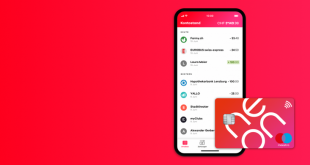

Smartphone-Bankinglösung neon erhält 5 Mio CHF in Round A-Finanzierung für weiteren Produktausbau Neon, die Zürcher Antwort auf Revolut und Transferweise hat erfolgreich die nächste Finanzierungsrunde in Höhe von 5 Mio. CHF abgeschlossen. Nach dem aufmerksamkeitsstarken Markteintritt finanziert das Start-Up den weiteren Produktausbau. Neben Lead-Investor Tamedia haben auch die Zürcher Backbone Ventures und verschiedene Altinvestoren in...

Read More »London Outpaces New York in Fintech Sector, San Francisco Still Ahead of Both of Them

It seems that London has overtaken New York in the raising of finance for the global fintech sector or so it seems. According to CNBC, in terms of fundraising deals, the capital of the United Kingdom so far has raised about 114 deals worth about $2.1 Billion while the money City of the United States raised about $1.9 Billion figures show. The startup and venture capital hub San Francisco outpaced both cities with $3 Billion while Brussel in Belgium came a distant fourth with $881 Million and...

Read More »Ping An’s OneConnect Plans for Mid-November IPO in the U.S. Market

Recently, people familiar with the matter, shared information that OneConnect, which is the fintech and blockchain unit of the Chinese insurance giant Ping An, is planning to debut in New York with an IPO. The company plans to launch the IPO in mid-November this year. Also, Japan’s SoftBank Corp. is one of the largest investors in the company.Previously, the company had marked the listing venue in Hong Kong. However, a few months ago, it changed it to New York in order to achieve a more...

Read More »Transferwise schreibt überrasschenderweise Gewinn (Blogartikel enthält einen Gutschein! ????)

Meldungen über von Gewinne sprechenden Startups sind selten. Noch seltener ist die Veröffentlichung dieser Gewinne. Und gerade der Bereich Bitcoin und Fintech ist umkämpft. Es werden Millionen in Startups gepummpt, der Markt ist hart. Zudem können die Fintechs mit den Anforderungen der Politiker, Regulierenden und den Herausforderungen im Kundensupport und IT Security kaum mithalten. In der Regel schreiben Fintechs daher Verluste. Anders ist dies beim mittlerweile britischen...

Read More »Deutsche Bank Investment Lifts Fintech Startup Deposit Solutions to €1B Valuation

Open banking fintech company Deposit Solutions received its latest financing round of just over €40m involving Deutsche Bank. Part-owner and German Venture Capital firm Finlab revealed this in a statement on Wednesday. As part of the financing round, the shares of the Fintech startup were revalued according to the International Financial Reporting Standards (IFRS) and the company is now said to be worth about €1 Billion.Last year, the startup also received a financing round of €100 million...

Read More »TransferWise Posts Continuous Profit for Third Consecutive Year

U.K based fund transfer service, TrasnferWise Ltd, has announced that in its last fiscal year, the company’s revenues recorded growth by more than 50%. TransferWise which is fully backed by Sir Richard Branson as well as Peter Thiel’s Valar Ventures, had its fiscal year-end on the 19th of March, which confirms the company’s three-year consecutive profit streak.TransferWise successfully pulled in 179 million pounds (about $223 million) in revenue which is an increase of more than half of the...

Read More »Fintech Startups Will Eat a Massive $280 Billion Banking Revenues by 2025

Fintech startups across the globe are making massive inroads in the global payments industry. As per the Accenture report titled Banking Pulse Survey: Two Ways To Win, non-banking financial startups will eat 15% share in global payments revenue by 2025. As per the estimates and the growth projections, this share translates to a massive $280 billion.As per the report, the global payments revenue is expected to grow at an annual rate of 5.5%. In 2019 itself, the global payments market is...

Read More »Fintech Northmill Gets Banking License: Should Revolut, N26, and Others Be Worried?

Northmill is a Sweden-based fintech company, which, up until now, has been offering cloud-based financial services under the slogan “building the bank of tomorrow.” Since 2017 the company has been working closely with the SFSA to become a fully regulated bank. While some might think that such a rival newcomer can’t do a thing to industry giants like Revolut and N26, Northmill currently offers a consumer-focused product that could lure in potential clients from its competitors.The company...

Read More »Square Testing a New Free Stock-Trading Service

Internet entrepreneur who is also the co-founder and CEO of Twitter, and the founder and CEO of Square, a mobile payments company Jack Dorsey decided to have his company’s Square Inc. trade Bitcoin on their popular Cash App. Soon, they could include the possibility to buy and sell stocks as well.According to the company, they are now testing out their Cash App feature which point is to license users to make their free stock trades. And while the exact date of its launch is still not have been...

Read More » Crypto EcoBlog

Crypto EcoBlog