Since the new decade had started, Bitcoin is showing bullishness. The cryptocurrency started 2020 below 00 and skyrocketed to ,500 just days ago.However, Bitcoin gave us another reminder of its cruel volatility. After reaching almost ,300 as of yesterday’s high, just as Europeans went to sleep, Bitcoin started its show. In a little more than 50 minutes, Bitcoin dropped to as low as ,264 on BitMEX. The mega-dip was concentrated into five devastating minutes, during which Bitcoin lost more than 0.For those who have been in crypto for more than two years, a sudden drop of 00 or 10% shouldn’t be a surprising event. However, if Bitcoin wants to increase its adoption as a method of payment, or be included in a regulated ETF, those kinds of moves might slow down the process.But

Topics:

Yuval Gov considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Adoption, Editorials

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Christian Mäder writes Das Bitcoin-Rennen der US-Bundesstaaten: South Carolina plant millionenschweren Krypto-Reservefonds!

Since the new decade had started, Bitcoin is showing bullishness. The cryptocurrency started 2020 below $6800 and skyrocketed to $10,500 just days ago.

However, Bitcoin gave us another reminder of its cruel volatility. After reaching almost $10,300 as of yesterday’s high, just as Europeans went to sleep, Bitcoin started its show. In a little more than 50 minutes, Bitcoin dropped to as low as $9,264 on BitMEX. The mega-dip was concentrated into five devastating minutes, during which Bitcoin lost more than $600.

For those who have been in crypto for more than two years, a sudden drop of $1000 or 10% shouldn’t be a surprising event. However, if Bitcoin wants to increase its adoption as a method of payment, or be included in a regulated ETF, those kinds of moves might slow down the process.

But this is Bitcoin, and such volatility is unlikely to go away in the next few years, so at least let’s have a look at some takeaways from yesterday’s $1000 price drop.

People Have Short Memory

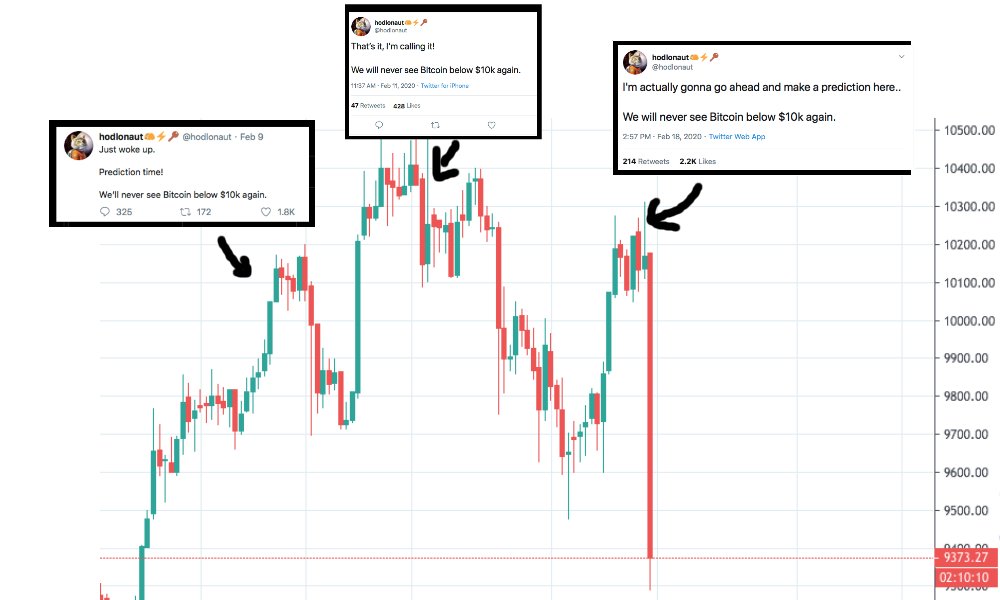

Just a few days ago, when Bitcoin was in its second attempt to break the $10,500 significant resistance, the whole Twitter community was so bullish, that one could think Bitcoin had reached a new all-time high.

Today, following the mega dump, the momentum of #bitcoin has changed into sad bearishness. Those who predicted Bitcoin to retest $5,000 are popping again.

Did you notice Bitcoin is still 30% above the price it had started 2020 just 50 days ago? Besides, did you see the recovery after the dump brought Bitcoin to around $9,600? Three days ago, it was trading for under $9,500. Proportions.

Crypto Twitter:$BTC pumps 10% = “This is totally normal. We’re going to the moon. Why didn’t I buy more?”$BTC dumps 10% = “This is manipulation. We’re going to zero. Why did I buy this ponzi?”

— Bitcoin Macro (@BTC_Macro) February 19, 2020

No One Has a Working Crystal Ball

Without mentioning big names, we saw the founder of one of the biggest crypto exchanges’ urging’ people to buy Bitcoin because it will “never be below $10,000 again.”

Unless you have inside information from Satoshi, you don’t know if Bitcoin will go again below a specific price. In this case, the $10,000 benchmark.

The Golden Cross Hype

Most of the recent day’s hype came as a result of the Golden Cross. This technical term describes a pattern where the 50-days moving average line crosses above the 200-days moving average line.

From the above definitions, one can understand that it’s a lagging indicator. This means that the price effect is likely to take place in the middle and long term (months), rather than in the short-term (days, weeks).

Just as a reminder, during the last Golden Cross of April 2019, Bitcoin plunged 10% before its ignition of 170% to the $13,880 peak, which was 2019’s high.

The Big Winner Of The Night

There is no doubt that Arthur Hayes, BitMEX CEO, could be delighted after such a volatile night. According to data from Skew, more than $100 million worth of Bitcoin long positions were liquidated in that hourly drop.

Crypto margin exchanges, which allow leverage of more than 100X, offer great opportunities for traders. However, unlike traditional exchanges, volatility can kill positions very easily.

This is the place to remind that for most of the traders and investors, the best way to invest in Bitcoin is by HODLing, or slow accumulation using the DCA method (Dollar Cost Averaging).

Traditional Media Will Never Understand Crypto

Such sudden and sharp price fluctuations give us another opportunity to laugh at the traditional media that usually don’t do their homework in understanding the properties of Bitcoin and the other cryptocurrencies.