Ireland increasingly becoming the 'go-to' funds jurisdiction globally Significant industry growth combined with a historic shift in behaviour means that Ireland is increasingly becoming the ‘go-to’ jurisdiction globally for funds, says Ocorian, the global diversified financial services group (please see the attached press release). That is being reflected in a historic change in buyer behaviour, as domiciling and entity decisions are no longer being driven purely by jurisdictional familiarity, but increasingly by what a jurisdiction and its service providers have to offer. There are, for instance, currently over 17,000 people directly employed in the funds industry in Ireland. Its industry services over 90 countries, with over €3.9 trillion in

Topics:

Bitcoin Schweiz News considers the following as important: Allgemein, Celtic Tiger, Irish, Irland

This could be interesting, too:

Bitcoin Schweiz News writes 2025: PayPal setzt alles auf PYUSD – Wird dieser Stablecoin den Zahlungsmarkt dominieren?

Bitcoin Schweiz News writes Finanzaufsicht Austria warnt: Likes statt Lizenz – So erkennt man seriöse Finfluencer

Bitcoin Schweiz News writes Kühner neuer Plan um PEP-20 lässt Bitcoin-Fans aufhorchen

Christian Mäder writes SEC Establishes New Cyber and Emerging Technologies Unit (CETU)

Significant industry growth combined with a historic shift in behaviour means that Ireland is increasingly becoming the ‘go-to’ jurisdiction globally for funds, says Ocorian, the global diversified financial services group (please see the attached press release). That is being reflected in a historic change in buyer behaviour, as domiciling and entity decisions are no longer being driven purely by jurisdictional familiarity, but increasingly by what a jurisdiction and its service providers have to offer. There are, for instance, currently over 17,000 people directly employed in the funds industry in Ireland.

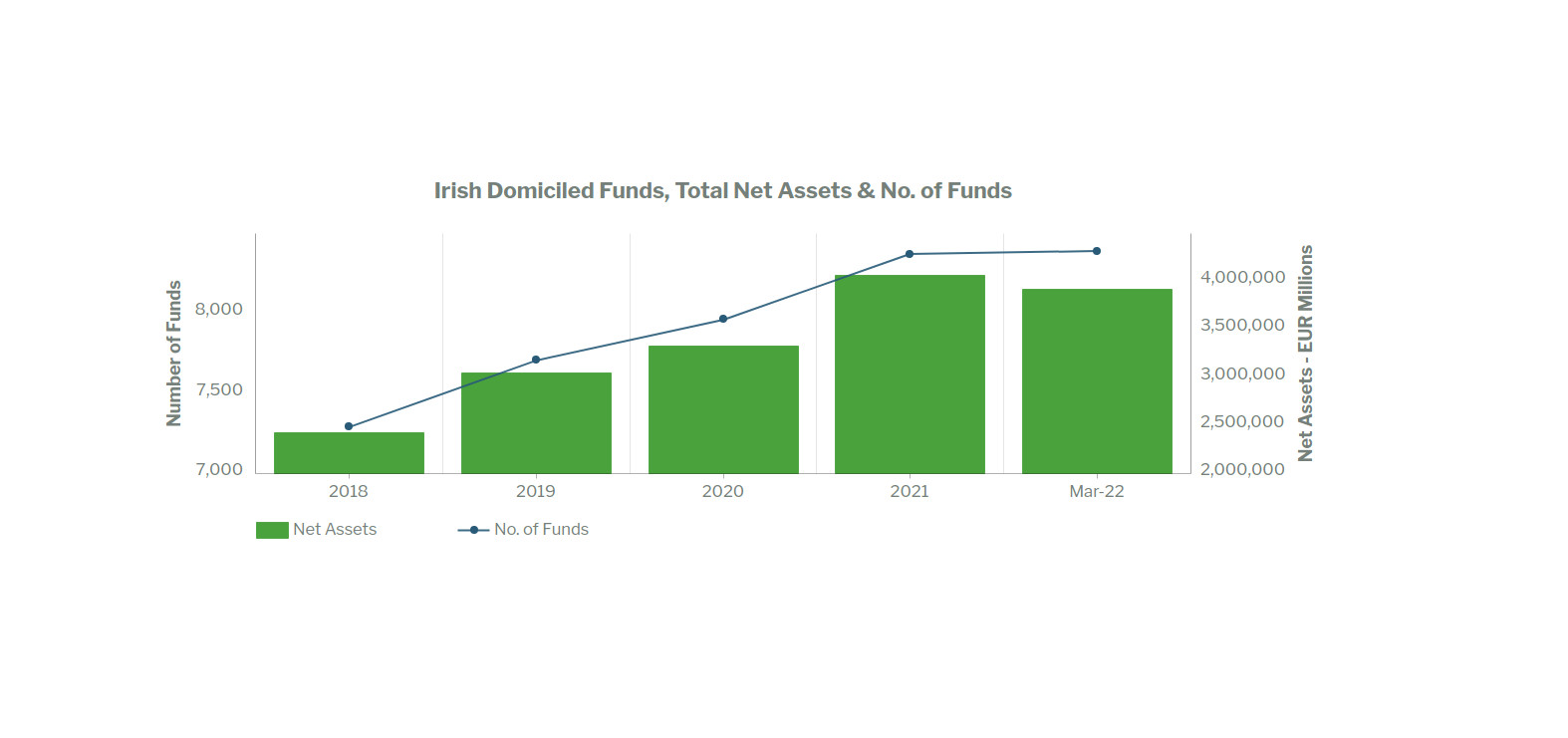

Its industry services over 90 countries, with over €3.9 trillion in net assets held in approximately 8,000 Irish domiciled funds. Latest figures show 17 of the world’s top 20 global asset managers offer Irish domiciled funds and 40% of global alternative assets are either domiciled or serviced in Ireland. Growth is being supported by Ireland’s new and revamped Investment Limited Partnership (ILP) regime, its common law jurisdiction, clear tax transparency regime and range of well-established service providers which coupled with the fact it’s English speaking – means it is a viable alternative to Luxembourg.

Simon Behan, Chief Commercial Officer, Ocorian said:

“The figures speak for themselves – Ireland is increasingly the go-to jurisdiction, and we see plenty of reasons why this is set to continue. It combines vast funds expertise, a wealth of industry knowledge with a substantial experienced workforce and a deep pool of top service providers making it an easy choice for private equity firms, investment banks and real estate developers.

“We’re seeing this rapid growth at the same time as a historic shift in buyer behaviour – our clients are increasingly focusing on ‘what’ jurisdictions offer rather than ‘where’ they are. This is in part due to the regulatory equalisation across markets and the fact that many jurisdictions are offering similar structuring and funds ‘products.’”