Just yesterday, we had celebrated the goodbye party from the 00 price level, which held Bitcoin for the past couple of days.Yesterday’s bloody price action ended up in a retest of the significant support area of 00. The last was the lowest price level of BTC before the vast 42% price surge, which took place on October 26, and ended up touching ,350.It’s not even a month later, and Bitcoin is down again, no recognition of the October 26 impressive price surge. Bitcoin is now struggling, marking 00 as it’s current daily low (as of writing this). This is a new monthly low for Bitcoin, and the lowest price the cryptocurrency had seen in the past six months, since May 17.Looking on the following daily chart, Bitcoin touched a historic support trend-line, which started forming in

Topics:

Yuval Gov considers the following as important: Bitcoin Prediction, bitcoin price, BTC, BTCanalysis

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Emily John writes Metaplanet Expands Bitcoin Holdings with .4M BTC Purchase

Christian Mäder writes Die besten Bitcoin-Visualisierungen: Ein Blick auf Preisentwicklung, Blockchain und Netzwerk

Just yesterday, we had celebrated the goodbye party from the $8000 price level, which held Bitcoin for the past couple of days.

Yesterday’s bloody price action ended up in a retest of the significant support area of $7400. The last was the lowest price level of BTC before the vast 42% price surge, which took place on October 26, and ended up touching $10,350.

It’s not even a month later, and Bitcoin is down again, no recognition of the October 26 impressive price surge. Bitcoin is now struggling, marking $7000 as it’s current daily low (as of writing this). This is a new monthly low for Bitcoin, and the lowest price the cryptocurrency had seen in the past six months, since May 17.

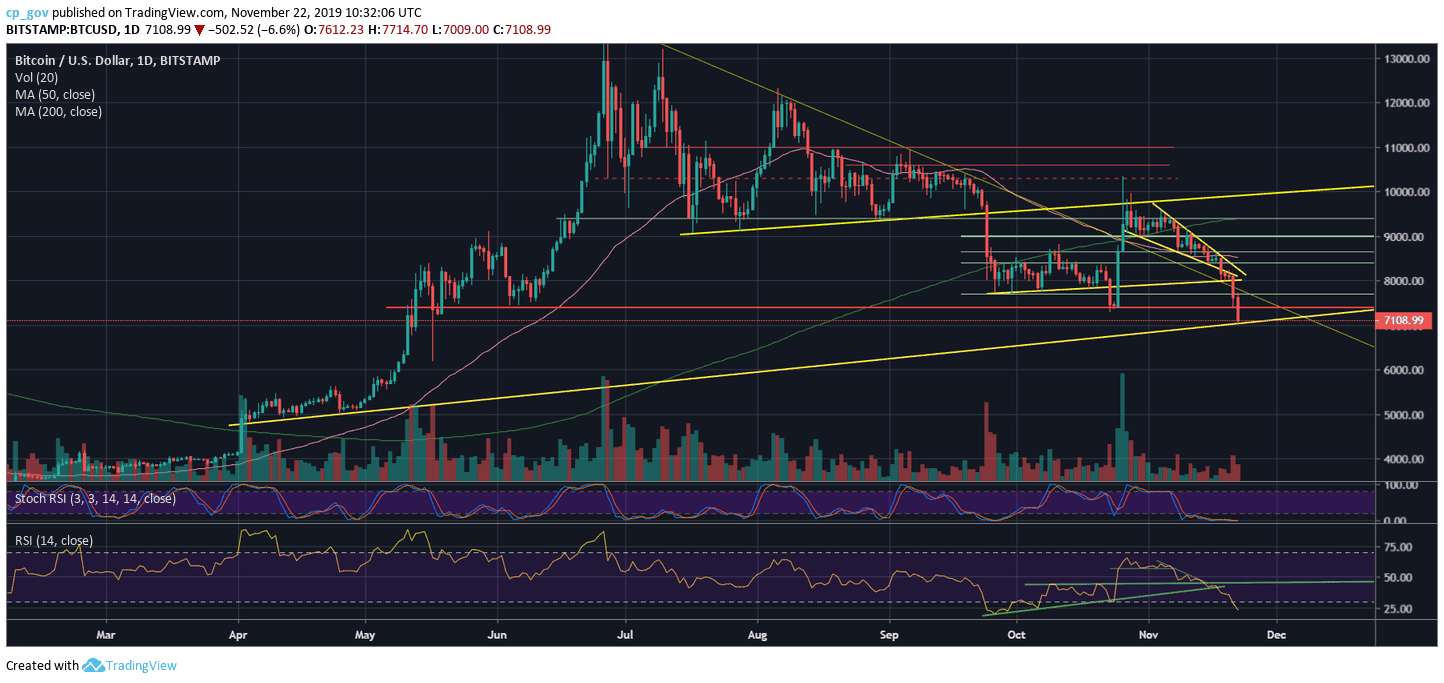

Looking on the following daily chart, Bitcoin touched a historic support trend-line, which started forming in April this year. So far, the support line, along with the psychological level of $7000, holds well. However, things can change at any moment.

After such severe declines, which lasts so far for the past five consecutive daily candles (in case today won’t surprise and close above $7700), the crypto market is bearish without a doubt.

Total Market Cap: $197 billion

Bitcoin Market Cap: $130 billion

BTC Dominance Index: 66.0%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: After breaking down the $7400 support, this level had now turned into the first resistance from above. Further above lies old support at $7700 (which was confirmed as resistance during yesterday’s price action).

From below, the $6K prefix is closer than ever: In case $7000 gets broken down, there is not much demand till the $6200 area. There might be some support at $6600, but the panic could quickly get Bitcoin to $6000 and even below ($5400 -$5600

– The RSI Indicator: As said here yesterday – the RSI looks very bearish. Since yesterday the RSI discovered new lows, now encountering the 25 levels, which might halt the declines for a bit.

Stochastic RSI oscillator is pointing on oversold on the 1-day chart. This can lead to a possible positive correction in the case of a cross-over.

– Trading volume: The bears are here. After no significant volume days, yesterday seen the highest volume day since the end of October. Blood on the streets.