Bitcoin (BTC)Yesterday, the price of Bitcoin crashed by over 40%, following the emerging global market crisis. Before this fatal plunge, Bitcoin showed signs of weakness consolidating around the 00 mark for three days.Meanwhile, this whole bearish scenario started from a mid-February high of ,500, which was later confirmed by a bearish head-and-shoulds pattern, which played out around 00 last week.Unfortunately for Bitcoin, the price has not just dropped to a 4-month low but now trading again inside a long-term descending channel that was formed in June 2019. Though, Bitcoin has managed to recover from the channel’s lower support of 00 and surged to 00 today. Bitcoin is trading above 00 at the moment.If the price remains trapped inside this descending channel, it would be

Topics:

Michael Fasogbon considers the following as important: Bitcoin (BTC) Price, BTC Analysis, ETH Analysis, Ethereum (ETH) Price, Litecoin (LTC) Price, Price Analysis, Ripple (XRP) Price, Tezos (XTZ) Price, XRP Analysis

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Jordan Lyanchev writes Liquidations Top 0M as Bitcoin Falls K, Reversing Trump-Driven Rally

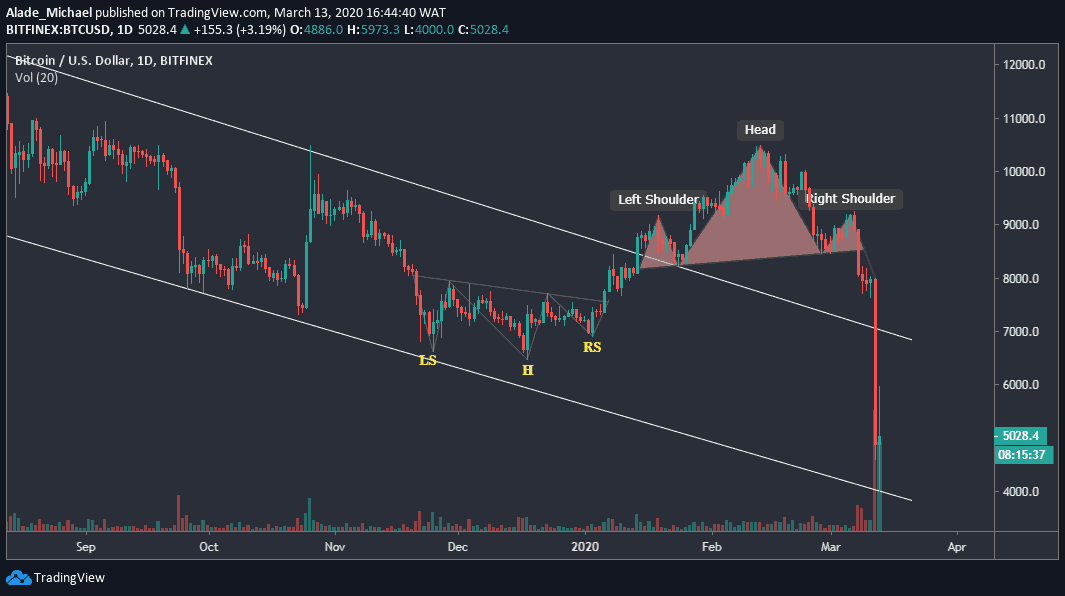

Bitcoin (BTC)

Yesterday, the price of Bitcoin crashed by over 40%, following the emerging global market crisis. Before this fatal plunge, Bitcoin showed signs of weakness consolidating around the $8000 mark for three days.

Meanwhile, this whole bearish scenario started from a mid-February high of $10,500, which was later confirmed by a bearish head-and-shoulds pattern, which played out around $8500 last week.

Unfortunately for Bitcoin, the price has not just dropped to a 4-month low but now trading again inside a long-term descending channel that was formed in June 2019. Though, Bitcoin has managed to recover from the channel’s lower support of $4000 and surged to $5800 today. Bitcoin is trading above $5000 at the moment.

If the price remains trapped inside this descending channel, it would be difficult for Bitcoin to regain momentum until a break up takes place. And if Bitcoin breaks beneath $4,000, the market may collapse to $3600 (yesterday’s low) and then to $3200, which is December 2018 low.

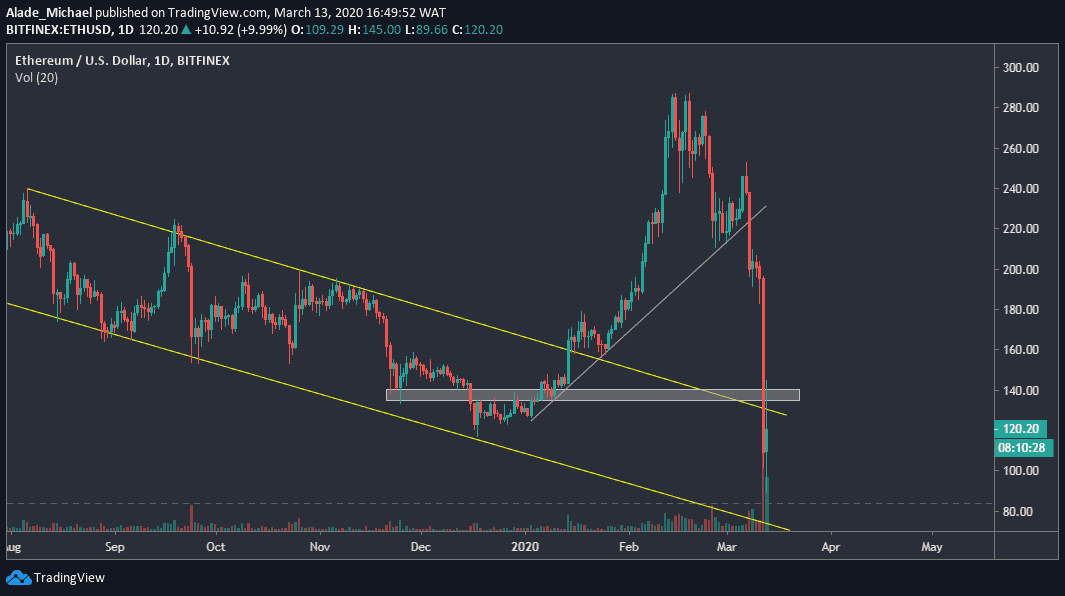

Ethereum (ETH)

From $235 weekly opening, Ethereum had lost over 80% of its value to reach a daily low of $86. After dropping near the channel’s support, ETH saw a quick 60% recovery to a critical resistance area of $140, marked grey on the daily chart. As of now, Ethereum is trading around $120 against the US Dollar.

If Ethereum can spike above the channel, and most importantly, the grey resistance area, we can start to consider some bullish action. Otherwise, Ethereum would stay and continue to struggle in the channel boundary.

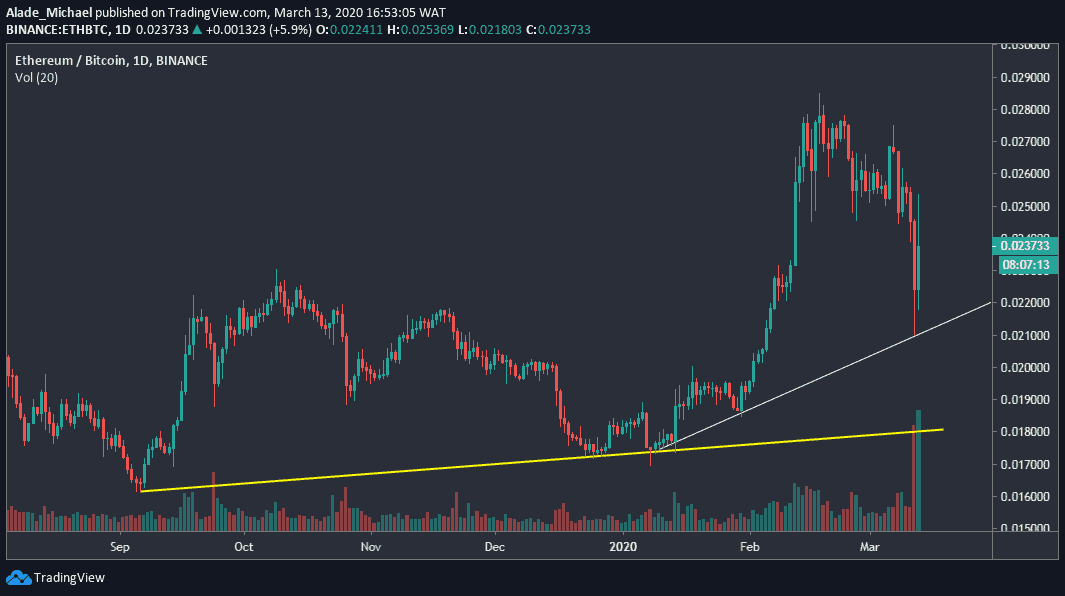

Against Bitcoin, Ethereum saw a massive price movement to the downside but found support around the $0.021 BTC level yesterday, followed by a 2-month rising support line (white). Despite the drops, the market has bounced back following 3.5% gains.

It appeared that the bulls are showing commitment at the moment. If they can push further, the price of ETH could touch 0.025 BTC resistance level in the next few days. More so, Ethereum may initiate a new rally, in case the buyers reclaim the 0.028 BTC level. Notwithstanding, the market is still looking bearish on a mid-term. If the bears resume pressure below this white line, 0.018 BTC would be the next selling target beyond 0.02.

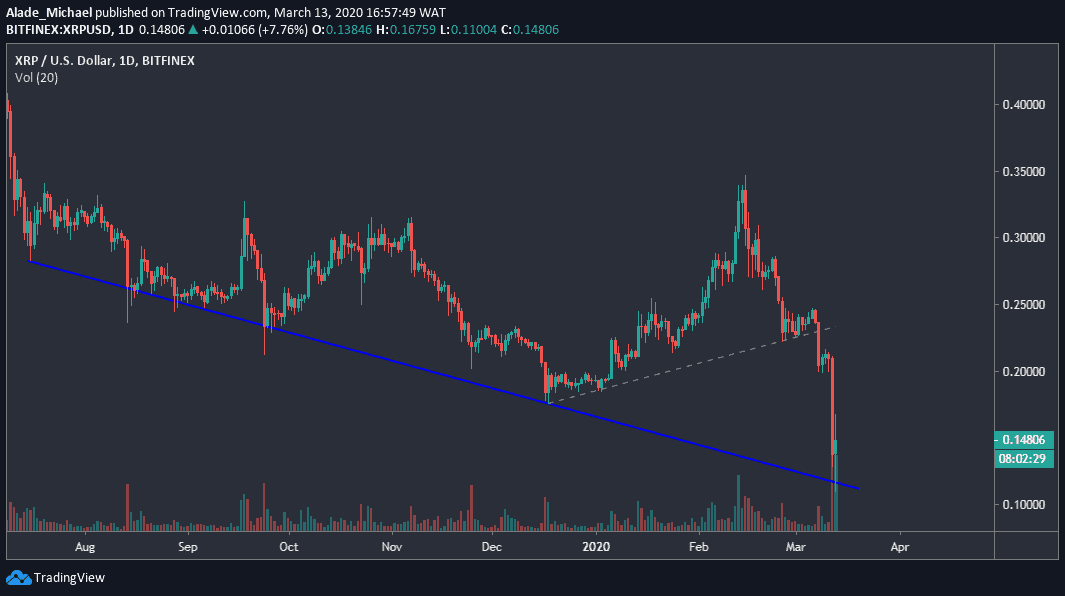

Ripple

This week, Ripple continued to lose momentum following a bearish correction that started a few weeks back. Today, the XRP/USD pair reached a 9-month low of $0.11 after witnessing a consistent four weeks decline from $0.335 resistance, from where Ripple initiated sell last month.

As we can see on the daily chart, Ripple is currently supported by a blue long-term support line. Following a small recovery, XRP is now trading at $0.148 level. If volume increases, Ripple might retest $0.2 on the upside. However, the price may slip back to $0.11 if the sellers continue to show interest.

Against Bitcoin, Ripple increased by 5% over the past 24-hours. The market is now showing strength after finding weekly support around 2400 SAT levels. Following a sharp rejection from a psychological level of 3000 SAT, Ripple has now dropped to support level at 2820 SAT.

If the buyers can push above the first white resistance line of 3075, we can expect XRP price to reclaim the second level of 3321 SAT. On the downside, the 2600 SAT and 2400 SAT levels should be on the watch in case the price falls back.

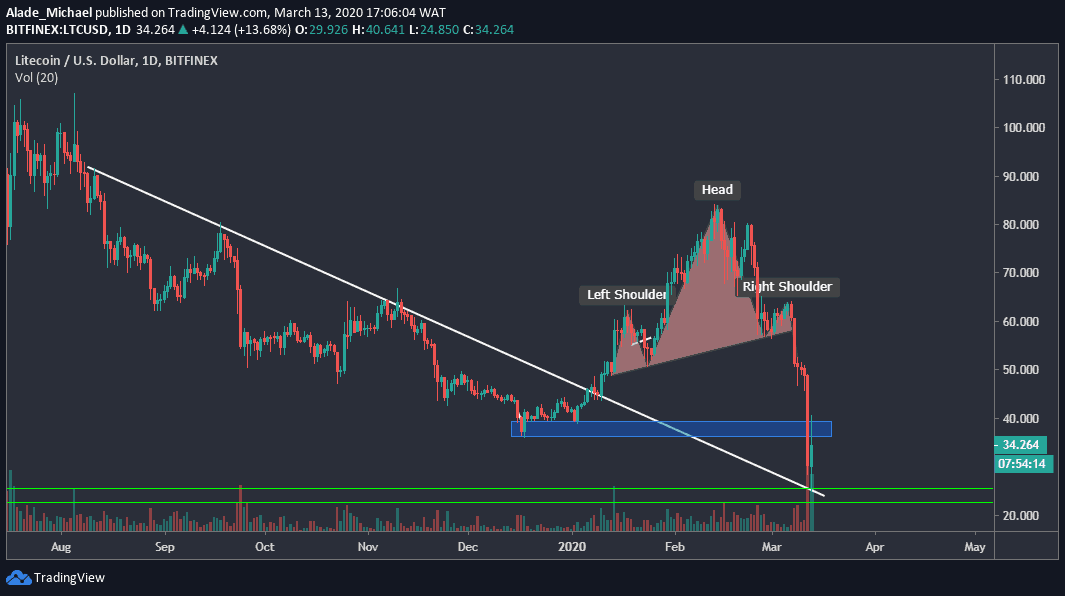

Litecoin

Following the head-and-shoulders pattern, Litecoin saw a massive drop over the past few days, losing more than 50% of its value this month. After breaking down December 2019 low, yesterday, LTC dropped to long-term support of $24, marked green on the daily chart.

LTC has bounced back to retest the key resistance area $40, marked blue on the chart, but failed to break. Followed the rejection, Litecoin is now trading at $34. A break above $40 would allow a further increase to $50 and above. If Litecoin drops, however, the green lines may act as support one more time.

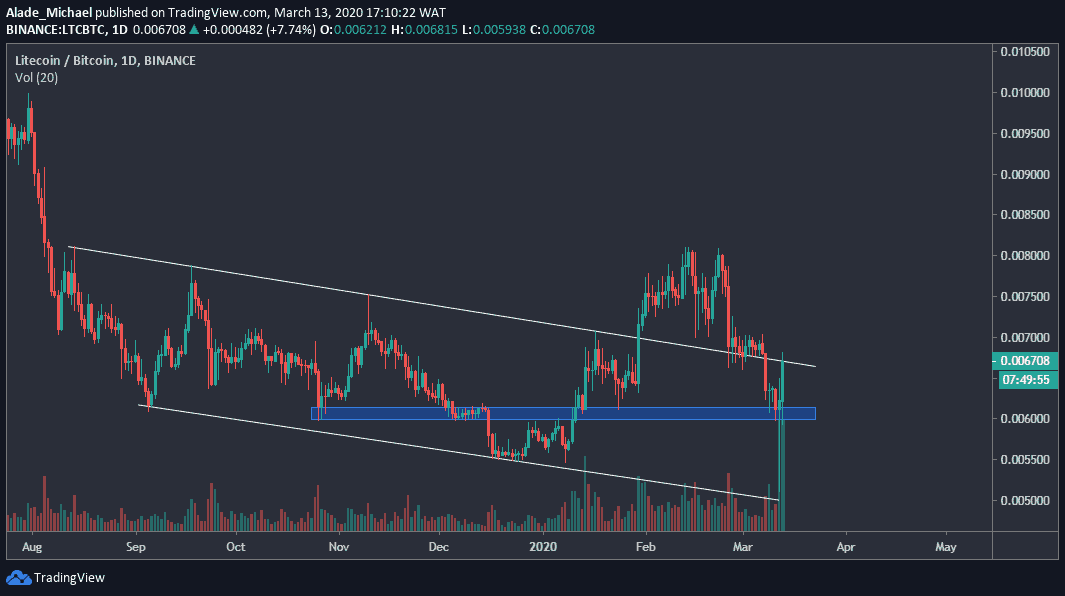

After creating a double-top around 0.0080 BTC mark, Litcoin saw a huge drop and rolled back inside the descending channel boundary, which was carved since August 2019. Meanwhile, Litecoin has recently established support around 0.006 BTC level against Bitcoin.

Followed by a small bounce, Litecoin is now facing resistance at 0.067 BTC level. If LTC can break above this channel’s resistance to retake the $0.0070 BTC level, the next target for buyers would be 0.008 BTC resistance level. Inversely, Litecoin may floor back to the blue support zone if price rejects at the current level. The channel’s support (0.0050 BTC) might become the next selling target if Litecoin drops further.

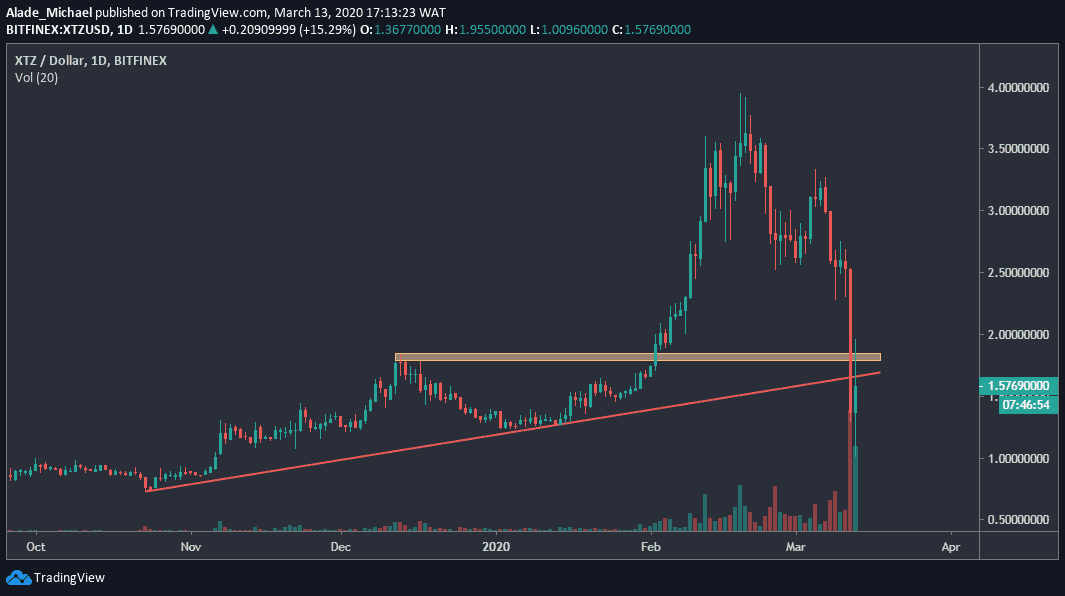

Tezos

Tezos is extremely oversold on the daily chart. After a quick recovery from a daily low ($1.1), we can see that the price is now trading at $1.57, still below a crucial resistance level of $1.8, as can be seen in orange on the daily chart. Though, Tezos attempted to regain momentum above this resistance but failed to do so.

If XTZ can manage to close significantly above $1.8 this week, especially above $2 resistance, we can anticipate a bullish price action to $2.5 and $3 in the coming days. If not, we may consider more bearish reactions to occur. In case of this, the $1.1 may be revisited or even $0.5 if it breaks.

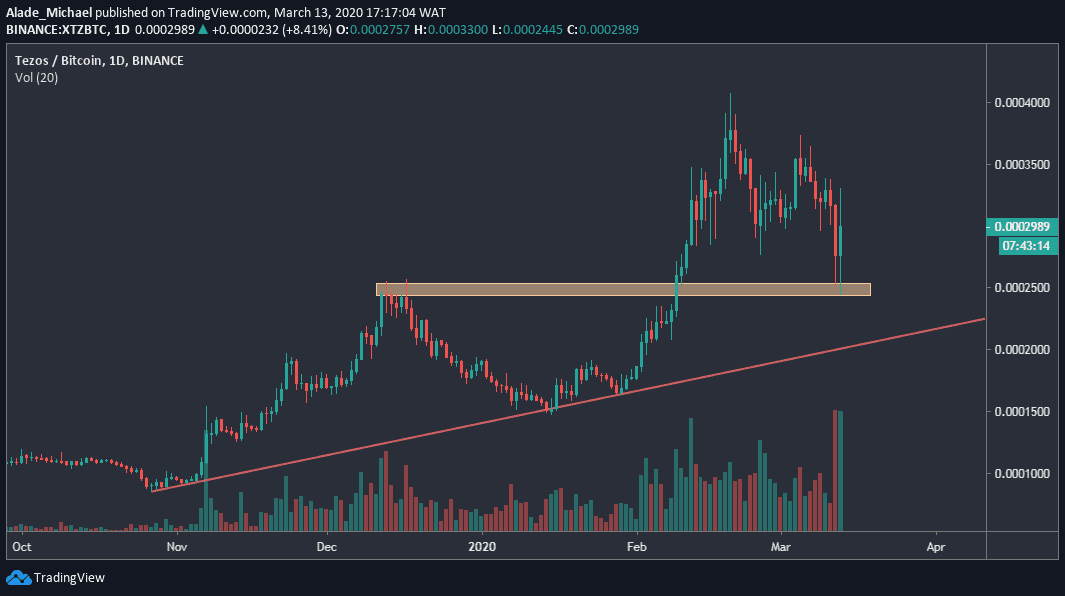

Against Bitcoin, Tezos is currently relying on the 0.00025 BTC support level. There’s still support on the red rising trend line in case Tezos drops beneath this orange area on the daily chart. With 2.32% losses over the past hours, Tezos is currently priced at 0.002989 level.

At the time of writing, the bulls are reacting to price actions, although Tezos is still looking bearish. If the buyers increase pressure, we can watch out for the next resistance to be 0.00035 BTC and perhaps 0.00040 level (near the all-time high). A sell action could drop XTZ back to 0.00025 BTC support. Support below this level lies 0.00020 BTC, right under the 5-month red rising line.