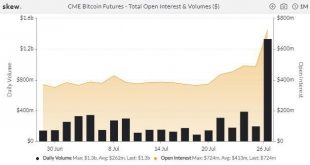

CME’s rise to prominence is often viewed as a sign of an institutional-led rally in the cryptocurrency market. The Chicago Mercantile Exchange (CME), a regulated financial marketplace is surging through the ranks of the largest Bitcoin (BTC) futures and perpetual futures exchanges by Open Interest, and it’s reminiscent of the early stages of the 2020-21 bull run. Bitcoin Futures Exchange: Open Interest and Rankings With a notional Open Interest (OI) of $3.54 billion, CME has now secured...

Read More »Treasury Yields Fall in Anticipation of Possible Interest Rate Hike

Data has shown that the US Treasury yields fell as the traders and investors expect the Fed to either increase or postpone a rate hike. US Treasury yields fell on Wednesday as the market anticipates the Federal Reserve’s decision on subsequent interest rate hikes. The 2-year Treasury yield fell to 4.656%, losing 4 basis points, while the10-year Treasury yield fell to 3.808% after losing 3 basis points. Traders generally expect the Fed to resume rate hikes by July, with a 63% chance that...

Read More »Der grösste Kursgewinn von Bitcoin in einem Tag..

Bitocin-Geschichte: Der höchste Kursgewinn von Bitcoin in einem Tag passierte am 17. Dezember 2017. Der grösste Kursgewinn von Bitcoin in einem Tag passierte am 17. Dezember 2017. An diesem Tag stieg der Preis von Bitcoin um 29.54 Prozent, von 13.000 US-Dollar auf 16’800 US-Dollar. Dies war ein bemerkenswerter Anstieg, da Bitcoin in den Monaten davor einen stetigen Anstieg verzeichnet hatte. Entscheidende Faktoren Dieser plötzliche Preisschub war...

Read More »CME Group Sees One Million BTC Micro Futures Contracts Traded

The Chicago Mercantile Exchange (CME) has hit a new peak. Just one month after launching its new bitcoin micro futures, the company has seen approximately one million of these contracts traded, suggesting that institutional investing in the bitcoin space has not died down since the currency began experiencing heavy losses from its mid-April high. The CME Has Struck a Top Chord CME put out the following message on Twitter: Today, we announced a new milestone for micro...

Read More »Binance Bitcoin Futures Markets Clock Highest 24h Volumes as Institutions Go Long

With bitcoin’s latest rally beyond the $13,000 mark, it seems like the next bull market is here. It can be seen from BTC markets that have been on fire for the last 7 days, including derivatives. The latest data shows that bitcoin futures markets on Binance have clocked the highest 24h BTC futures volumes amongst all platforms. This comes amid the exchange registering $760 million in open interest. Binance Experiences Explosive Bitcoin Futures Market Action Bitcoin rallied...

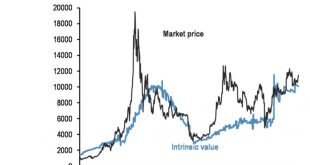

Read More »Bitcoin is Overpriced and Trades 13% Above its Intrinsic Value: JP Morgan

Financial strategists at JP Morgan have projected a bleak outlook for bitcoin prices in the short term. According to them, the cryptocurrency has a higher price and is trending at 13 percent over its ‘intrinsic value.’ They based their analysis on ‘positioning indicators’ derived from bets made by traders in the futures markets. But does the argument hold true? The Weather in Bitcoin Land Will Consist Of ‘Modest Headwinds’ According to the latest reports from mainstream media...

Read More »Crypto Derivatives September’s Recap: Binance Futures Leading As BitMEX Down 30%

Although the cryptocurrency spot and derivatives trading volume declined on most platforms in September, Binance has taken the lead as the largest derivatives exchange, a new report revealed.Simultaneously, the regulated Chicago Mercantile Exchange (CME) saw steady Bitcoin futures performance, while the options trading exploded.Binance Takes The Top Spot For Derivatives TradingThe data analytics company CryptoCompare explores the performance of the most popular digital asset exchanges on a...

Read More »Bitcoin Futures Hit New Highs as BTC Price Taps 11-Month Peak

The Intercontinental Exchange (ICE) backed Bakkt has just reported its largest single-day volumes for physically settled monthly Bitcoin futures contracts. On Monday, the figure hit a new record, trouncing the previous one. “Our Bakkt Bitcoin Futures reached a new record high of 11,509 contracts traded today – an increase of 85% from our last record-setting day,” – Bakkt tweeted. Physically-settled contracts are paid out in BTC as opposed to cash-settled ones that get delivered in USD....

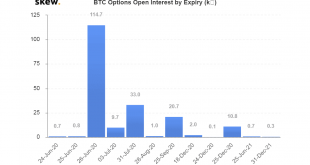

Read More »$1 Billion Bitcoin Options Expire On Friday: Upcoming Showtime For BTC Price?

The notional value of Bitcoin options contracts set to expire tomorrow has reached a new record by exceeding $1 billion. With such a massive amount, the question remains how and if it will impact the price of the primary cryptocurrency.BTC Option Contracts To The MoonAs CryptoPotato reported shortly after the mid-March panic sell-offs, Bitcoin options trading volume was declining, especially on regulated exchanges. However, the tide has turned since then, according to the cryptocurrency...

Read More »Crypto Derivatives Monthly Volume At New All-Time High: Binance Ahead of BitMEX

Cryptocurrency derivatives trading volume reached a new monthly all-time high in May 2020, surpassing the previous record recorded in March, recent research indicates. Volumes on regulated exchanges such as CME soared as well for both futures and options trading. Crypto Derivatives Monthly Volume ATH According to the report by CryptoCompare, the monthly trading volume of cryptocurrency derivatives surged by 30% in May. It hit a fresh all-time high of $602 billion, beating the previous record...

Read More » Crypto EcoBlog

Crypto EcoBlog