Trading cryptocurrency has become increasingly popular ever since Bitcoin skyrocketed to ,000 in 2017. However, what followed was a prolonged bear market, and the demand for trading services that allow users to capitalize on the declining price grew in demand.This lead to a surge in popularity of cryptocurrency derivative products, especially futures contracts which allow traders to open both long and short positions. As such, we saw an increasing number of exchanges adding these products to their toolkits. One such venue is Delta Exchange – a cryptocurrency exchange that offers futures trading with up to 100x leverage.Delta Security 9.0 Coin Variety 9.0 Liquidity 7.0 ProsSimplified and intuitive trading interfaceVariety of different cryptocurrencies and trading pairsBoth traditional

Topics:

George Georgiev considers the following as important: Investors, Margin Trading Exchange

This could be interesting, too:

George Georgiev writes Phemex Beginner’s Guide & Exchange Review (Updated 2021)

George Georgiev writes Bityard Beginner’s Guide & Exchange Review

Nick Marinoff writes Many More Bitcoin Investors Are Entering the Fray, Analysts Claim

George Georgiev writes PrimeBit Exchange Trading Guide & Tutorial: Everything You Need To Know

Trading cryptocurrency has become increasingly popular ever since Bitcoin skyrocketed to $20,000 in 2017. However, what followed was a prolonged bear market, and the demand for trading services that allow users to capitalize on the declining price grew in demand.

This lead to a surge in popularity of cryptocurrency derivative products, especially futures contracts which allow traders to open both long and short positions. As such, we saw an increasing number of exchanges adding these products to their toolkits. One such venue is Delta Exchange – a cryptocurrency exchange that offers futures trading with up to 100x leverage.

Delta Exchange Futures

Delta Exchange offers trading in cryptocurrency futures and perpetual contracts. For those who aren’t familiar with these products, cryptocurrency futures represent a legal agreement between two parties to buy or sell an asset at a predetermined price at a specified time in the future.

These contracts allow traders to speculate on whether the price of a cryptocurrency is going to go up or down and open a position accordingly. Futures contracts have a fixed maturity date. Perpetual contracts, on the other hand, do not have an expiry date.

Delta Exchange also allows trading with leverage. In other words, you can open a trade larger than your current holdings by using borrowed funds. However, keep in mind that even though this could increase your profits, it can also put your capital at risk. Margin trading should be carried out by traders with sufficient experience in the field.

What Trading Pairs Does Delta Exchange Support?

First things first, Delta Exchange is a derivatives exchange. This means that you can trade futures contracts on cryptocurrencies, but not the coins themselves

Users can trade futures on Bitcoin and 13 altcoins, including ETH, XRP, XLM, BNB, LEO, LTC, XTZ, ATOM, BCH, BSV, NEO, XMR, and BAT. Several of these altcoins are exclusive to Delta. This means that for traders looking to long or short these alts with leverage, Delta is the only destination.

In terms of leverage, traders can take advantage of the maximum allowed leverage of up to 100x for BTC and ETH, up to 50x for XRP, and up to 20x for the remaining altcoins.

The exciting thing about futures is that you do not need to own the crypto-assets you upon which you are speculating. The currency in which you are required to keep the margin, and in which the profit or loss of a trade is denominated, is known as the settlement currency. Delta Exchange has two settlement currencies:

- BTC: You need to have bitcoin in your Delta Exchange wallet to trade futures that are settled in BTC. The profit or loss of these contracts is denominated in BTC.

- USDC: USDC is a stablecoin whose value is pegged to the US dollar. The margin and profit or loss of USDC settled contracts is denominated in USDC. You cannot directly bring USDC to your Delta wallet. Instead, Delta gives you the flexibility of converting your BTC to USDC through their currency converter.

Getting Started: How to Register an Account

Before you can begin trading contracts, you first have to set up an account on Delta Exchange. The process is relatively simple and it doesn’t require you to submit any personal information. However, large deposits or withdrawals will attract KYC requirements.

On the homepage, there is a central blue button that reads, “Start Trading.” Clicking on it opens another page with the trading desk, and on the top right corner, there is a “Register” button. Clicking on it will pull up the following screen:

The required information for getting an account opened include first and last name, country of residence, email, and a password. Once completed, a confirmation letter will be sent to the email address associated with the new account. After clicking on the confirmation link in the email, you will be ready to start trading.

Deposit Funds

Before you can do that, however, you will need to deposit some funds. In the right corner of the screen is a drop-down menu. From that menu, click on “My Account.” Then, on the left side, you will see the different options, including Deposits and Withdrawals.

Delta Exchange allows you to deposit only Bitcoin. Similarly, you can withdraw only Bitcoin. Traders who wish to long or short USDC settled contracts need to convert their BTC to USDC. Delta Exchange provides a ‘Currency Converter’ for this. Once you have BTC and/or USDC in your Delta wallet, you can start trading.

Trading On Delta: Short and Long

There are several different order types that the exchange supports – Limit, Market, Stop Market, Stop Limit, Trailing Stop, and Bracket Orders.

Limit Order

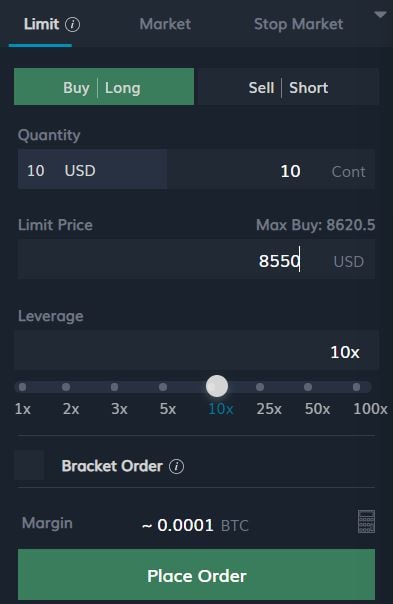

This is the type of order that traders open when they want to enter the market at a price that is different than the current one.

At the time of this writing, Bitcoin is trading at around $8,407. However, the $8,500 level is an important one to watch, and if the price goes above it, it might surge past that. Hence, if you want to capitalize on the movement, you might want to put a limit order to buy at $8,550, for example.

We’ve set an order for 10 Contracts that are priced $1 each, and we’ve used the leverage of 10x. So, in this case, when the price reaches $8,550, we would have a long position that’s worth $100.

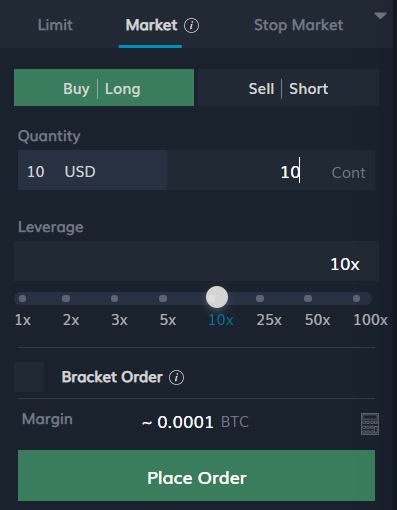

Market Order

Market Order

This is a very common order and one that is simple to use. Traders place it when they want to buy immediately at market price. Again, we want to open an order for ten contracts with leverage of 10x, which will give us a position of $100 bought at market price.

Stop Market and Stop Limit Orders

Once you have your position ready, you might want to put stops to optimize your profit or to minimize your risk. This is done with Stop orders. The stop market order is used to put a particular price point when you want your order to be executed.

For example, if you enter at $8,400 and want to exit at $9,000, you just put a stop market order for the same amount of contracts to be executed at $9,000.

If you want to see where the action will head, however, you might want to use a Stop Limit order. Here, your order won’t be active until it reaches a specific Stop price. This is when it will be put in the order books, and it will be executed when it has reached the limit price.

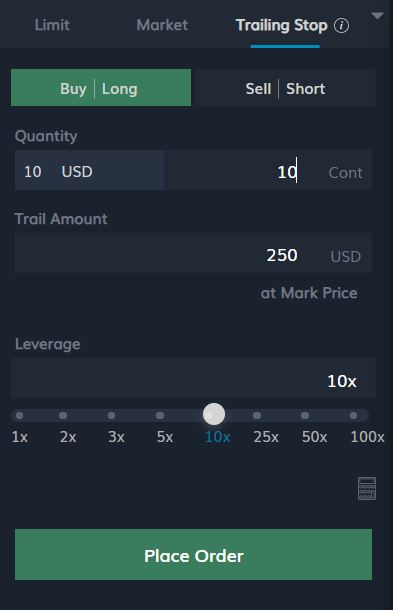

Setting a Trailing Stop

A trailing stop order is used when you don’t want to input a specific price but rather the range that you think Bitcoin will travel.

In the photo below, you can see a trailing stop order set for ten contracts with 10x leverage and a $250 trail amount. In other words, if you think that Bitcoin will increase by $250, you can open a long position. If you think it will decrease by $250, you can open a short position.

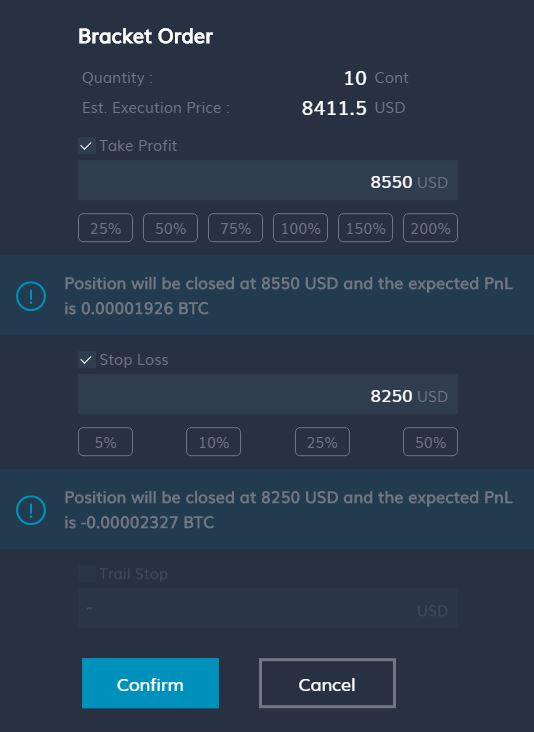

Bracket Orders

Delta also has bracket orders. Using bracket orders, you can specify your take profit and stop loss levels at the time of order placement.

These bracket orders have the OCO (one-cancels-the-other) feature. This means that when one of the take-profit or stop-loss order is activated, the other one is canceled.

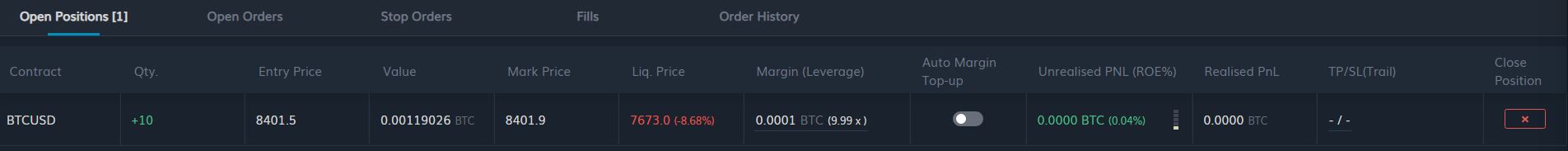

Closing a Position

Once you have opened a position, you will see it displayed right below the chart on the main dashboard.

This is where traders can monitor everything related to their positions, including entry price, value, market price, liquidation price, margin, realized and unrealized profit and loss, and so forth.

This is also where you can instantly close your positions by clicking on the X button on the far right side. This closes your position at the current market price, and you get out of it immediately.

Alternatively, you can close your positions by using the above stop limit, stop market, and trailing stop orders.

Trading Fees on Delta Exchange

Delta Exchange has two types of fees based on whether you open a traditional or a perpetual contract.

Two terms should be accounted for here:

Market Takers: These are traders who agree with the current price on the order book and want to get their orders filled in immediately. Takers consume the existing liquidity in the book and are required to pay for it.

Market Makers: These are traders who place orders at prices that are different than the current market price. Since their orders are not immediately executed and sit in the order book, they effectively add to the liquidity in the order book. For this reason, makers get a rebate.

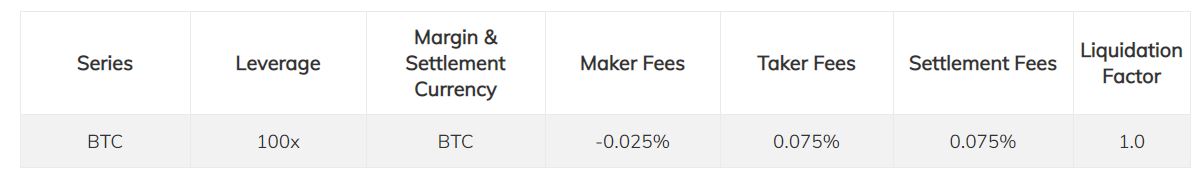

With this in mind, the fees are as follows, depending on whether you open a traditional futures contract or a perpetual one.

Traditional Contracts:

Perpetual Contracts:

As noted, the Maker fees are negative, meaning that users receive a rebate for placing trades of the kind.

Security: Is Delta Exchange Safe?

In terms of security, it’s important to note that Delta Exchange claims to use enterprise-grade solutions and that it stores the cryptocurrency in multi-sig wallets, which require numerous signatures to allow a transaction.

Similar to other margin exchanges, Delta Exchange also processes withdrawals only once a day, and they go through a manual review, according to the website.

Conclusion

Delta Exchange looks like a reliable platform suited for those looking to engage in Bitcoin and cryptocurrency futures trading. It offers relatively high leverage and a variety of different altcoins to work with. It is also interesting to see a platform with negative market makers fees, which could certainly save a lot of money.