The events of the past days shook the DeFi space in a way that no other project did this year. The lead developer of the project dumped all of his token on the market, crashing SUSHI’s price by over 50%.After that, he transferred the control over the protocol to FTX’s CEO and the price bounced by almost 200%. It’s no doubt that these kinds of swings are likely to be only possible in the crypto field.However, the community also took it upon itself to largely criticize Binance for listing...

Read More »SUSHI Rebounds 190% As Sushiswap Lead Dev Transfers Control to FTX CEO

Sushiswap is all the rage within the cryptocurrency community right now. The protocol that’s intended to be a fork of Uniswap had all eyes turned to it as the lead developer dumped all of his tokens on the market, essentially crashing the price of its native SUSHI token by more than 50%.However, since then, the lead developer has transferred control over the protocol to the CEO of FTX, which was seen as a boost of confidence by the community. Consequently, the price surged.Sushiswap Lead Dev...

Read More »Bitcoin Price Indecisive Above $10,000 As DeFi Coins Bounce on SUSHI News

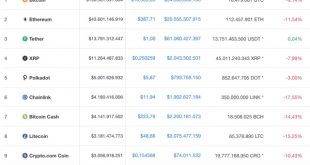

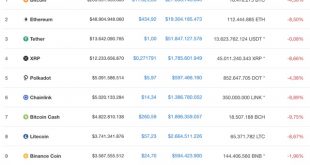

Bitcoin continues above $10,000, while Ethereum’s free fall has only intensified in the past 24 hours.The DeFi space is also facing major hurdles, but over the past few hours, a lot of DeFi coins have bounced following new developments with SUSHI.Bitcoin Fights To Stay Above $10KAs CryptoPotato reported yesterday, Bitcoin bottomed at about $9,825 (on Binance). The asset managed to recover some ground in the next few hours to approximately $10,200.Bitcoin bounced off the critical support at...

Read More »SUSHI Sell Off Drives the Crypto Market to Abyss: Bitcoin Below $10K

Earlier on Saturday, the lead developer behind the popular Sushiswap protocol sold all of his tokens, causing a massive drop upwards of 50% in the token’s price.Elsewhere, the entire cryptocurrency market is feeling the pressure as the total capitalization is down by more than $11 billion in the last few hours.Sushi Seloff Headstarts a Market CollapseCryptoPotato reported earlier that the lead developer of the popular Uniswap fork, Sushiswap, swapped all of his tokens for ETH. In a trade...

Read More »SUSHI Crashing Over 50% As Sushiswap’s Lead Developer Sells His Tokens

This week has been great for SushiSwap’s leading developer, not so much for the token hodlers. A few hours ago, Chef Nomi, the anonymous character behind the project, sold all his tokens and cashed out.The self-proclaimed “head chef” sold millions SUSHI tokens over the weekend. Money is a “Distraction”Following what many call a rug pull, the token’s price has dropped more than 50%. The move caused strong reactions within the community, especially from critics and analysts who rushed to call...

Read More »Stocks and Bitcoin Crash On Escalating Job Fears: The Weekly Crypto Market Update

The events of the past seven days took a turn for the worst throughout the entire cryptocurrency market. Bitcoin started the week trading at around $11,500 and managed to advance to a peak of around $12,050 a few days later.And that’s when it went downhill.In less than two days, BTC lost around $1,500 of its value, bringing the price down to its current level of $10,500. However, the primary cryptocurrency spiked to a low of $9,875 on Binance before recovering, taking all large-cap altcoins...

Read More »#963 Sicherheitslücken SushiSwap, Kanton Zug Steuern in BTC & Bithumb durchsucht

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 963. Im heutigen Video geht’s um folgende Themen: Sicherheitslücken bei DeFi-Protokoll SushiSwap, Kanton Zug will Steuern in Bitcoin akzeptieren & Bithumb von koreanischer Polizei durchsucht. [embedded content] 1.) Sicherheitslücken bei DeFi-Protokoll SushiSwap aufgedeckthttps://www.btc-echo.de/sicherheitsluecken-bei-defi-protokoll-sushiswap/ 2.) Schweizer Kanton Zug will Steuern in Bitcoin akzeptieren,...

Read More »#962 Ethereum Miner Goldrush, Uniswap schlägt Coinbase Pro & DeFi explodiert

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 962. Im heutigen Video geht’s um folgende Themen: Ethereum Miner verdienen 800.000$ pro Stunde, Uniswap schlägt Coinbase Pro nach Handelsvolumen & DeFi auf 500 Millionen in Stunden. [embedded content] 1.) Ethereum Miner verdienen 800.000$ pro Stunde – Wird DeFi zum Whale-Territorium?https://cryptomonday.de/ethereum-miner-verdienen-800-000-pro-stunde-wird-defi-zum-whale-territorium/ 2.) Kampf der Bitcoin-Börsen: Uniswap schlägt...

Read More »$4000 To $1 In 5 Minutes: DeFi HOTDOG and Pizza Present Free Fall on Their First Day

The latest two DeFi protocols to pump and dump worthless tokens have been Hotdog and Pizza as the food meme trend continues. They are essentially clones of other defi platforms, some of which are clones themselves.The latest is a Uniswap clone called Hotdog that, just like SushiSwap, promised better APYs and shares in governance tokens. Yield farmers, dubbed degens from the word degenerate, flocked to the platform in hopes of similar gains that SushiSwap made.DeFi Pump and DumpHOTDOG tokens...

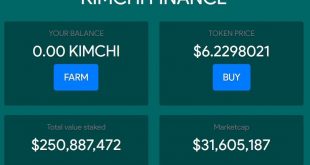

Read More »120,000% APY On The New Trending DeFi KIMCHI But There’s a Catch

Named after the fermented Korean dish, Kimchi is a fork of the wildly popular SushiSwap protocol that was forked from Uniswap late last week. Launched on Tuesday, September 1, Kimchi has already accrued almost $250,000 in liquidity in less than 24 hours, according to its dashboard.In the first few hours after its launch, the protocol offered APYs upward of 120,000% on the KIMCHI/TEND pool, and more than 70,000% on the other KIMCHI pools. Even though these numbers have since decreased, they...

Read More » Crypto EcoBlog

Crypto EcoBlog