Months after India’s Supreme Court lifted a 2-year-old directive against cryptocurrency usage in the country, the Reserve Bank of India (RBI) is still not cooperating with digital asset businesses. Several exchanges have requested clarifications from the bank regarding their status as the scrutiny from lenders continues.Crypto Exchanges Contact RBIA local report from today indicated that digital asset exchanges are still unclear regarding their stance. Therefore, many platforms have written...

Read More »Bitcoin Hash Rate Hits All-Time High: Here’s How It Works And How It Affects The Price

Bitcoin intelligence, data, and analytics firm Glassnode found the Bitcoin hash rate hit a new all-time high over the weekend, ten days before the Bitcoin halving event.In other words, miners are putting more computational power into maintaining the Bitcoin network. Because miners must venture electricity and capital intensive computer processors to mine Bitcoin, the increase in hash rate is a bullish sign. It means miners are after the Bitcoin rewards they get from maintaining the network....

Read More »Bitcoin Accounts For 78% Of The Cryptocurrency Derivatives Market In Q1 2020, Study Finds

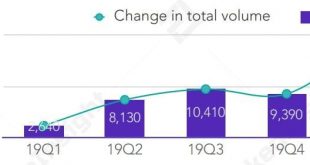

According to a new study, the total trading volume of cryptocurrency derivatives has increased dramatically by over 300%.At the same time, BitMEX’s leadership position in the field has been challenged by Huobi, OKEx, and Binance.Derivatives On The RiseAnd amid the most apprehensive days of uncertainty prompted by the eventual aftermath of the COVID-19, the cryptocurrency market went through a substantial losses. Most assets plunged by as much as 50% in mid-March.During these times of hyper...

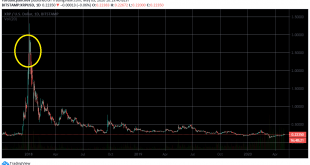

Read More »CNBC Puts Bitcoin In The Spotlight: The Last Time It Was A Bearish Signal For BTC

The recent Bitcoin price increases, and the upcoming halving have brought back media attention. CNBC recently explained the upcoming halving and made a bold prediction claiming that BTC could surge soon.CNBC Believes Bitcoin Will SurgeBitcoin made an appearance on CNBC’s Fast Money on Friday following the recent price surge. Crypto-friendly expert, Brian Kelly, outlined his views on the current situation and explained the halving:“As the whole world is quantitative easing (QE), Bitcoin is...

Read More »Research: While Bitcoin Price and Volume Fully Recovered, Open Interest Is Still Lower Than March 12 Levels

The latest price developments helped Bitcoin’s price to recover following the massive sell-offs in mid-March. However, while most features of the cryptocurrency market have reclaimed previous positions, a few are still showing weak charts.Bitcoin Price Recovered Since Black ThursdayThe year started quite positively for Bitcoin and the entire cryptocurrency market. Interest, trading volumes, and ultimately prices were soaring.BTC reached its yearly high in February at around $10,500. And when...

Read More »Tether Printer Goes Brrrr: 1.6 Billion USDT Minted In April As Bitcoin Recovers From March Loss

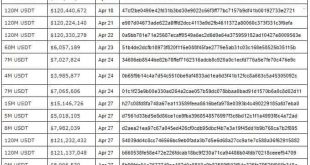

Tether, the issuer of the dollar-pegged stablecoin USDT, is in the limelight again as the company’s treasury minted fresh USDT worth more than a billion dollars in a single month.Tether Mints 1.6B USDT in April.From April 1, 2020, to April 30, accumulated records from Whale Alert, a platform that tracks large crypto transactions from and to exchanges, revealed that the Tether Treasury printed a total of 1.58 billion USDT worth just shy of $1.59 billion.Tether minted 480 million USDT tokens in...

Read More »Bitcoin Price Analysis: BTC Is Trading Sideways Since Yesterday, Huge Weekend Move Upcoming?

This past week was a blessing for the price of Bitcoin. The primary cryptocurrency was trading around $7500 just a week ago, while the highest of the past week reached over $9400.Only ten days left until the anticipated Bitcoin halving event, and so far, it seems like BTC fires its engines. As of writing these lines, the coin is safely maintaining the $8800 price zone.If we look at the macro level, since breaking out from the $7800 – $8000 region, a zone which was consisted of some...

Read More »10 Days To The Halving As Bitcoin Decouples And Recovers From March 12 Crash: The Crypto Weekly Market Update

Bitcoin’s halving is right around the corner. It will slash the block reward miners get from minting new bitcoins in half and potentially reduce the supply of the cryptocurrency on the market. Historically, this has been a major bullish catalyst for Bitcoin as its price has so far increased substantially after the two previous halvings.The last couple of days have been nothing but impressive for the leading cryptocurrency as it managed to touch $9,500 before retracing to where it currently...

Read More »Crypto Price Analysis & Overview May 1st: Bitcoin, Ethereum, Ripple, Stellar, and Chainlink

BitcoinBitcoin saw an impressive 17.5% price increase over the past 7-days of trading as the cryptocurrency managed to climb above the $7,500 resistance to break above $8,000. It continued to push higher and eventually reached a weekly high of $9,430 before dropping to the current resistance at $8,870 (1.272 Fib Extension).This price increase is not surprising because the Bitcoin block halving event is just a short 10-days away.If the buyers continue to push above the current $8,870 level,...

Read More »Decoupling: Bitcoin Price Loses Correlation – Surging While Global Markets and Gold Tumble

Bitcoin’s price increased substantially over the past few days, breaking a lot of important resistance levels on its way up. The cryptocurrency touched $9,500 but has since retraced to its current trading price at around $8,900.In any case, this staged it for a full recovery from the mid-March selloff while equity markets are yet to regain their strength.Bitcoin Decoupling From Equities And GoldThe past couple of days have been nothing but interesting for Bitcoin as its price marked yet...

Read More » Crypto EcoBlog

Crypto EcoBlog