Over the past two days, we had seen the price of Bitcoin trading mainly under a very tight range between 00 and 00.As a reminder of the recent price action, Bitcoin had gone through a decent rally since starting the new decade.However, right after touching the significant 200-days moving average line (marked light green on the following daily chart), Bitcoin got rejected, plunged more than 0 intraday, and trading safely around the 00 mark since then.In the micro-level, we can see Bitcoin’s immediate correction reaching the 38.2% Fibonacci retracement level (~30) of the enormous price plunge, as can be seen on the following 4-hour chart.Besides, the drop had reached the lower trend-line of the marked ascending channel on the 4-hour chart. Bitcoin respected that technical

Topics:

Yuval Gov considers the following as important: Bitcoin (BTC) Price, BTCanalysis

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Jordan Lyanchev writes Liquidations Top 0M as Bitcoin Falls K, Reversing Trump-Driven Rally

Over the past two days, we had seen the price of Bitcoin trading mainly under a very tight range between $8600 and $8700.

As a reminder of the recent price action, Bitcoin had gone through a decent rally since starting the new decade.

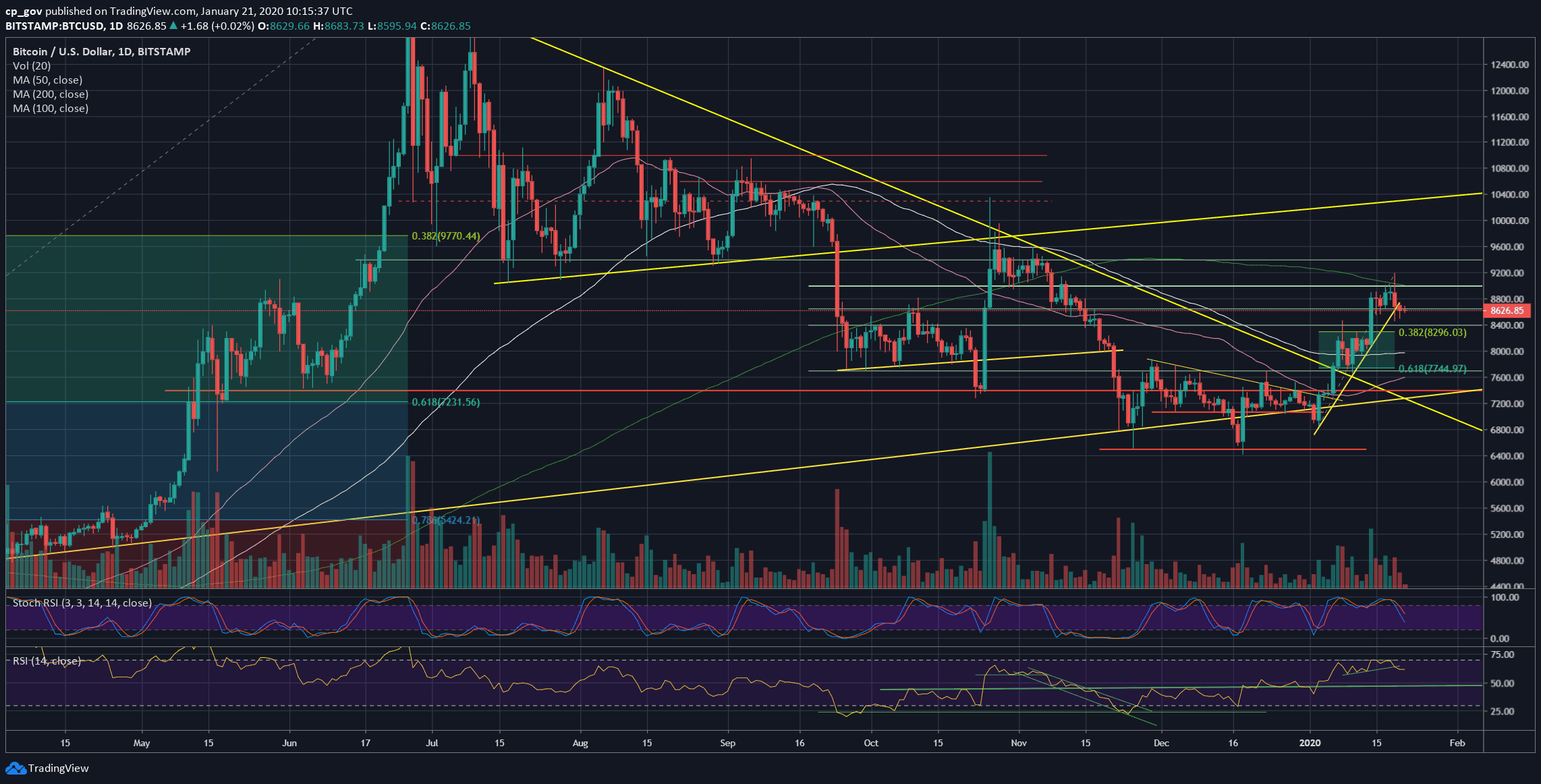

However, right after touching the significant 200-days moving average line (marked light green on the following daily chart), Bitcoin got rejected, plunged more than $700 intraday, and trading safely around the $8600 mark since then.

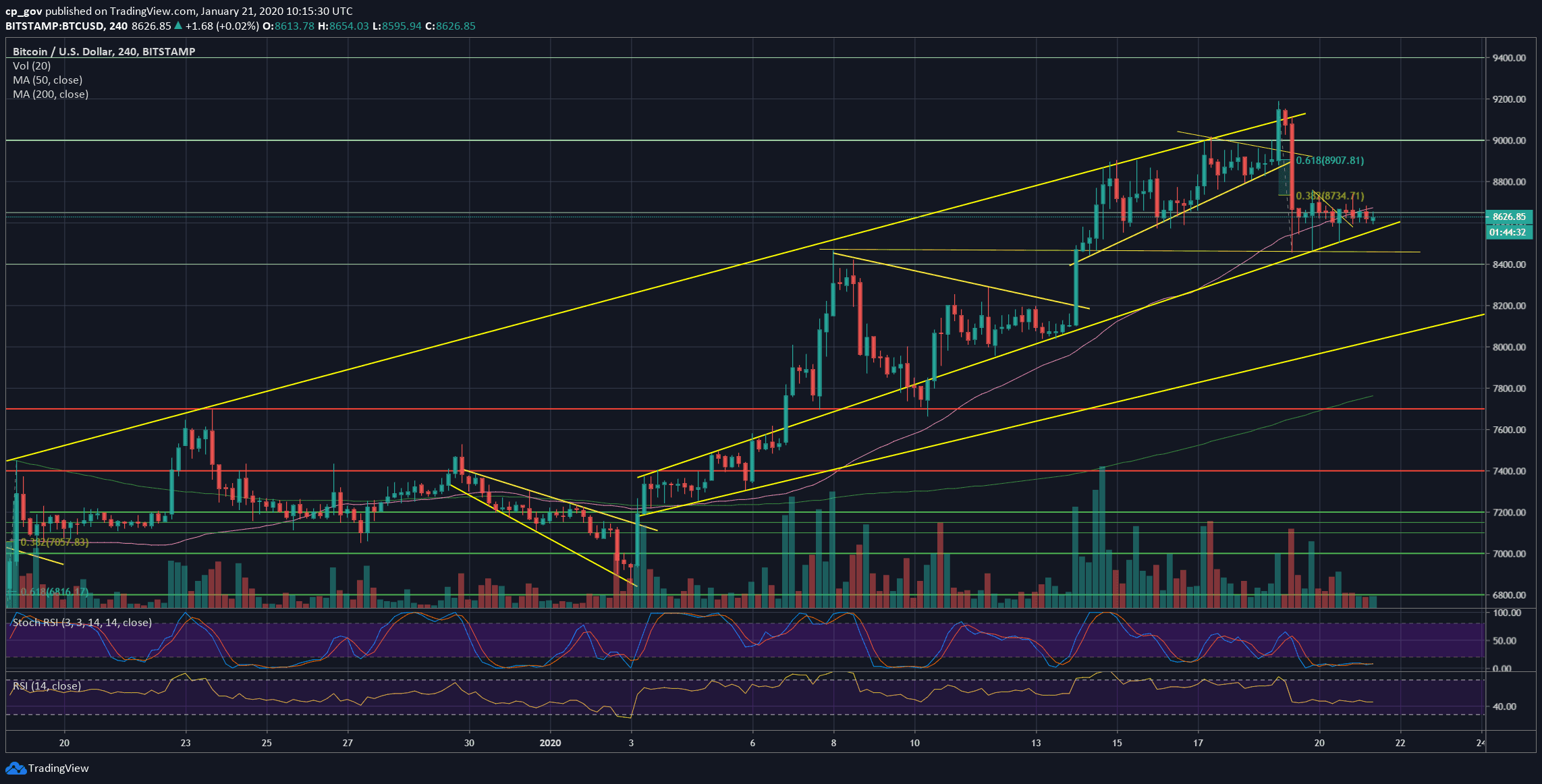

In the micro-level, we can see Bitcoin’s immediate correction reaching the 38.2% Fibonacci retracement level (~$8730) of the enormous price plunge, as can be seen on the following 4-hour chart.

Besides, the drop had reached the lower trend-line of the marked ascending channel on the 4-hour chart. Bitcoin respected that technical pattern since the beginning of the month.

Bitcoin Short-term’s Fragility

Usually, after a huge move like this, which is followed by a price consolidation period, another big move takes place. And this is precisely the situation here. Especially because Bitcoin is trading right by the lower marked trend-line.

The bulls would like to see Bitcoin finding support on top of the ascending line, and in general, not breaking the $8460 – $8600 range.

Total Market Cap: $238.7 billion

Bitcoin Market Cap: $157 billion

BTC Dominance Index: 65.8%

*Data by CoinGecko

Key Levels To Watch & Next Targets

– Support/Resistance levels: The bigger picture hadn’t changed since our previous analysis from two days ago.

The first line of support is the mentioned ascending trend-line (on the 4-hour chart). Further below is the double-bottom on the 4-hour’s chart, which is this week’s low at $8460.

A little below is the confluence zone of $8300 – $8400, along with the Fibonacci retracement level of 38.2% (of the January rise), before reaching the $8000 area, along with the 100-days moving average line (marked by white).

From above, $8730 – $8750 is still the first level of resistance Bitcoin will face (38.2% Fib level), which Bitcoin couldn’t overcome in the past two days. The next major resistance is $8900, along with the Golden Fib of 61.8%.

Further above is $9000, along with the most significant resistance at the current price area – the 200-days moving average line.

– The RSI Indicator: Following the recent price action, the RSI is showing some bearish signs, after breaking below the short-term ascending trend-line. The RSI is now facing support at 60.

The bearish momentum can also be seen in the Stochastic RSI oscillator, which is pointing lower following a crossover in the overbought territory.

– Trading volume: The recent price plunge didn’t carry a tremendous amount of volume, as compared to last month’s average volume levels. Yesterday ended with a relatively low amount of volume, maybe because of the holiday in the US.