Data from popular cryptocurrency monitoring firm reveals that institutional investors had a record-breaking number of leveraged short positions in Bitcoin futures contracts on the Chicago Mercantile Exchange (CME).While this might imply a lot of things, it appears that smart money is leaning toward bearish developments in the market. Of course, there’s always the possibility of a short squeeze.Institutional Bitcoin Shorts on the RiseBitcoin’s price lost about ,200 in the last seven days. Data from the popular cryptocurrency monitoring company Skew revealed that during the week ending on August 18th, institutional investors opened a record number of short contracts on the Chicago Mercantile Exchange (CME).Leveraged funds and net open interest on Bitcoin Futures at CME. Source: SkewTo be

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

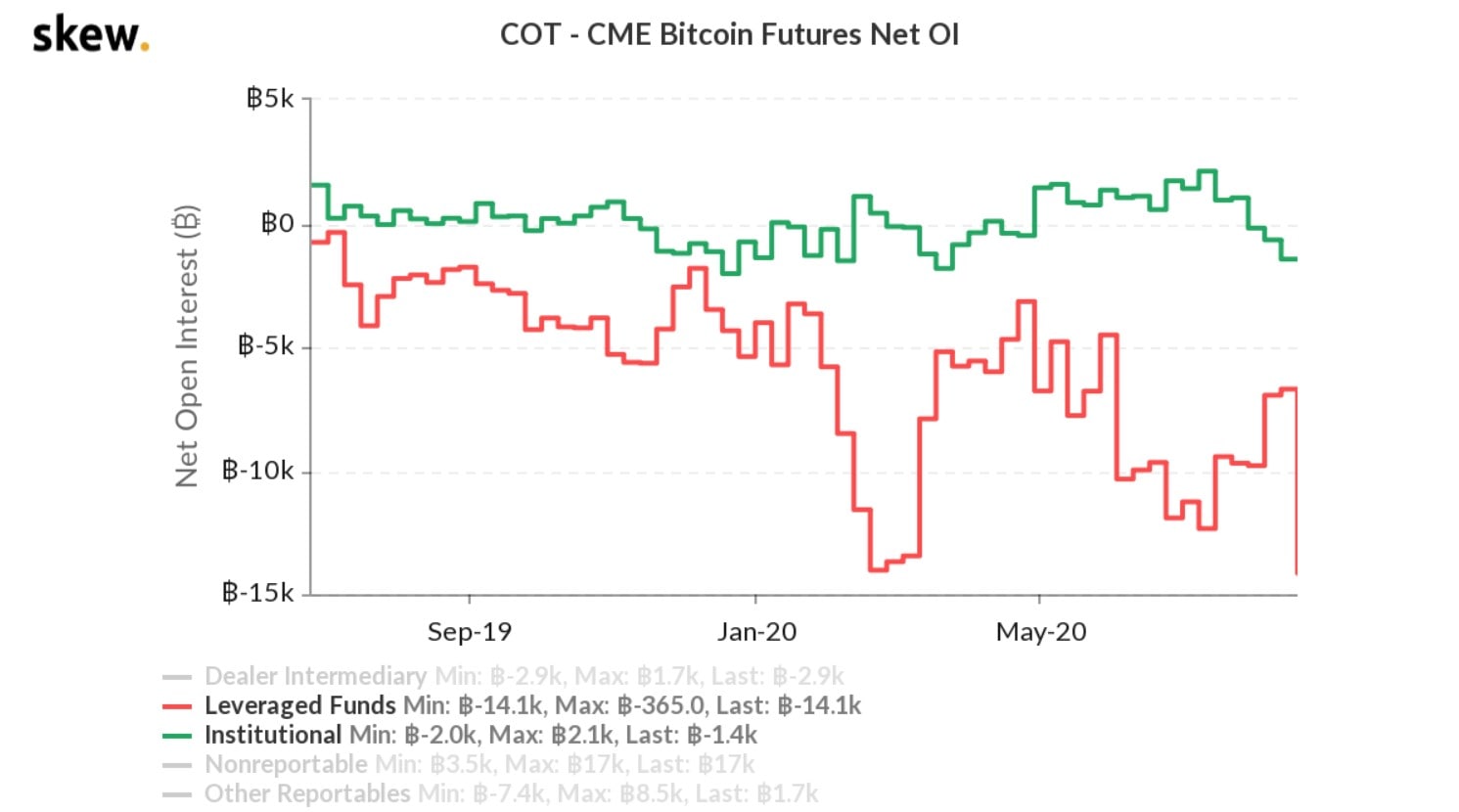

Data from popular cryptocurrency monitoring firm reveals that institutional investors had a record-breaking number of leveraged short positions in Bitcoin futures contracts on the Chicago Mercantile Exchange (CME).

While this might imply a lot of things, it appears that smart money is leaning toward bearish developments in the market. Of course, there’s always the possibility of a short squeeze.

Institutional Bitcoin Shorts on the Rise

Bitcoin’s price lost about $1,200 in the last seven days. Data from the popular cryptocurrency monitoring company Skew revealed that during the week ending on August 18th, institutional investors opened a record number of short contracts on the Chicago Mercantile Exchange (CME).

To be precise, institutional investors held 1,400 short contracts last week.

The company said that it might be a function of attractive cash and carry levels. This is a strategy used by arbitrage traders who seek to capitalize on the difference between the pricing of a derivative product and the underlying asset.

A Possible Short Squeeze?

It’s worth noting that a short squeeze might also be in the cards.

This is a scenario when the number of shorts is comparatively higher than the number of long positions. In this case, the market is usually primed for the so-called short squeeze.

This is an event where the price of an asset jumps high in a sharp manner, forcing traders who had bet that its price would decline, to buy it at a higher price to forestall greater losses. In turn, this particular scramble to buy adds more upwards pressure on the stock’s price and pushes it even higher. They are characterized by vicious green candles.

However, the events of this week might not be favorable for a scenario of the kind. Bitcoin’s price has lost about $750 since August 18th, putting all those short positions well into profit.

As CryptoPotato reported earlier today, the next critical level to keep in mind is the previous 2020 high that got breached last month – $10,500.