The constant expansion of the coronavirus continues to harm the global economic markets. Monday’s severe stock sell-off pushed the UK to cut the interest rates, a week after the US did the same.As a result, Europe stocks are in the green as of writing these lines. Wall Street’s major indexes opened Wednesday’s trading in the deep red zone – S&P 500 and NASDAQ are down 3% at the moment. At the same time, Bitcoin’s price is steady around 00.Coronavirus Spreads: Global Markets ReactThe COVID-19 started a domino effect on the global economic scene. Affected people led to countries shutting their borders, businesses slowing down, Saudi Arabia launching an Oil Price War, and inevitably, the latest brutal equity sell-off on Monday – the worst day Wall Street saw since 2008.While doctors are

Topics:

Jordan Lyanchev considers the following as important: AA News, bank of england, Bitcoin (BTC) Price, btcusd, coronavirus, Donald Trump, federal reserve

This could be interesting, too:

Bitcoin Schweiz News writes GameStop nimmt Bitcoin in Firmenreserven auf

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

The constant expansion of the coronavirus continues to harm the global economic markets. Monday’s severe stock sell-off pushed the UK to cut the interest rates, a week after the US did the same.

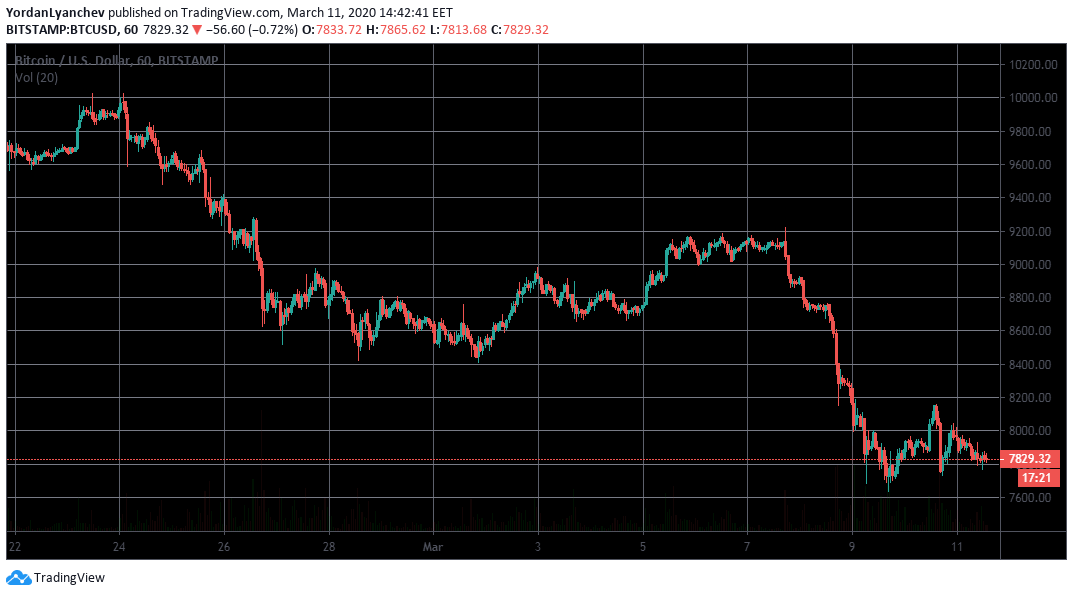

As a result, Europe stocks are in the green as of writing these lines. Wall Street’s major indexes opened Wednesday’s trading in the deep red zone – S&P 500 and NASDAQ are down 3% at the moment. At the same time, Bitcoin’s price is steady around $7800.

Coronavirus Spreads: Global Markets React

The COVID-19 started a domino effect on the global economic scene. Affected people led to countries shutting their borders, businesses slowing down, Saudi Arabia launching an Oil Price War, and inevitably, the latest brutal equity sell-off on Monday – the worst day Wall Street saw since 2008.

While doctors are trying to find a way to fight the deadly effect on people’s health, country leaders are taking drastic economic measures, as well.

The U.S. Federal Reserve issued an emergency interest rate cut last week by reducing a 0.5% reduction. President Donald Trump, though, considered the move as not sufficient enough. He said that they should slash the “Fed Rate down to the levels of our competitor nations.” Interestingly enough, the Fed is expected to cut the rates even more next week.

After yesterday’s price jumps, major US indexes are in the red today. The Dow Jones, the Nasdaq Composite, and the S&P500 – all of them are to open trading with 2-3% decreases.

The Asian stock market continues to tumble, as well. China’s Shanghai Composite is 1% down, Japan’s Nikkei 225 noted a decrease of 2.3%, and Hong Kong’s Hang Seng dropped with 0.6%.

Unlike Asia and the US, the Europan markets are showing slight green: Britain’s FTSE 100 index is up by 0.5%, while Germany’s DAX and France’s CAC 40 are up by almost 2%.

It comes only hours after the U.K. followed the Fed’s example from last week. In another emergency reaction, the Bank of England slashed interest rates to a record low.

Bitcoin Correlates With Wall Street?

The crypto community follows Bitcoin’s performance tightly during the current time of economic uncertainty.

The primary digital asset has previously indicated an on and off correlation with the stock market. BTC lost around $1,400 of its value at the start of this week, as well.

The latest developments showcased that Bitcoin and Wall Street have similar paths. During yesterday’s U.S. stock market rise, BTC also shot up to $8,100 but since then retraced to the current level of about $7,850.

Bitcoin price finds itself at a critical historical spot now, retesting a long-term trend-line started forming during 2015.