A MetaMask user, attempting to swap Ethereum for a DeFi token, paid over $9,000 transaction fees while transferring only $120 worth of ETH. The user has reached out to the mining pool that processed the transaction for assistance but has yet to receive a response. A Costly ETH-DeFi Swap The user, going by the nickname ProudBitcoiner, explained his rather dire situation on Reddit. He was using the popular online wallet MetaMask to swap 0.2955 wrapped Ether (WETH) for 531 Chi...

Read More »Binance Recovers $345,000 (99.9%) of Stolen Funds in a DeFi Exit Scam

The leading cryptocurrency exchange Binance has helped recover almost all $345,000 funds stolen due to an exit scam conducted by an automated market maker (AMM) dubbed Wine Swap. Binance Security Team Recovers 99.9% of Stolen Funds In a press release shared with CryptoPotato, the popular exchange shared that Wine Swap launched on Binance Smart Chain as an AMM platform on October 13th, 2020. However, just an hour after the product release, the team behind it “pulled the rug,”...

Read More »Ethereum and DeFi Have Really Pushed Bitcoin Ahead

Bitcoin is doing rather well as of late, but among all the reasons why, one of them has really got advocates scratching their heads. It looks like the world’s number one cryptocurrency by market cap is getting a lot of support from its biggest competitor: Ethereum.Ethereum Has Really Moved BTC ForwardAs the second-largest cryptocurrency in the world, Ethereum was introduced in 2015, roughly six years after bitcoin was first brought to the trading table. The currency is widely recognized for...

Read More »Kava CEO Brian Kerr: DeFi Will Escape Ethereum’s Dominance In 2021 (Exclusive Interview)

CryptoPotato recently had the opportunity to interview Brian Kerr – the CEO of the DeFi project Kava. Built on Cosmos as a proof-of-stake blockchain, Kava allows users to stake tokens and participate as validators in the network. The project saw the light of day as an IEO on Binance Launchpad. Kerr’s project description said it’s a “stand-alone blockchain that has interoperable bridges, Chainlink oracles, unique validators, and other infrastructure that allows it to provide a...

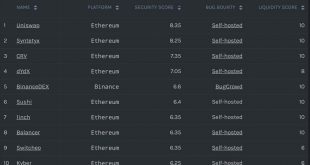

Read More »Only 8% Of All Examined Decentralized Exchanges Are Safe: Report

Decentralized finance exploded in popularity this year and especially during and after the summer. Apart from numerous DeFi-oriented protocols, the cryptocurrency space saw the emergence of multiple new decentralized exchanges. The sharp increase in demand led to rapid project developments and impressive volume growth. However, the speed compromised user security on some occasions. Consequently, the cryptocurrency exchange analytics resource CER decided to compile a report on...

Read More »Bitcoin and DeFi Rally Led Crypto Hedge Funds To Log More Than 100% Gains in 2020

Owning to the Bitcoin and the aggregated cryptocurrency market’s recent roaring rally, BTC, and crypto hedge funds have reportedly registered profits upwards of the 100 percent mark. This comes amid the rising sentiment of sidestepping banks to avail quick loans through digital assets. What does this say about the cryptocurrency industry? Bitcoin And Cryptocurrency Hedge Funds Raked In A Lot Of Moolah As per Reuters’ latest report, Christmas for digital currency-based hedge...

Read More »Hacker Returns $2.5 Million to Harvest Finance Deployer Contract

The fiasco with Harvest Finance continues with full force. The team has put a $100,000 bounty for the first person or team to reach out with information about the hacker. It’s also important to note that the attacker has decided to return $2.5 million to the deployer contract of Havers Finance. However, given that the total amount of stolen funds is close to $24 million, the returned sum represents a tight 10% of it all. Developments in the Making: $2.5 Million Returned to...

Read More »OKEx and Bit Berry Work to Support Each Other’s Wallets

Leading crypto wallet Bit Berry has signed an MOU with OKEx, one of the world’s biggest cryptocurrency trading platforms. The document states that each company will work with the other to further establish each enterprise’s digital wallet technology. In addition, Bit Berry will list the exchange’s native currency OKB, giving its clients access to an entirely new coin.OKEx and Bit Berry Join HandsAt the time of writing, Bit Berry is stationed in South Korea and boasts more than 100,000...

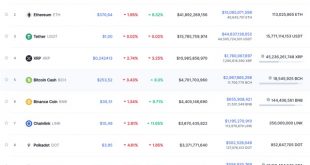

Read More »Flippening: Crypto Decentralized Exchanges Grew More Than Centralized Ones In Q3 2020

In the latest report summarizing the Q3 2020 developments in the cryptocurrency field, CoinGecko has classified the outcome as the “summer of decentralized finance (DeFi).” The popular data aggregator noted that the top-performing decentralized exchanges saw (DEX) massive growth in terms of trading volume resulting in reducing the market share of centralized exchanges (CEX). DEX Are On The Rise CoinGecko’s report emphasized on the developments within the decentralized finance...

Read More »#993 DeFi nicht Bitcoin, OKEx Auszahlungen gestoppt & Mt. Gox 1.7 Milliarden Bitcoin Rückzahlung

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 993. Im heutigen Video geht’s um folgende Themen: Revolutionär in Krypto ist DeFi nicht Bitcoin, OKEx Auszahlungen gestoppt & Mt. Gox 1.7 Milliarden Bitcoin Rückzahlung verschoben. [embedded content] 1.) ShapeShift-CEO: Wirklich revolutionär in Krypto ist DeFi – nicht Bitcoinhttps://coincierge.de/2020/es-ist-magisch-shapeshift-ceo-wirklich-revolutionaer-in-krypto-ist-defi-nicht-bitcoin/ 2.) OKEx setzt Abhebungen aus – Bitcoin...

Read More » Crypto EcoBlog

Crypto EcoBlog