[Featured Content]Take a glance at Bitcoin price charts in comparison to gold, and the two asset’s price action looks nothing at all alike.How then, did the two assets end up with nearly the same exact performance after two full years of trading? And what does the vastly different price action say about each asset?The Surprising Outcome Of The Safe Haven ShowdownInvestors in Bitcoin and other cryptocurrencies have spent the last two full years on a wild roller coaster ride, full of exhilarating highs and frightening lows.Those who hold gold, on the other hand, have enjoyed a slow, stable, and steady rise for two years now, with very few moments of panic or over-exuberance in between.The two assets are often brought up in the same conversation together for several reasons. Both gold and

Topics:

Danish Yasin considers the following as important: Projects

This could be interesting, too:

Felix Mollen writes Bitcoin, Cardano, Solaxy Among Biggest Winners From Trump’s US Crypto Reserve Pledge

Felix Mollen writes XRP to as Part of US Crypto Reserve? ADA, BTCBULL Also Bullish

Felix Mollen writes XRP, Ethereum Dip Has Some Whales Eye New Altcoins Best Wallet Token and Human Protocol

Felix Mollen writes Crypto Whales Appear to Be Buying Solana on the Dip, What About Solaxy?

[Featured Content]

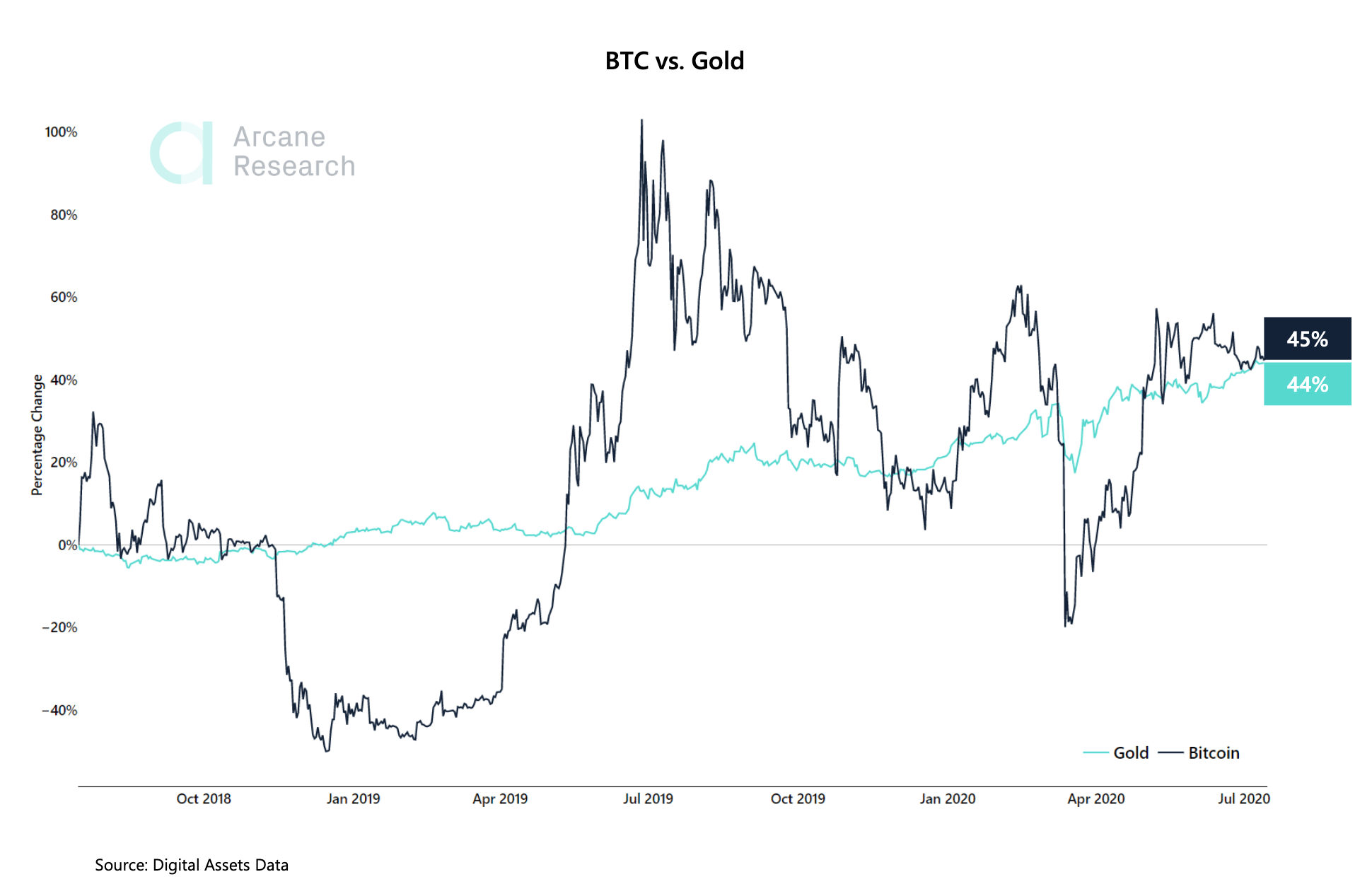

Take a glance at Bitcoin price charts in comparison to gold, and the two asset’s price action looks nothing at all alike.

How then, did the two assets end up with nearly the same exact performance after two full years of trading? And what does the vastly different price action say about each asset?

The Surprising Outcome Of The Safe Haven Showdown

Investors in Bitcoin and other cryptocurrencies have spent the last two full years on a wild roller coaster ride, full of exhilarating highs and frightening lows.

Those who hold gold, on the other hand, have enjoyed a slow, stable, and steady rise for two years now, with very few moments of panic or over-exuberance in between.

The two assets are often brought up in the same conversation together for several reasons. Both gold and Bitcoin are scarce, hard assets, that, due to limited supplies, could thrive in the face of inflation.

Each asset has been lauded as a hedge against any looming hyperinflation resulting from the stimulus money being printed by central banks. Both are also considered to be safe-haven assets, where capital can flee to during economic downturns.

Due to Bitcoin’s characteristic notorious volatility, many of the same pundits that argued against the store of wealth narrative, also pressed against the asset performing in such fashion.

After two years of performance, however, both BTCUSD and XAUUSD have brought investors almost the same exact ROI.

The comparable returns might suggest that Bitcoin is behaving as a safe haven asset, much like the precious metal has. However, how the cryptocurrency got to such a number, may put an end to the idea of the asset acting as a safe haven once and for all.

Bitcoin and Gold Bring Investors Nearly The Same Exact Two-Year Performance

According to data comparing BTCUSD and XAUUSD price action for the last two years, gold has brought investors a 44% ROI, while Bitcoin generated a 45% ROI during the same timeframe.

During the same period, gold investors saw the asset grow at a leisurely and comfortable pace. Any pullbacks were quickly shaken off, nor were they cause for significant concern or panic.

In Bitcoin, however, the asset reached a high in the second half of 2018 of $8,500, only to later fall over 60% to $3,200. From that bottom, it climbed over 340% to $14,000 in 2019. In 2020, the cryptocurrency plummeted to $3,800 on Black Thursday.

Gold plunged that fateful day also, but nowhere near as much as Bitcoin or the stock markets. Gold proved once again it could act as a safe haven asset, while Bitcoin proved otherwise.

As an investment, Bitcoin is no safe haven asset anywhere in the same playing field as gold, as least judging by the past two years. A safe haven lets investors sleep well at night, knowing their capital is parked somewhere safe and stable.

For those who have spent any time investing in cryptocurrencies, sleep doesn’t come easy. Not when crypto assets are rising and falling by 50% or more in both directions, only to earn just 1% more than holding gold would have returned.

Bolster ROI On The Ultimate Trader’s Asset With PrimeXBT

So what does this mean for Bitcoin? The safe-haven narrative clearly isn’t yet ready. Someday the asset may serve that purpose when it is less speculative and more stable.

For now, gold makes for the better safe-haven investment, but Bitcoin is still far more profitable for those who take full advantage of its signature volatility.

If the comparison were between trading gold and Bitcoin, gold wouldn’t even come close to bringing traders the same opportunity for ROI over the same time period.

Rather than push a safe haven narrative that can’t catch on, investors in Bitcoin need to embrace what the asset is all about and trade its wild price swings rather than merely “HODL.”

Trading BTC on an award-winning margin trading platform like PrimeXBT can lead to far more opportunities in the cryptocurrency than holding alone.

The advanced trading platform also offers spot gold and silver trading, along with forex, stock indices, and commodities like oil and gas.

The Black Thursday crash that crushed Bitcoin, stocks, oil, and more, set traditional markets on fire. Even gold trading has become more volatile as a result. With Bitcoin gearing up for an explosive move, and gold ready to soar to a new all-time high, there’s no better time to start trading all these assets and more under one roof on PrimeXBT.

* Disclaimer: The above is a contributed article and should not be taken as investment advice