It’s another exciting day in Bitcoin land. And no, it doesn’t have to anything with BTC’s rallying price. Of course, the price has brought smiles on the faces of Bitcoiners across the world, but there’s something else too.The latest data shows that whales no longer control Bitcoin’s supply. The number of retail investors owning little BTC has steadily increased in the last 5 years. Does it point to a rise in Bitcoin adoption?≤ 10 BTC Holders Increased While Those Holding 100 – 100K BTC Reduced ConsiderablyFresh data from on-chain analytics firm Glassnode, points to a reduction in ‘deep-pocketed Bitcoin investors’. This is not a recent change, but a trend that has been noticed over a period of last 5 years. Also, it was found that retail BTC ownership has increased to a double-digit figure.

Topics:

Himadri Saha considers the following as important: AA News, Bitcoin Adoption, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Christian Mäder writes Das Bitcoin-Rennen der US-Bundesstaaten: South Carolina plant millionenschweren Krypto-Reservefonds!

It’s another exciting day in Bitcoin land. And no, it doesn’t have to anything with BTC’s rallying price. Of course, the price has brought smiles on the faces of Bitcoiners across the world, but there’s something else too.

The latest data shows that whales no longer control Bitcoin’s supply. The number of retail investors owning little BTC has steadily increased in the last 5 years. Does it point to a rise in Bitcoin adoption?

≤ 10 BTC Holders Increased While Those Holding 100 – 100K BTC Reduced Considerably

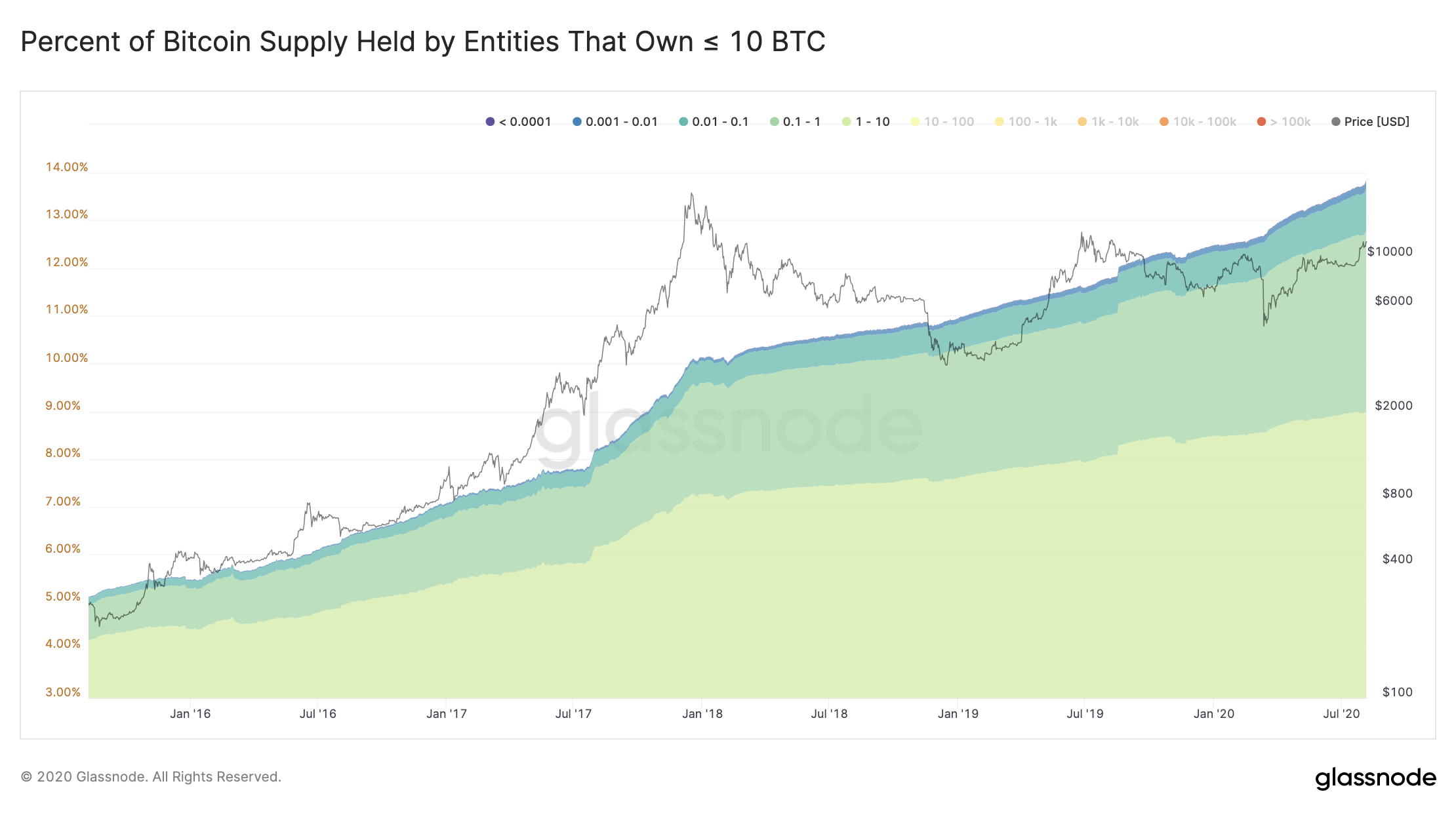

Fresh data from on-chain analytics firm Glassnode, points to a reduction in ‘deep-pocketed Bitcoin investors’. This is not a recent change, but a trend that has been noticed over a period of last 5 years. Also, it was found that retail BTC ownership has increased to a double-digit figure. As per a tweet posted by Glassnode:

Control of #Bitcoin’s supply has been steadily shifting towards smaller entities. The % of supply owned by entities holding ≤ 10 $BTC grew from 5.1% to 13.8% in 5 years, while the percent held by entities with 100-100k BTC declined from 62.9% to 49.8%.

This points to an increased decentralization and democratization in Bitcoin’s ownership, just like Satoshi intended while designing the protocol. What this also means is that the risk of whales dumping to cash out from an ongoing rally is also declining. Apart from this, there’s another metric that points to surging retail BTC investment interest.

Bitcoin Addresses Holding More Than $10 Worth of BTC Hits New ATH

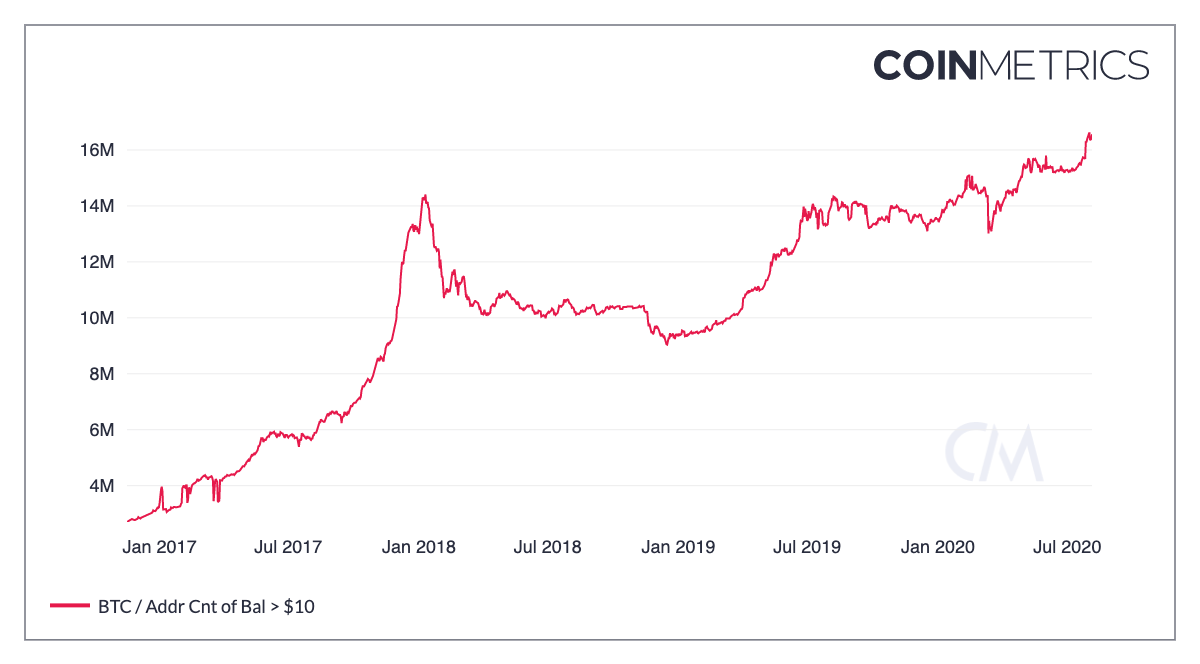

Bitcoin as an asset will only achieve its true purpose if more people own it. Data from Coin Metrics shows that is in fact the case. In a tweet on Tuesday, network data manager at the crypto data provider firm, Lucas Nuzzi observed that Bitcoin addresses holding more than $10 worth of BTC has touched the 16.6 million mark.

That’s a new all-time high and is significantly more (to the tune of millions) than what was seen during the 2017 bull rally.

A new adoption cycle is brewing

We just hit an all time high in the number of addresses holding more than $10 worth of $BTC (16.6M) and $ETH (6M). Millions of addresses more than what was seen at the top of the 2017 bubble

This and the earlier Glassnode observations indicate clearly that the rate of Bitcoin adoption has grown remarkably during the last 3-5 years. Retail investors are getting involved not just for the explosive price action but to preserve the value of their fiat funds. And why?

Bitcoin is a global asset. Dovish economic/monetary policies of governments across the world, especially the United States, are dwindling both the value and relevance of their respective fiat currencies. BTC investors are well aware of the drastic inflationary effects that these faulty moves will have on the overall economic scenario.

Also, the US Dollar stands to lose its dominance in international forex markets as per a recent Goldman Sachs report.

Bitcoin and hard assets like gold are serving as de-facto safe havens and insulating people from ‘receiving the short end’ of the uncertain macroeconomic stick.