The launch of the updated Augur v2 betting platform has attracted massive interest from investors. Recent data indicated that the number of active addresses has skyrocketed on the day after the v2 release.Augur V2 Is LiveThe veteran decentralized betting platform allowing customers to place bets on various cryptocurrency-related outcomes Augur launched the second version of its platform on July 28th, 2020. Dubbed Augur v2, it has brought multiple upgrades, including touching upon the ongoing DeFi boom with the Interplanetary File System (IPFS), 0x Mesh, MakerDAO’s DAI, and Uniswap’s v2 oracle network.“The Augur v2 protocol contracts have been successfully deployed on the Ethereum Mainnet. The contracts have been verified on Etherscan, and the deployers address can be found here.” – reads

Topics:

Jordan Lyanchev considers the following as important: AA News, augur, Binance

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

Bitcoin Schweiz News writes Bitpanda vs. Binance: Welche Bitcoin-App ist die beste für die Schweiz?

Bitcoin Schweiz News writes Binance: Warum diese Bitcoin-Börse die Konkurrenz abhängt!

The launch of the updated Augur v2 betting platform has attracted massive interest from investors. Recent data indicated that the number of active addresses has skyrocketed on the day after the v2 release.

Augur V2 Is Live

The veteran decentralized betting platform allowing customers to place bets on various cryptocurrency-related outcomes Augur launched the second version of its platform on July 28th, 2020. Dubbed Augur v2, it has brought multiple upgrades, including touching upon the ongoing DeFi boom with the Interplanetary File System (IPFS), 0x Mesh, MakerDAO’s DAI, and Uniswap’s v2 oracle network.

“The Augur v2 protocol contracts have been successfully deployed on the Ethereum Mainnet. The contracts have been verified on Etherscan, and the deployers address can be found here.” – reads the statement.

One of the most significant alternations coming from the upgrade affected the native cryptocurrency. While the company dismissed the initial plans to rename the original REP token to REPv1, it proceeded with the launch of a new one capable of working with Augur v2 called REPv2.

“Exchanges, wallet providers, block explorer, and additional services will be updating to the REPv2 contract address over the coming day. If you’re using a service that is not reflecting the new REPv2 token contract, please send them a message and let them know.”

Surge In Active Addresses

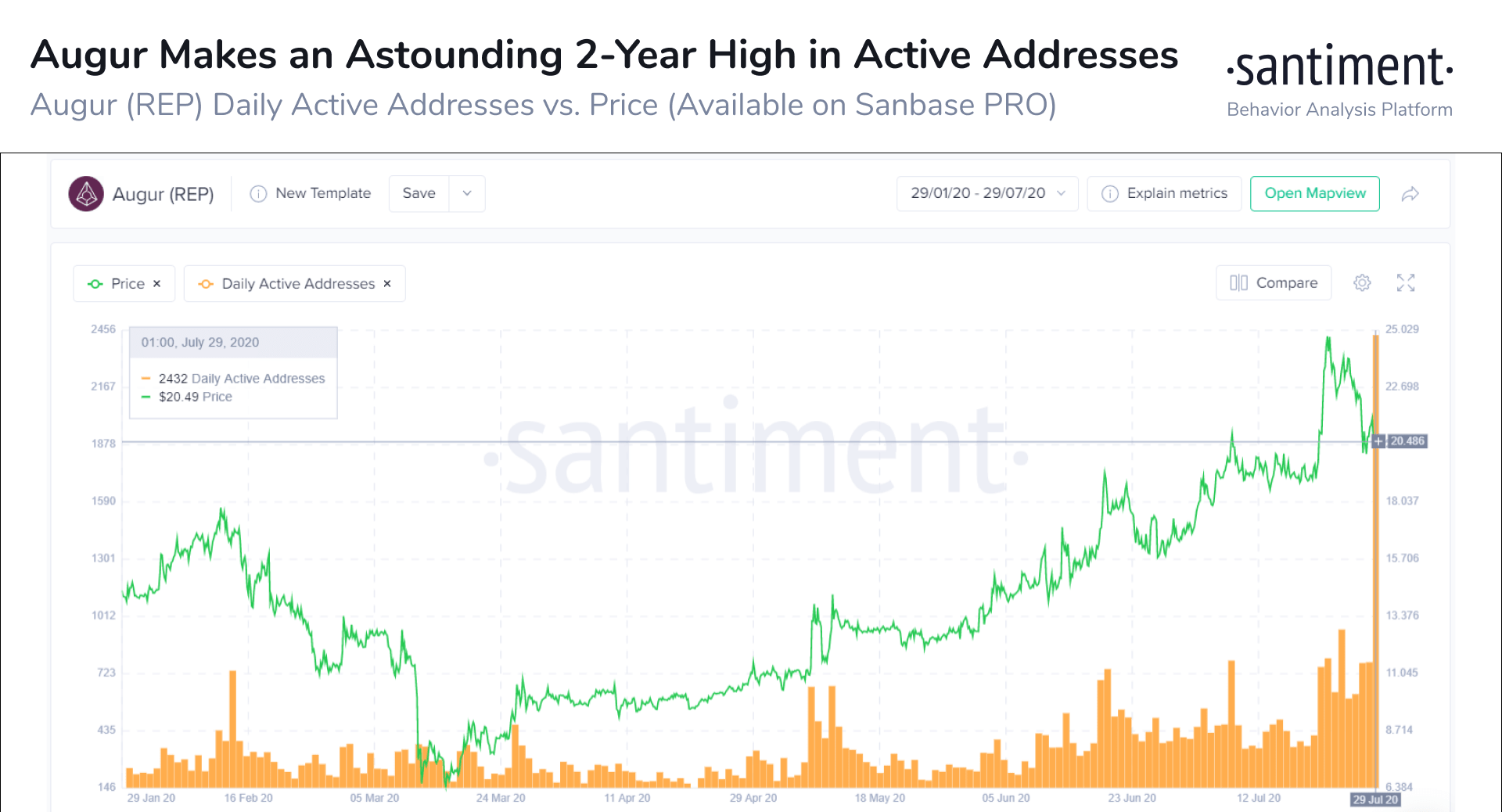

The hype surrounding the second version of the project has reached investors as exemplified by data from the popular analytics company – Santiment. It asserted that “Augur has made a new 2-year high in daily active addresses following changes to the REP token swap on Binance.” The number of such addresses skyrocketed from about 700 to over 2,400 in a day.

The native cryptocurrency has been quite bullish this year. It entered 2020 at approximately $8.4 and just a few days ago marked its yearly high of $25 – registering an increase of nearly 200%. With the launch of Augur v2 approaching, REP even received a spot in CryptoPotato’s Crypto Fund.

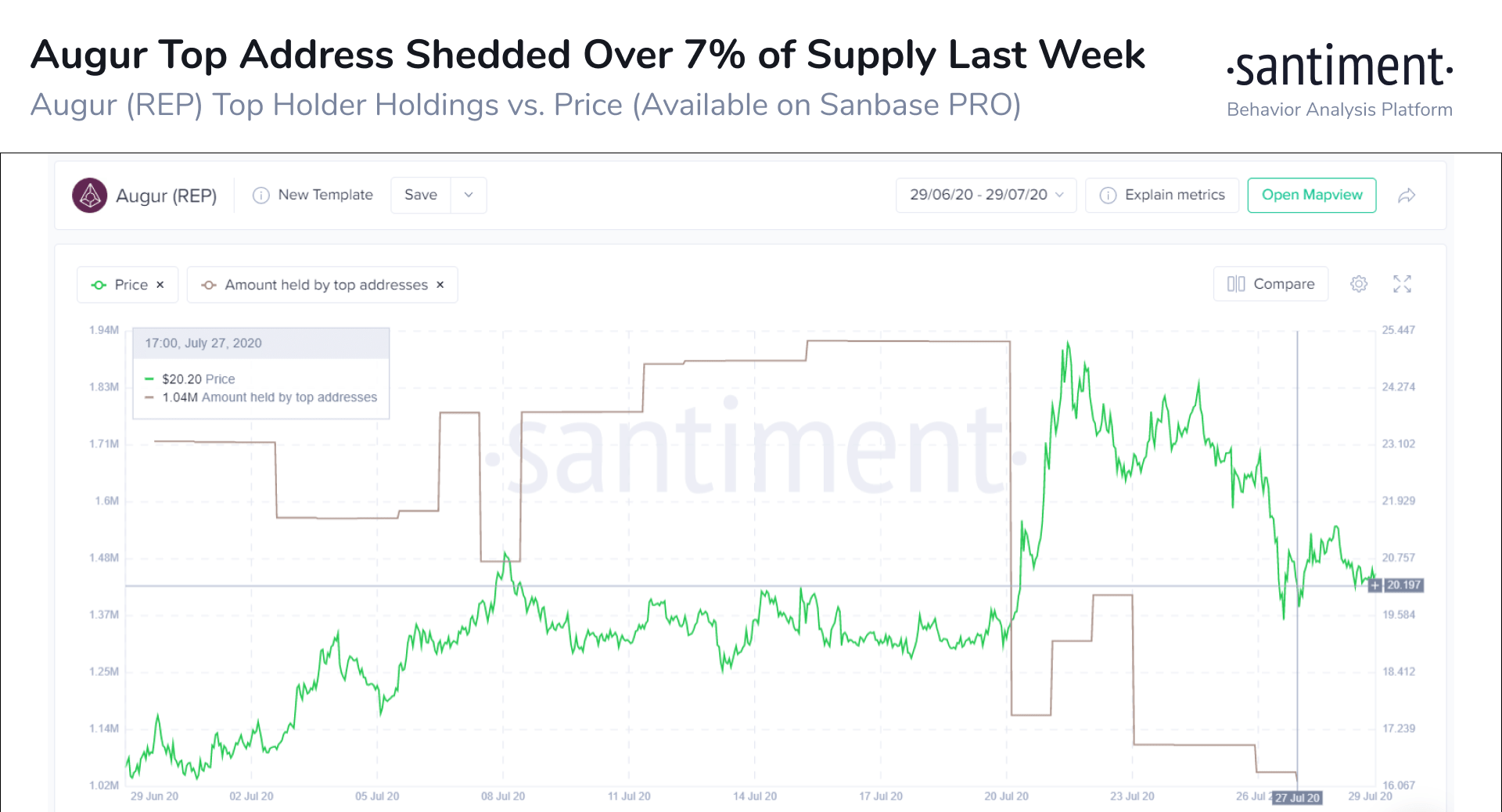

However, Sentiment also informed that upon reaching the top, whale addresses “dumped nearly 7.5% of the total supply.” Consequently, the price retraced to about $20.7 at the time of this writing. Nevertheless, the data analytics company noted that the asset is “showing a major bullish divergence, and [is] primed for a rebound.”