Checking if the site connection is secure Enable JavaScript and cookies to continue www.coinspeaker.com needs to review the security of your connection before proceeding.

Read More »GBTC Reaches All-Time Low Discount of -35%

Shares of the Grayscale Bitcoin Trust (GBTC) have never been cheaper relative to the value of the company’s underlying Bitcoin holdings. The GBTC discount has gone below 35% again for the first time since June. While the company’s holdings per share are worth $17.27, the market value of each share is only $11.18. Figures for calculating the discount are publicly available on Grayscale’s website. As is displayed, GBTC share prices were down 4.77% on Monday, versus a mere...

Read More »Grayscale May Reward Shareholders With ETHPoW Cash Disbursal

Grayscale – one of the world’s largest cryptocurrency asset managers – may be readying a cash-airdrop for holders of its Ethereum Trust and Digital Large Cap Fund. The cash grant represents the value of ETHPoW (ETHW) tokens that Grayscale investors are entitled to following the network fork, according to a company filing with the SEC on Friday. Free Money for Grayscale Investors? The filing declared Grayscale’s right to distribute the cash equivalent of ETHW tokens to its...

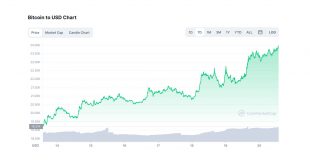

Read More »Bitcoin-Preis steigt innert 7 Tage um 24.72 Prozent. Kommt jetzt die Trendwende?

Bitcoin-Preis seit sieben Tagen im Plus: Ist dies die lang ersehnte Trendwende? Schaut man sich den Bitcoin-Preis Chart auf Coinmarketcap an, so sieht man sofort, dass der Bitcoin-Preis seit genau sieben Tagen steigt und steigt. Der Bitcoin-Preis liegt mittlerweile mit gut 24 Prozent im Plus. Kommt jetzt die Wende? Die ganz grosse Frage lautet nun also, ist das endlich die Trendwende? Geht es endlich wieder einmal etwas nachhaltiger nach oben? Ein...

Read More »Grayscale Holds Private Meeting With SEC Discussing Bitcoin Spot ETF Transition

Grayscale – the world’s largest Bitcoin fund – reportedly met with the Securities and Exchange Commission (SEC) in private last week. The company argued that the commission should approve its transition into a Bitcoin Spot ETF to unlock over $8 billion in value for its investors. Why Convert Grayscale? In a presentation shared with CNBC, Grayscale claimed that a Bitcoin spot ETF would be “no riskier than a Bitcoin futures ETF”. The company believes that both spot and futures...

Read More »Grayscale Comapres Ethereum to New York City

Given the total addressable market for digital on-chain transactions is far bigger than the current DeFi market size, worth around $200B, Grayscale said DeFi protocols powered by smart contracts are still being undervalued. The current capital markets alone are 500x more than the DeFi market, Grayscale outlined. In addition, NFT-associated transactions and Metaverse-related applications could critically drive up the value of base chains. American Cities Analogous to...

Read More »Grayscale Launches Smart Contract Platform Fund

Grayscale – a popular cryptocurrency asset manager – has now launched the Grayscale Smart Contract Platform Ex-Ethereum Fund. The fund includes exposure to a variety of cryptocurrencies that power major smart contract networks besides Ethereum. Investing in Smart Contracts As announced by Grayscale in a press release on Tuesday, the fund marks the firm’s 18th investment product, and third diversified fund offering. It adjusts its exposure to various cryptocurrencies using...

Read More »Grayscale Investors Urge SEC To Allow GBTC Transition To Bitcoin Spot ETF

Grayscale – the world’s largest Bitcoin fund – has long had its attempts to become a spot-based Bitcoin ETF denied by the Securities and Exchange Commission (SEC). Investors are now speaking out against this, and have sent roughly 200 letters to the commission in support of the fund’s transition. Grayscale Investors Speak Out As reported by Bloomberg, the SEC received over 170 letters from Grayscale investors in February alone. This followed a public solicitation from the...

Read More »Grayscale and Bloomberg Launch First Equity ETF

The world’s largest digital asset manager, Grayscale Investments, announced today the launch of its first ETF. Dubbed Grayscale Future of Finance ETF, it will be the first equity ETF to track the performance of the Bloomberg Grayscale Future of Finance Index. The statement dated February 2nd informed that the new product’s ticker will be GFOF. It will aim to build “upon the thesis that the digital economy will boost global commerce, drive market efficiencies, and provide...

Read More »Grayscale Bitcoin Trust (GBTC) Premium Plummets 30% to All-time Low Amid Market Sell-off

As the crypto market continues to bleed over the past days, the Grayscale Bitcoin Trust (GBTC) shares have widened their discount in relation to the underlying crypto held in the fund. GBTC Premium at New Lows According to recent data from Coinglass, the trust’s negative premium hit a new all-time low (ATL) as bitcoin struggles around the $35,000 mark. The GBTC has been trading on a steady decline since February last year, with the premium now sitting at 30%. The Grayscale...

Read More » Crypto EcoBlog

Crypto EcoBlog