Bitcoin’s price is eyeing a fast return to ,000.The largest digital currency is still on track for its worst month of 2019.Bitcoin Fear & Greed Index shows investor sentiment has recovered slightly from last week’s FUD-induced selloff.Bitcoin’s price made another move higher on Friday following one of the biggest percentage gains of the month, signaling that the worst of the recent downtrend had subsided. The largest cryptocurrency is eyeing a fast return north of ,000 – a move that would negate bearish calls for an extended crypto winter.BTC/USD Eyes ,000Bitcoin’s trading range continued to narrow on Friday following a roller coaster start to the week. The price rose by as much as 5.8% on Bitstamp to reach ,870.35. It was last spotted hovering around ,740 for a gain of

Topics:

Sam Bourgi considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Bitcoin’s price is eyeing a fast return to $8,000.

- The largest digital currency is still on track for its worst month of 2019.

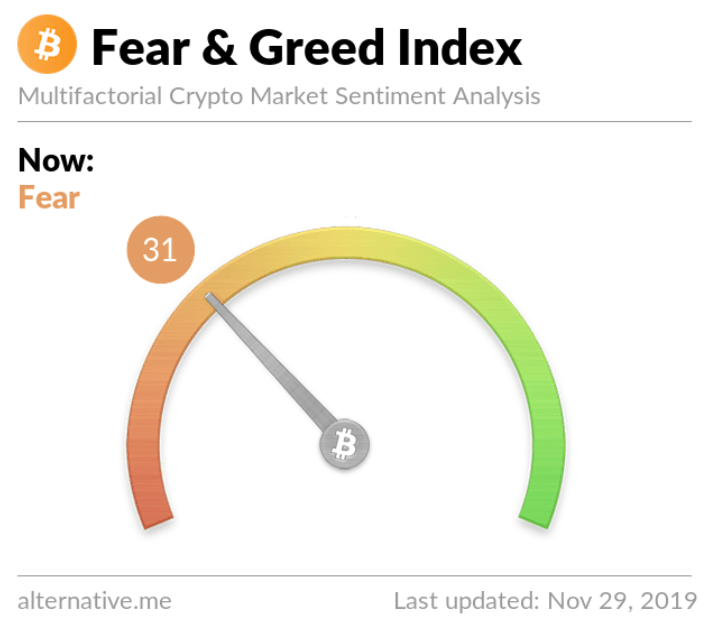

- Bitcoin Fear & Greed Index shows investor sentiment has recovered slightly from last week’s FUD-induced selloff.

Bitcoin’s price made another move higher on Friday following one of the biggest percentage gains of the month, signaling that the worst of the recent downtrend had subsided.

The largest cryptocurrency is eyeing a fast return north of $8,000 – a move that would negate bearish calls for an extended crypto winter.

BTC/USD Eyes $8,000

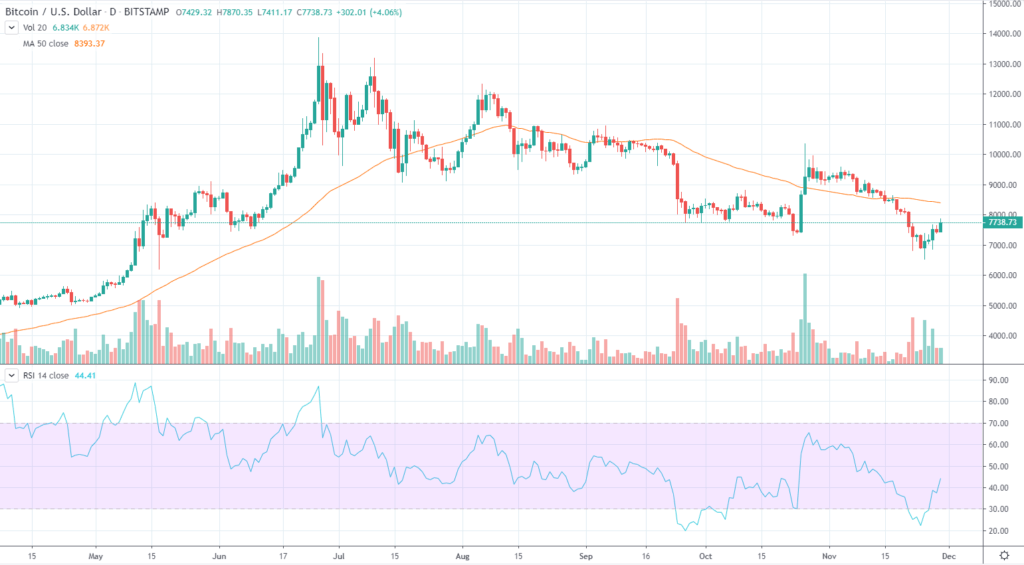

Bitcoin’s trading range continued to narrow on Friday following a roller coaster start to the week. The price rose by as much as 5.8% on Bitstamp to reach $7,870.35. It was last spotted hovering around $7,740 for a gain of 4%.

The largest cryptocurrency rebounded more than 11% on Wednesday after breaching new six-month lows. Even with the latest recovery, bitcoin is still on track for its biggest monthly drop of the year.

At current values, bitcoin has a total market capitalization of $140.3 billion. representing a 66.7% share of the overall crypto market.

Overall, market sentiment remains weak as the price continues to trade well below the 50-day moving average. The bitcoin Fear & Greed Index is currently at 31, which denotes ‘fear.’ The index plunged to the low 20s last year as fear, uncertainty and doubt (FUD) swept the markets.

New Buying Trend Emerges

With just two days left of November, bitcoin is on track for its worst monthly drop of 2019. After opening November at a price point of around $9,600, the dominant cryptocurrency has retraced some 19%. Despite the brutal bear trend, new technical indicators suggest that the worst of the selloff may have passed.

The GTI Vera Convergence Divergence Indicator – a technical tool that measures changes in trend – has entered a new buying phase, according to Bloomberg. That means bitcoin has a short-term price target of around $8,000. Whether it holds that level is another story.

In an interview with Bloomberg, Oanda analyst Craig Erlam tempered expectations that a bearish to bullish trend had emerged. He attributed the latest recovery to “some profit taking on short positions,” adding “there’s nothing in the bounce that suggests a shift to me.”

Nevertheless, bitcoin has recovered 14% from its recent trough despite ongoing attacks from mainstream media and China’s renewed efforts to clamp down on digital currency trading. Current price points should still be attractive for long-term holders who believe that bitcoin’s stock-to-flow ratio will underpin its value in the future.

This article was edited by Josiah Wilmoth.