The news recently got a splash because of the Twitter user reporting transaction censorship. Binance Singapore froze his money because he was sending them to a Wasabi Wallet.CZ Answers on Espionage Allegations by Twitter CrowdsChangpeng pointed out that there are lots of comments on Twitter under the post about a frozen payment. It shows that people still do not understand how the exchange regulation works, while its a broad topic. In terms of AML procedures, the exchange is obliged to monitor the user’s transactions. But the exchange is not doing it by itself. There are plenty of services gathering information from open blockchains like Bitcoin, Bitcoin Cash, Ethereum, Litecoin, etc.Binance CEO elaborated that in the fiat world, banks demand clients to provide information on the source of

Topics:

Jeff Fawkes considers the following as important: Binance, Bitcoin Cash, Bitcoin Cash (BCH), Bitcoin Core, Blockchain News, chainalysis, Changpeng Zhao, Cryptocurrency News, crystal, CZ, electrum, james edwards, localbitcoins, News, Plus Token, Plustoken, satochip, Story of the Day, trezor, Wallets, Wasabi, wasabi wallet

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

Bitcoin Schweiz News writes 6 Bitcoin Hardware Wallets, die man kennen muss

Bitcoin Schweiz News writes Bitpanda vs. Binance: Welche Bitcoin-App ist die beste für die Schweiz?

The news recently got a splash because of the Twitter user reporting transaction censorship. Binance Singapore froze his money because he was sending them to a Wasabi Wallet.

CZ Answers on Espionage Allegations by Twitter Crowds

Changpeng pointed out that there are lots of comments on Twitter under the post about a frozen payment. It shows that people still do not understand how the exchange regulation works, while its a broad topic. In terms of AML procedures, the exchange is obliged to monitor the user’s transactions. But the exchange is not doing it by itself. There are plenty of services gathering information from open blockchains like Bitcoin, Bitcoin Cash, Ethereum, Litecoin, etc.

Binance CEO elaborated that in the fiat world, banks demand clients to provide information on the source of funds. And in the crypto world, there are risk scores assigned to different addresses after substantial surveillance efforts. Many of the regulators receive pressure from the governments, which results in signing contracts with companies like Chainalysis or Crystal.

Zhao Describes Three Types of Cryptocurrency Exchanges

The first type is Regulated, it has official user agreement, guidelines and even some ties with the local jurisdiction. Such exchanges need to obtain a local crypto license, or some other type of financial license, to operate and pay taxes. Each country has own rules.

The second type of exchange is Unregulated ones, they typically reside in the countries without strict financial guidelines. Sometimes, the exchange has no jurisdiction at all, using expensive cloud servers, VPN and Proxy, as well as abuse proof providers.

And the third type is a DEX or a Decentralized Exchange. Changpeng says that they usually facilitate a separate blockchain or a smart contract. Decentralized means that there is no need for any government, and there are no regulation measures. Different DEXes have different levels of decentralization, depending on what the creators wanted to achieve.

What’s More Important: Privacy or Transparency?

In terms of privacy, most of the centralized exchanges will prefer to comply with the law rather than go against it and face regulatory troubles. Technically, the exchange can operate under the local law or leave the specific jurisdiction. The users will be able to trade using VPN, but at the risk of their funds being frozen.

What’s more important for the bitcoin economy?

— Udi Wertheimer (@udiWertheimer) December 13, 2019

Usually, the exchanges don’t want to leave the jurisdictions because some countries constitute a majority of the crypto traders. The only thing they can do to stay on the market is running AML checks.

Binance Picks Transparency, but Not Every Time

Changpeng goes on into explaining that Binance is a large worldwide entity working as several separate companies. Binance.US, Binance Jersey, Binance DEX, as well as Binance Singapore, operate independently and comply with the local laws. That’s why the users must understand the difference between the “choices” and pick the correct exchange for correct transactions:

“At Binance, we strive to provide you with different choices and different levels of privacy. We don’t live in a perfect world. There are different compromises with each of the choices. It is important to understand the choices in front of us and the world we live in. I hope this article helps with that understanding. We believe privacy is a fundamental right and is supportive of privacy driven initiatives. If you are serious about privacy, you should consider using a privacy coin, as the name suggests.”

At the same time, several researchers claim that Binance had no regulatory problems with a hefty portion of the funds sent by the Plus Token hacker.

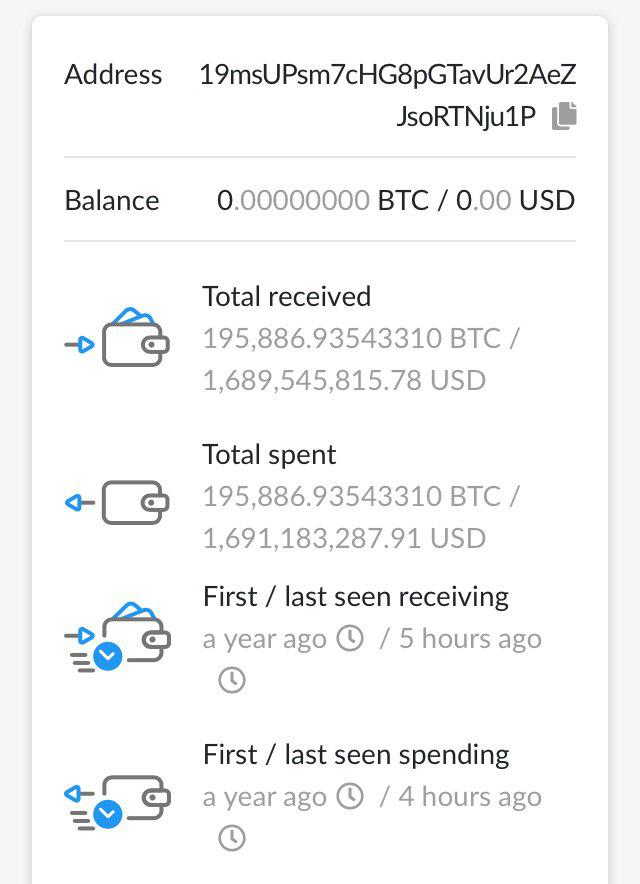

For instance, hash.fail maintainer James Edwards has posted the graphics you see above. He took it from some competing research team, and the screenshot shows presumably a “deposit address” that was linked to the PlusToken theft. This address had a $1.6+ billion cycle through Binance.

Do Not Send Funds from Binance to Wasabi

Wasabi is a Bitcoin wallet supporting a mixing algorithm called CoinJoin. In Wasabi, the developers used the upgraded version of this protocol. Anyone who has a substantial sum of bitcoins to join the mixing process will have the ability to increase the anonymity of the tokens. CoinJoin unites several transactions into one and mixes the inputs and the outputs into a single transaction.

So, presumably, if you need a Wasabi wallet for something, you need sending to vanilla wallets like the Electrum or the Bitcoin Core, or to hardware wallets like Satochip or TREZOR. You can also use LocalBitcoins address, it helps mix the coins and have the green lights from Binance in terms of transaction espionage. Make 1-2 additional hops to simulate “different persons” and then send to Wasabi. When sending back to Binance, repeat the sequence.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.