[unable to retrieve full-text content]CoinspeakerCoinShares Report: Digital Asset Investment Products Suffer $206M Outflows, Ethereum Dips Further Ethereum continued its trend of outflows, recording its sixth consecutive week with a $34 million outflow. CoinShares Report: Digital Asset Investment Products Suffer $206M Outflows, Ethereum Dips Further

Read More »ETFs Einfach Erklärt: Der Schlüssel zu Deiner Finanziellen Freiheit

ETFs, kurz für Exchange Traded Funds, sind eine Form von Investmentfonds, die an Börsen gehandelt werden und darauf abzielen, die Rendite eines bestimmten Indexes nachzubilden. Hier ist eine einfache Erklärung, wie ETFs funktionieren: Grundkonzept: Ein ETF ist ein Fonds, der in eine Sammlung von Wertpapieren investiert, wie z.B. Aktien oder Anleihen. Der Fonds wird dann in Anteile unterteilt, die von Anlegern über die Börse gekauft und verkauft...

Read More »Crypto Market Poised for Positive Second Quarter despite Recent Corrections, Coinbase Reports

[unable to retrieve full-text content]CoinspeakerCrypto Market Poised for Positive Second Quarter despite Recent Corrections, Coinbase Reports A recent research conducted by Coinbase said the market is poised for a positive second quarter despite the recent corrections that saw Bitcoin retrace to $65,000 on April 2, 2024. Crypto Market Poised for Positive Second Quarter despite Recent Corrections, Coinbase Reports

Read More »Digital Asset Investment Products Rebound with $862M Inflows, ETF Activity Slows Down

[unable to retrieve full-text content]CoinspeakerDigital Asset Investment Products Rebound with $862M Inflows, ETF Activity Slows Down While the Bitcoin investment products registered strong inflows, the Ethereum products registered their fourht consecutive week of outflows. Digital Asset Investment Products Rebound with $862M Inflows, ETF Activity Slows Down

Read More »South Korean Political Parties Vie for Crypto Investor Support Ahead of General Election

[unable to retrieve full-text content]CoinspeakerSouth Korean Political Parties Vie for Crypto Investor Support Ahead of General Election South Korea's upcoming election sees cryptocurrency's rising influence as parties propose contrasting policies, sparking debates over taxation and regulation. South Korean Political Parties Vie for Crypto Investor Support Ahead of General Election

Read More »Ethereum-Preis: Ethereum steigt kurzzeitig über 3’000 US-Dollar

Ethereum steigt kurzzeitig über 3.000 US-Dollar Knapp eine Woche nachdem BTC die Marke von 50.000 $ überschritten hat, ist ETH am Dienstag kurzzeitig auf über 3.000 $ gestiegen – ein Stand, der seit 2022 nicht mehr erreicht wurde. Genau wie bei BTC sind die treibenden Kräfte für den Preisanstieg von ETH grundsolide Fundamentaldaten: Es gibt eine stetig steigende Nachfrage sowohl von Privatanlegern als auch von institutionellen Investoren in...

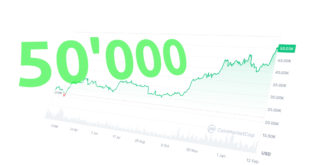

Read More »Bitcoin-Preis über 50’000

Bitcoin-Preis auf 50'000. Der Börsenwert aller Bitcoins liegt nun bei knapp einer Milliarde Dollar. Die wichtigste digitale Währung notiert auf dem höchsten Stand seit mehr als zwei Jahren. Eine entscheidende Rolle spielen dabei neu eingeführte, börsengehandelte Fonds. Ein guter Zeitpunkt, jetzt Bitcoin zu kaufen? Denn wenn es so weiter geht, knackt der Bitcoin-Preis bald die 100’000er Marke. Und dann ist alle Möglich. Warum steigt der...

Read More »US-Börsenaufsicht lässt Bitcoin-ETFs zu

Seit Jahren hat die Bitcoin Community darauf gewartet, dass die US-Börsenaufsicht den ersten Bitcoin-ETF genehmigt. Jetzt geben die Aufseher endlich grünes Licht. Die Entscheidung wird wahrscheinlich dazu führen, dass der Grayscale Bitcoin Trust, der etwa 29 Milliarden Dollar der Kryptowährung hält, in einen börsengehandelten Fonds umgewandelt wird, und dass konkurrierende Fonds von Mainstream-Emittenten wie iShares von BlackRock und Fidelity...

Read More »Top 10 Major Crypto Headlines in 2023 by Coinspeaker: Year of Triumphs, Scandals, and Transformations

It was a controversial year for the crypto indutrsy. Let’s have a closer look at the major crypto-related events that too place in 2023. The year 2023 has been a rollercoaster ride for the cryptocurrency ecosystem, defined by important events that have impacted the industry’s direction. From stablecoin woes to regulatory disputes, institutional acceptance, and the advent of meme coins, the crypto sector has seen a wide range of stories. Here are the top 10 major crypto headlines that have...

Read More »Hong Kong Ready to Accept Proposals for Crypto Spot ETFs

Regarding custody arrangements, the SFC emphasizes that the fund’s trustee or custodian can delegate its crypto custody function solely to an SFC-licensed VATP or entities meeting the crypto custody standards set forth by the HKMA. Hong Kong has announced its readiness to receive applications from traditional financial companies interested in exploring the emerging economy by creating exchange-traded funds (ETFs) tracking spot-based cryptocurrencies. The country already allows...

Read More » Crypto EcoBlog

Crypto EcoBlog