Buying shares of Grayscale’s Ethereum Trust would require investors to pay a premium upwards of 750% compared to ETH’s current market price.ETH Sold For More Than 00 On GrayscaleGrayscale is a company that provides institutional investors with exposure to the price of cryptocurrencies such as Bitcoin and Ethereum through their trust products.The company’s Ethereum Trust is currently selling shares of ETH, where one share represents 0.09395466 ETH. In other words, for one to own a full ETH, they’d have to purchase slightly more than 11 shares.However, according to the company’s official website, the market price per share at the closing market time on June 12th, 2020, was 5.50, where the worth of ETH Holdings per share was just .Source: GrayscalePut simply, an investor would have

Topics:

George Georgiev considers the following as important: AA News, ETHBTC, Ethereum (ETH) Price, ethusd, Grayscale

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Buying shares of Grayscale’s Ethereum Trust would require investors to pay a premium upwards of 750% compared to ETH’s current market price.

ETH Sold For More Than $2000 On Grayscale

Grayscale is a company that provides institutional investors with exposure to the price of cryptocurrencies such as Bitcoin and Ethereum through their trust products.

The company’s Ethereum Trust is currently selling shares of ETH, where one share represents 0.09395466 ETH. In other words, for one to own a full ETH, they’d have to purchase slightly more than 11 shares.

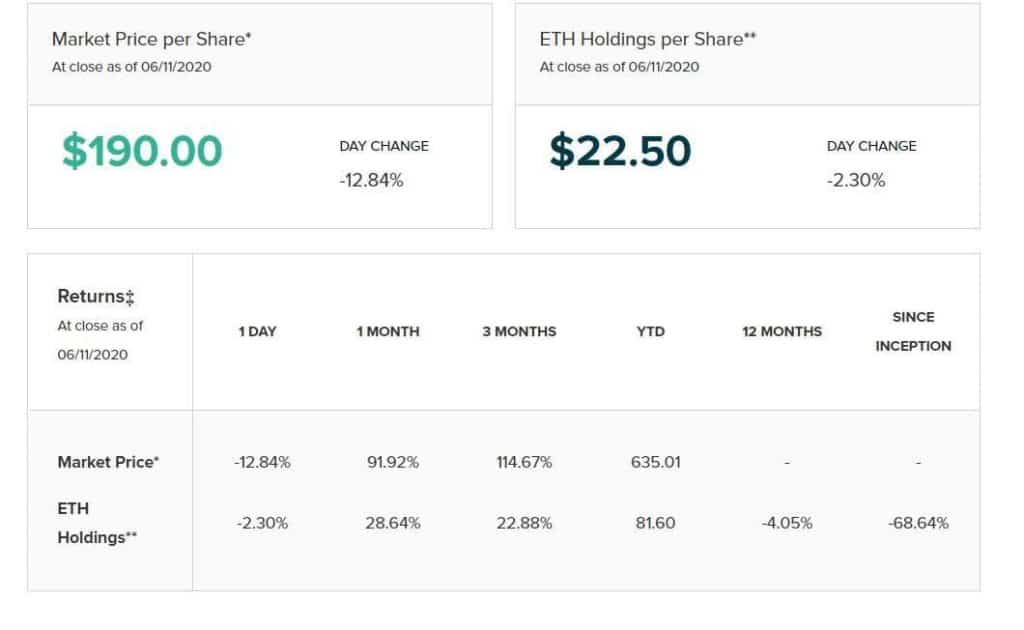

However, according to the company’s official website, the market price per share at the closing market time on June 12th, 2020, was $195.50, where the worth of ETH Holdings per share was just $22.

Put simply, an investor would have to pay more than $2,000 to own a full ETH through Grayscale’s Ethereum Trust. This represents a premium of more than 750% compared to ETH’s current market price.

Premium on Grayscale Bitcoin Trust

Grayscale investors are also happily paying a premium on their Bitcoin products as well. The current market price per share is $10.88, whereas the BTC holdings per share equal $9.01. This means that investors are paying more than 20% on top of Bitcoin’s price on the market.

Now, the upside of owning shares of Grayscale’s products is that investors don’t have to worry about storage, clearance, and custody of their assets. This is perhaps the reason for which larger investors are happily paying a 20% premium on BTC.

However, the premium on ETH is astronomically higher, and there doesn’t seem to be a reasonable explanation as to why large investors would pay more than $2,000 for ETH that they can buy for roughly ten times lower.

As CryptoPotato reported recently, Grayscale has been buying about 150% of the newly minted bitcoins after the third halving took place. It has increased its holdings by more than 60,000 BTC in the past few months.