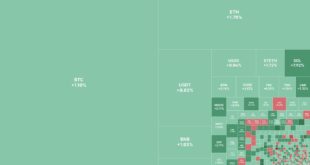

Uptober: Fast alle Kryptowährungen im Plus Nicht nur der Uptober hat einmal mehr gezeigt, dass der Oktober generell ein guter Monat ist, was den Bitcoin-Preis betrifft. Kommt nach dem Uptober der Pumpvember? Ein schöner Abschluss macht nun eine Grafik, welche von Blockchain.com gepostet wurde. Diese Grafik zeigt, in den letzten 24 Stunden notieren fast alle Kryptowährungen im Plus. Darum steigt der Bitcoin-Preis Der Bitcoin-Preis hat in den letzten...

Read More »Tokenization Accelerating Owing to High Yield Environment: Coinbase

According to a recent Coinbase research, the tokenization of financial assets has been steadily gaining momentum since 2017, bringing the evolution of digital financial assets, including sovereign bonds, money market funds, and repurchase agreements. As per the report, the growth has been dramatically buoyed by the existing high-yield environments but still faces huge infrastructural and legal obstacles. Tokenization Market Primed for Growth The report says in part: “We...

Read More »Wieviele Bitcoins sind verloren? Ein Blick auf verlorene Kryptowährungen und ihre Auswirkungen!

Binance Research: Mehr als 90% der "Heavy User" speichern den Private Key ihrer Bitcoins nicht selbst. Bitcoins sind seit ihrer Einführung im Jahr 2009 zu einem faszinierenden und lukrativen Asset geworden. Doch während immer mehr Menschen in Kryptowährungen investieren und handeln, stellt sich die Frage: Sind viele Bitcoins verloren? Die Antwort ist komplex und wirft wichtige Fragen über die Natur von Kryptowährungen, Sicherheit und Verantwortung...

Read More »Die Rätselhafte Herkunft von Bitcoin

Seit der Einführung von Bitcoin im Jahr 2009 ranken sich zahlreiche Spekulationen darüber, wer hinter der Erfindung der Kryptowährung steht. Während der Pseudonym „Satoshi Nakamoto“ als der Schöpfer von Bitcoin gilt, blieb die wahre Identität hinter diesem Namen ein wohlgehütetes Geheimnis. In jüngster Zeit wurde jedoch eine alte Theorie wiederbelebt, die besagt, dass die US-amerikanische National Security Agency (NSA) eine zentrale Rolle bei der...

Read More »SEC to Possibly Reevaluate Grayscale Spot Bitcoin Application at November 2 Closed Meeting

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be. The United States Securities and Exchange Commission (SEC) appears to be gearing up to reexamine Grayscale’s application to convert its Bitcoin trust into a spot exchange-traded fund (ETF). This comes after a recent decision by the D.C. Circuit Court of Appeals to scrape the regulator’s rejection of Grayscale’s spot Bitcoin ETF application. The court described the SEC’s...

Read More »Valkyrie Amends Prospectus for Spot Bitcoin ETF Application

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings. Asset manager Valkyrie has recently made waves due to its decision to amend its prospectus for a spot Bitcoin (BTC) ETF filed with the US Securities and Exchange Commission (SEC). The Valkyrie Bitcoin ETF Update James Seyffart, a renowned analyst at Bloomberg, shared this development on social media platform X, shedding light on Valkyrie’s efforts to meet the SEC’s requirements for its...

Read More »Andreessen Horowitz to Raise $3.4B Fund for Crypto Startups

Andreessen Horowitz, to date, is arguably one of the most prolific investors in the blockchain space. Andreessen Horowitz (a16z) is reportedly planning to raise a $3.4 billion fund that will be designated for early-stage and seed-stage crypto businesses. The development was shared by Axios, which also cited other sources. According to Axios, a16z, the Silicon Valley venture capital firm “plans to raise new growth, crypto and bio vehicles in 2025.” And, for what it’s worth, the intended...

Read More »How Satoshi Nakamoto and Bitcoin Whitepaper Changed World within 15 Years

With the imminent launch of Bitcoin spot ETFs, many institutions are also looking to gain increased exposure to BTC. Exactly 15 years ago, Satoshi Nakamoto, the pseudonymous creator of Bitcoin, sent the Bitcoin whitepaper via email to a select number of cryptographers. Satoshi is fondly quoted to have opened the email saying: “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” He then went on to link the Whitepaper which he...

Read More »Hong Kong CBDC Advances to Phase 2 after Successful First Phase

The e-HKD program has taken a three-rail approach for the potential implementation of the virtual currency: foundation layer development, industry pilots and iterative enhancements, and full launch. Hong Kong’s central bank digital currency (CBDC) pilot is set to advance to its second phase following the successful completion of phase one. The first phase was largely focused on full-fledged payments, programmable payments, offline payments, tokenized deposits, and the settlement of Web3...

Read More »Saga Launches Pegasus Incentivized Testnet for Web 3.0 Gaming Ecosystem

The Pegasus Testnet has gone through various stages of rapid development in order to support Saga’s partners and innovators. Based on a report from Chainwire, Saga, a layer-1 protocol for Web 3.0 gaming, has announced the introduction of its Incentivized Testnet, which is known as Pegasus. This marks a major milestone for the project as it prepares for the full Saga Protocol V1 Mainnet that it plans to roll out in early 2024. Saga is a developers’ ecosystem that works best for Web 3.0...

Read More » Blockchain

Blockchain