While Warren has expressed her dissatisfaction with the approval of the 11 BTC ETFs, some lawmakers in the US support the SEC’s decision. In a recent development, US Senator Elizabeth Warren, a key Democratic figure from Massachusetts and a Senate Banking Committee member, has strongly criticized the Securities and Exchange Commission (SEC) for its recent approval of spot Bitcoin exchange-traded funds (ETFs). On January 10, 2024, the SEC authorized 11 asset managers in the US to offer...

Read More »South Korea’s Financial Regulator Says US Bitcoin ETFs Defy Local Law

Authorities in South Korea have warned local financial institutions from offering spot crypto ETFs following SEC approval in the US. South Korea’s financial regulator, the Financial Services Commission (FSC), has said that the spot Bitcoin ETFs recently approved in the US may contravene the country’s law. In an official statement published on Friday, the regulator sounded a note of warning without providing extensive details: “Domestic securities firms brokering overseas-listed Bitcoin...

Read More »Robinhood Lists All 11 New Spot Bitcoin ETFs

US-based customers may now access all 11 spot Bitcoin ETFs in both retirement and brokerage accounts through Robinhood Financial. Robinhood has stayed true to its word by listing all new spot Bitcoin exchange-traded funds (ETFs) on its platform. The US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs on Wednesday, including funds from BlackRock, Grayscale, Fidelity, Invesco, Valkyrie, Bitwise, Hashdex, BZX, VanEck, WisdomTree, and Franklin Templeton. Shortly after the...

Read More »US-Börsenaufsicht lässt Bitcoin-ETFs zu

Seit Jahren hat die Bitcoin Community darauf gewartet, dass die US-Börsenaufsicht den ersten Bitcoin-ETF genehmigt. Jetzt geben die Aufseher endlich grünes Licht. Die Entscheidung wird wahrscheinlich dazu führen, dass der Grayscale Bitcoin Trust, der etwa 29 Milliarden Dollar der Kryptowährung hält, in einen börsengehandelten Fonds umgewandelt wird, und dass konkurrierende Fonds von Mainstream-Emittenten wie iShares von BlackRock und Fidelity...

Read More »Bitcoin Price Analysis: BTC Rallies Toward $48K, Eyes More Upsides

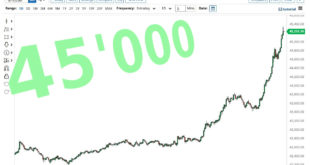

Bitcoin price started a strong increase above the $45,000 zone against the US Dollar. The price is now trading above $45,200 and the 55 simple moving average (4 hours). There was a break above a key contracting triangle with resistance near $44,300 on the 4-hour chart of the BTC/USD pair (data feed from Coinbase). The pair could continue to rise if it stays above the $44,300 support zone. Bitcoin price is showing positive signs above $45,000 against the US Dollar....

Read More »Bitcoin Price Analysis: BTC Rally Could Extend Toward $48K

Bitcoin price started a strong increase above the $44,000 zone against the US Dollar. The price is now trading above $44,000 and the 55 simple moving average (4 hours). There was a break above a key bearish trend line with resistance near $42,650 on the 4-hour chart of the BTC/USD pair (data feed from Coinbase). The pair could continue to rise if it stays above the $44,350 support zone. Bitcoin price is showing positive signs above $44,000 against the US Dollar....

Read More »Bitcoin-Preis auf 45’000

Bitcoin-Preis auf 45'000 US-Dollar Wie so oft im Januar und in den Weihnachtsferien: Die Leute kaufen Bitcoin en masse. Sehen wir bald ein neues Allzeithoch in Sachen Bitcoin-Preis? Bitcoin-Preis: Nach oben ist alles möglich Bitcoin, die führende Kryptowährung auf dem Markt, erlebt derzeit eine beispiellose Phase der Volatilität und Unsicherheit. Dennoch bleibt die allgemeine Stimmung unter Investoren und Marktbeobachtern optimistisch, wobei viele...

Read More »Top 10 Major Crypto Headlines in 2023 by Coinspeaker: Year of Triumphs, Scandals, and Transformations

It was a controversial year for the crypto indutrsy. Let’s have a closer look at the major crypto-related events that too place in 2023. The year 2023 has been a rollercoaster ride for the cryptocurrency ecosystem, defined by important events that have impacted the industry’s direction. From stablecoin woes to regulatory disputes, institutional acceptance, and the advent of meme coins, the crypto sector has seen a wide range of stories. Here are the top 10 major crypto headlines that have...

Read More »Hive Digital Secures $22M in Funding for Bitcoin Mining Operations

On December 28, the company announced that its fleet of 3,750 Bitcoin ASIC miners, purchased last year, had already generated profits due to the surge in the coin’s price. Canadian Bitcoin mining company Hive Digital has recently concluded a successful $22 million private financing round. The company achieved this milestone through the sale of 5.75 million special warrants at a price of $3.87 each, resulting in total proceeds of $22 million. This financing round will enable the company to...

Read More »FTX Offers $16,871 Bitcoin Price for Creditor Claims, Users Reject

If the court approves the proposed plans from debtors, the FTX creditors could lose a huge sum of money considering the rally in crypto market this year. In a recent filing made on December 27 in the United States Bankruptcy Court for the District of Delaware, FTX debtors have unveiled estimates of the US Dollar value assigned to cryptocurrency prices and foreign currency for customers holding claims with the now-defunct exchange. The debtors expressed their intention to establish a “fair...

Read More » Crypto EcoBlog

Crypto EcoBlog