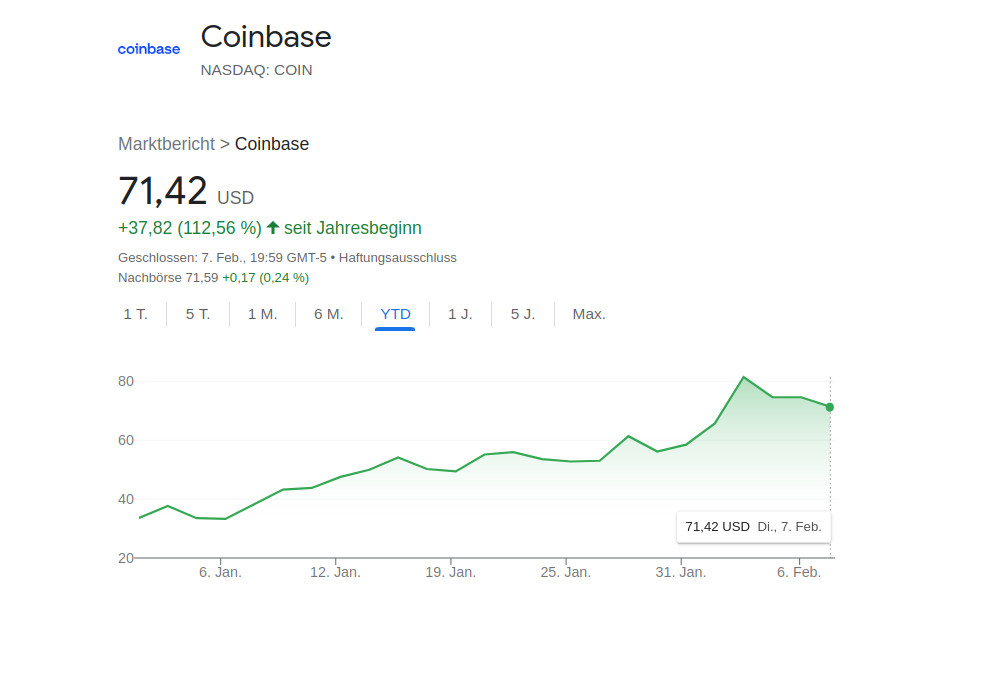

The Bitcoin recovery story has boosted shares in cryptocurrency exchange Coinbase from record lows last year. Coinbase (COIN) shares have rallied an impressive 120% from the low seen on 28th December as U.S. markets have surged in the new year on hopes that inflation is finally easing. The Bitcoin recovery story has boosted shares in cryptocurrency exchange Coinbase from record lows last year. Coinbase (COIN) shares have rallied an impressive 120% from the low seen on 28th December as U.S. markets have surged in the new year on hopes that inflation is finally easing. The price of Bitcoin has rallied 50% from its lows seen in November last year and GraniteShares believes that will be good news for sophisticated investors looking to go long on

Topics:

Bitcoin Schweiz News considers the following as important: BTC, Coin, coinbase, LTC, nasdaq, stock market

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Bitcoin Schweiz News writes Litecoin jetzt in der Telegram-Wallet verfügbar!

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

The Bitcoin recovery story has boosted shares in cryptocurrency exchange Coinbase from record lows last year. Coinbase (COIN) shares have rallied an impressive 120% from the low seen on 28th December as U.S. markets have surged in the new year on hopes that inflation is finally easing.

The price of Bitcoin has rallied 50% from its lows seen in November last year and GraniteShares believes that will be good news for sophisticated investors looking to go long on Coinbase which had lost as much as 85% of its value in the Crypto winter, since hitting a record valuation of $77 billion at the start of November 2021.

Coinbase, has suffered from the wipe-out in the cryptocurrency market driven by a combination of high-profile failures in the sector and rising interest rates which has hit Coinbase’s revenues and slashed its number of monthly users to 8.5 million from a peak of 11.1 million and assets under management.

Recent research from Graniteshares showed that investors had, perhaps unsurprisingly, lost confidence in the Crypto sector and cryptocurrencies in general. Its research* with UK traders shows that 33% of regular share traders say they now prefer to hold individual stocks in crypto companies as opposed to crypto exchanges or platforms which can often be unregulated or offer little in the way of investor protections.

Given the recent surge in Coinbase, Bitcoin and other cryptocurrencies, GraniteShares says it could be the right time to consider its 3x Long Daily ETP 3LCO to leverage gains.

Will Rhind, Founder and CEO of GraniteShares, said:

“Price predictions for Bitcoin in the year ahead are more optimistic and while it may not reach its previous all-time high of more than $68,000 in 2023 there is scope for considerable growth from current levels of around $23,000.”

“There is a growing consensus that the price will recover strongly this year and there is similar optimism about Ethereum. Our own research shows traders are becoming more interested in crypto companies which is good news for Coinbase as one of the major exchanges.”