presented by CryptoPresales.com, the number of unique addresses holding more than one ETH has jumped by 20% year-over-year, reaching 1.58 million last week.

Investors with 1 ETH Increase Exposure, Small Investors Lose Ground

The crypto analytics platform, Glassnode, showed Ether’s latest price dip was more interesting to crypto investors searching for a bigger investment chunk.

In October last year, the number of unique addresses holding more than or equal to 1 ETH reached 1.32 million. Ethereum’s price stood at close to $3,500 at that time. By March, the number of Ethereum wallets with balances of at least 1 ETH hit 1.41 million, while the price of the cryptocurrency dropped by 25% to $2,600. Statistics show the number of investors holding at least 1 ETH has increased by 170,000 since then, while the ETH price halved to $1,295.

On the other hand, small ETH investors have lost ground in the past few months. Statistics show the number of Ethereum addresses holding at least 0.1 ETH has been steadily increasing for some time before reaching an all-time high of 7 million in July this year. However, the number has crushed by 800,000 since then, standing at 6.19 million as of last week.

24.2 Million Ethereum Addresses Joined the Network in the Last Year

The Glassnode data also showed there are now more than 318,000 investors with at least 10 ETH, worth close to $13,000, up from 278,300 in October last year.

Another 6,300 hold 1,000 ETH in their portfolio, almost the same as a year ago, while only 1,164 addresses have impressive 10,000 ETH in their balance.

Overall, the Ethereum network gained 24.2 million addresses with a balance greater than zero year-over-year, rising from 63.2 million in October 2021 to 87.4 million last week.