On September 29, Gemini co-founder Tyler Winklevoss published a proposed “marketing incentive” on the MakerDAO forum to drive the adoption of his stablecoin GUSD through a three-month strategic plan. According to Tyler Winklevoss’ proposal, Gemini will pay monthly fixed annual interest of 1.25% on all the GUSD stored in MakerDAO PSM vaults, as long as the average monthly balance is at least 100 million GUSD by the end of the month. “As we’d like GUSD usage to increase...

Read More »MakerDAO Users Can Now Mint DAI For Free

Users of MakerDAO, the organization behind DAI, will now be able to mint the stablecoin for free. This was made possible after an executive vote increased the debt ceiling for its stETH vault to 200 million DAI. The higher debt ceiling is expected to minimize its dependency on support from centralized collateral assets. As such, the governance voted on the proposal that sought to reduce the fees for six vaults. The main idea was to promote DAI mints against decentralized...

Read More »MakerDAO Co-Founder Proposes Dumping $3.5 Billion USDC Reserves for ETH

MakerDAO co-founder Rune Christensen recently proposed removing all USDC from the DAI stablecoin’s peg-stability module. He suggested that the USDC within, worth $3.5 billion, could be used to buy ETH instead. Yet despite what such a conversion could do to boost ETH’s price, Vitalik Buterin said it was a “terrible idea.” Removing Exposure to USDC In the governance channel of MakerDAO’s official Discord, Rune expressed concerns over the US Treasury Department’s latest...

Read More »Total Supply Of Decentralized Stablecoin DAI Exceeds $10 Billion

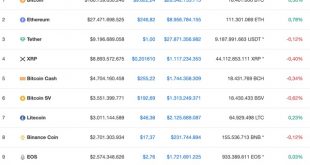

Currently, DAI is the fifth-largest stablecoin by market capitalization. Tether (USDT) may have continued to be the market leader after all these years, but DAI has the perk of being open-source and decentralized – something that’s sought after in the DeF community. DAI Ascends According to Makerburn, the total supply of MakerDAO’s DAI, a decentralized stablecoin, has shot up to a whopping $10 billion on February 8th. Moreover, its supply from stablecoin collateral stands at...

Read More »DeFi Explosion: Binance DeFi Index Hits ATH as Total Value Locked Eyes $25 Billion

The decentralized finance sector continues to grow with an impressive all-time high of over $24 billion locked. Additionally, the Binance DeFi Composite Index, measuring the performance of numerous DeFi coins, also marked a new ATH today.Binance DeFi Index To New HighsLaunched in August 2020, the DeFi Composite Index tracks and measures the performance of “a basket” of DeFi assets in what the company described as a “standardized way.”“The composite price indices are combinations of different...

Read More »RSK & RIF Bitcoin Sidechain Integrates DAI to Further Connect To Ethereum’s DeFi

The DeFi space continues to expand as the total value locked in protocols has recently almost hit $11 billion. More interestingly, BTC value locked in DeFi is also on the rise as there are currently around 141,000 bitcoins locked in various lending protocols.RSK’s infrastructure framework (RIF) has recently integrated Maker’s DAI stablecoin into its ecosystem.RIF Integrates Maker’s DAI StablecoinThe RSK infrastructure framework (RIF) has integrated the DAI stablecoin on its Bitcoin-powered...

Read More »Over $15M ETH Enters DeFi Per Day: 4x More Than Ethereum’s Daily Inflation Issuance

An average of $15 million worth of ETH has been locked into Ethereum’s DeFi protocols each day for the past week. That equates to more than four times the amount of Ethereum, which is produced every day as a result of mining.Ethereum’s DeFi Protocols See Huge InfluxAccording to data from DeFiPulse.com, over $500 million entered various DeFi protocols in the past seven days, averaging just over $78 million per day. Lock-ins of ETH specifically numbered 461,000 in that time, equating to an...

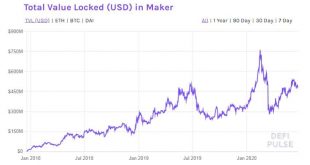

Read More »DeFi Flippening: The Total Value Locked in Compound Surpasses MakerDAO

The sudden jump of total value locked on the DeFi platform Compound has caused a flippening event in the decentralized finance sector. The TVL on Compound surpassed MakerDao’s as of yesterday, and the gap continues expanding today.Compound Overtakes MakerDAOMakerDAO has been the predominant force for total value locked for years, according to data from the DeFi monitoring resource – DeFi Pulse. Its influence over the entire marker was so unambiguous that the website tracked “Maker Dominance,”...

Read More »DeFi Adoption: Compound (COMP) Sees 100% Surge Amid Coinbase Pro Listing Announcement

The price of Compound (COMP) tokens is seeing a massive surge amid a manic week for the decentralized finance (DeFi) project, which included a listing announcement by U.S. crypto exchange giant Coinbase.Compound TVL Crosses $400M TVL MilestoneWith the number of lenders on the Compound protocol increasing rapidly, data from DeFiPulse shows the project crossing the $400M mark in total value locked (TVL). Barely a week ago, this figure stood at $100 million. Compound becomes the second lending...

Read More »#901 Hundert Prozent in 30 Tagen, Markteinbruch innerhalb 3 Wochen, & ETH 2,5 Mio Gebühr für 0,5 ETH

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 901. Heute sprechen wir über folgende Themen: MakerDao steigt 100 Prozent in 30 Tagen, Markteinbruch „innerhalb 3 Wochen“ & Nutzer gibt 2,5 Millionen Dollar Gebühr für 0,5 ETH aus. Die heutige Show wird gesponsert von Bitwala Blockchain Banking – Erhalte 35 Euro für dein kostenloses deutsches Konto inkl. Debit Masterkarte und Bitcoin Wallet – https://bit.ly/Bitwala-Banking [embedded content] 1.) MakerDAO: Der Siegeszug geht...

Read More » Crypto EcoBlog

Crypto EcoBlog