No doubt about it… The DeFi (decentralized finance) space is growing like there’s no tomorrow. One of the biggest coins within the arena to be expanding lately is known as yearn finance (YFI). Thus far, the coin is up more than 3,500 percent since last month.YFI Has Surged in Recent WeeksWhile everyone wants to make such a big deal out of bitcoin this year – the currency is presently up more than 40 percent since the beginning of 2020 – this is nothing compared with YFI, which has also put...

Read More »Framework Labs Seeks to Grow the DeFi Industry

Framework Labs, which is associated with the investment firm Framework Ventures, has recently socked away roughly $8 million thanks a new seed funding round led by some of the biggest names in the industry. Among the companies to take part in the funding round are Station 13.Framework Labs Is Taking DeFi to a New LevelAs a branch of Framework Ventures, Framework Labs is operated by Michael Anderson and Vance Spencer. The company is seeking to increase investors’ knowledge of the DeFi...

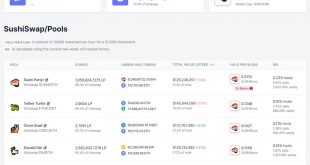

Read More »This Guy Earns $170 in SUSHI Every Minute: Here Is The Catch

The ongoing DeFi craze shows no signs of slowing down as the total value locked (TVL) in different protocols continues to increase by the day.As CryptoPotato reported earlier today, SushiSwap, the protocol that is attempting to fork the world’s leading decentralized exchange Uniswap by introducing a liquidity reward token called SUSHI, topped $1.2 billion in TVL.Many are taking advantage of the high APY and are staking their tokens to earn SUSHI, as the token’s price continues to appreciate....

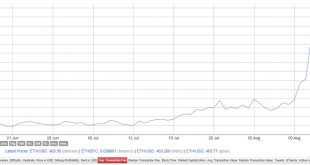

Read More »ETH Fees at a New ATH, Binance To The Rescue?

The crypto industry is scrambling to find a solution for the unfeasibly high gas fees that make smaller transactions on the Ethereum network financially unviable. The 2020 DeFi boom and explosion in yield farming platforms have strained the Ethereum network so much that whales and minnows alike are now fighting for block space to get their transactions through.Binance Chain to The Rescue?In a tweet on Tuesday, September 1, Binance CEO Changpeng Zhao hinted at a solution without giving...

Read More »SUSHI Price Recovers 1200% As The Protocol Tops $1 Billion in Total Value Locked

Launched just last week as a fork of Uniswap, SushiSwap has gained traction as the hottest thing in DeFi at the moment. It aimed to build on the popular token swapping protocol but offer a native token as a reward to liquidity providers.Uniswap only offers a 0.3% share of its trading fees to those that deposit collateral on the platform. Clearly, this isn’t enough for avaricious yield farmers who, over the past few days, have been moving their liquidity over to SushiSwap.Sushi TVL Tops a...

Read More »#959 Bitcoin Bull Run, Crypto Domain bringt 230 ETH & 9 Milliarden gelockt in Defi

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 959. Im heutigen Video geht’s um folgende Themen: Möglickheit das Bitcoin sich kaum bewegt im nöchsten Bull Run, Crypto Domain bringt 230 ETH & 9 Milliarden gelockt in DeFi. [embedded content] 1.) Synthetix Founder: There’s a Chance Bitcoin “Barely Moves” in this Bull Markethttps://www.newsbtc.com/2020/08/30/synthetix-founder-chance-bitcoin-barely-moves-bull-market/ 2.) Domainhandel: sex.crypto für 230 Ether...

Read More »OKEx CEO Jay Hao: Many People Will Lose Money In DeFi (Exclusive Interview)

OKEx has become one of the largest cryptocurrency exchanges in the past several years. The company’s growth is continuously emphasized by the trading volume and the growing user base.CryptoPotato recently had the opportunity to do an exclusive interview with the CEO of the company – Jay Hao.Hao spoke of the challenges OKEx has to overcome, the current cryptocurrency landscape, Bitcoin’s growing adoption, the DeFi craze, and more.Back to the Roots: Before OKExOne of the first things that Hao...

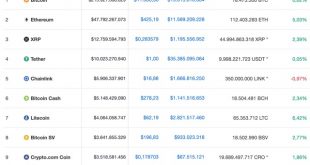

Read More »Market Watch: Over 100% Gains For YF Defi Tokens, Bitcoin Is Stable

Bitcoin seems stable after recovering from its drop to $11,100 and trades above $11,500. However, massive gains are evident among lower-cap alts and DeFi tokens, including YFI that doubled BTC’s all-time high. As such, Bitcoin’s dominance over the market has decreased by over 1%.YFI To $40k, Low-Caps SurgingIt’s no secret that the DeFi sector has been cryptocurrency’s hottest topic recently.YFI’s fork, which recently rebranded its name from YFII Finance to DFI.Money is the clear leader in...

Read More »YFI To $100,000 Says Arthur Hayes

Yearn Finance is undoubtedly all the rage in the cryptocurrency field right now. Up just shy of 80% in the past 24 hours, it peaked at almost $39,000 on Binance.Now, industry proponents such as the CEO of one of the world’s largest Bitcoin margin trading exchanges are making bold predictions about its price.Arthur Hayes: YFI to $100,000YFI is the governance token of the yield aggregating platform Yearn Finance. Launched in late July, the protocol attracted countless investors looking for...

Read More »Costly Mistake? Yearn Finance (YFI) Reached $77,000 On Binance

Yearn Finance, the DeFi protocol that took the entire crypto field by a storm, continues to break new grounds.Its governance token, YFI, suddenly shot up to 77,000 BUSD on Binance in what appears to have been some sort of a mishap.In any case, the cryptocurrency continues to impress as its price already surpassed the all-time high of Bitcoin, peaking at $23,166 against USDT on Binance.YFI Price Touches 77,000 BUSDIn what may have been a costly mistake, the price for YFI against BUSD suddenly...

Read More » Crypto EcoBlog

Crypto EcoBlog