Bitcoin price has managed to avoid all 3 unfilled CME gaps this week and go on to break the ,235 level for the first time since July 10, 2019 – 469 days ago. The catalyst for the 11% surge was the breaking news from PayPal yesterday that the payments giant will soon facilitate BTC and other crypto-asset payments. According to data from Datamish, the Paypal rally caused a .8M short squeeze on BitMEX as an eye-popping billion returned to the crypto market during yesterday’s frenzy. This will have undoubtedly helped catapult prices beyond the milestone K and K levels as short traders buy back into BTC to cover losses. Price Levels to Watch in the Short-Term On the weekly BTC/USD chart, we can see that prices fell just shy of the 0.618 Fibonacci resistance at

Topics:

Ollie Leech considers the following as important: Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

Bitcoin price has managed to avoid all 3 unfilled CME gaps this week and go on to break the $13,235 level for the first time since July 10, 2019 – 469 days ago.

The catalyst for the 11% surge was the breaking news from PayPal yesterday that the payments giant will soon facilitate BTC and other crypto-asset payments.

According to data from Datamish, the Paypal rally caused a $70.8M short squeeze on BitMEX as an eye-popping $31 billion returned to the crypto market during yesterday’s frenzy. This will have undoubtedly helped catapult prices beyond the milestone $12K and $13K levels as short traders buy back into BTC to cover losses.

Price Levels to Watch in the Short-Term

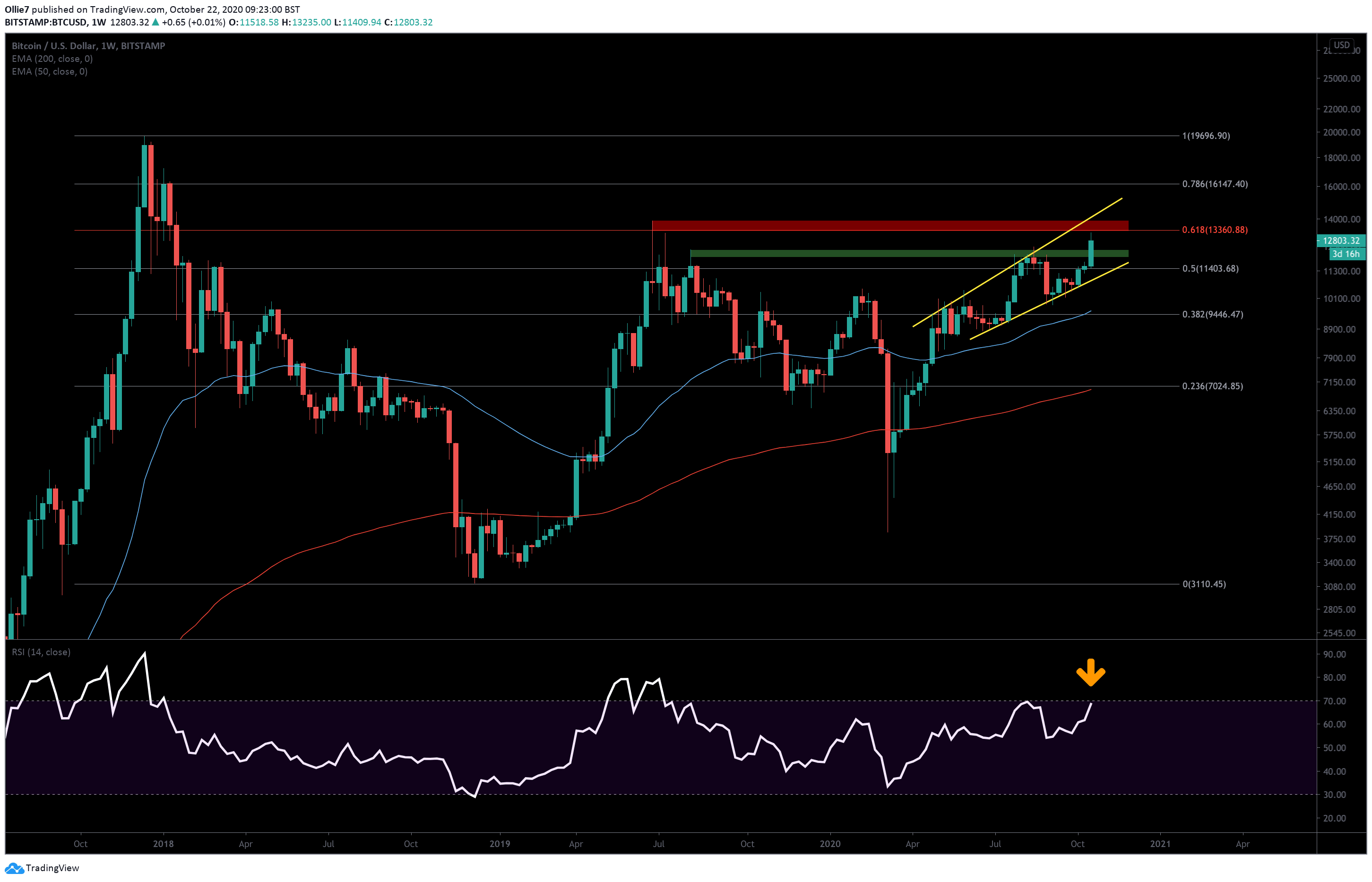

On the weekly BTC/USD chart, we can see that prices fell just shy of the 0.618 Fibonacci resistance at $13,360. Between this price point and the $13,890 level above, we have a major resistance zone (red shaded area) that has not been closed above since January 15, 2018 – during the huge crash from Bitcoin’s all-time high of $20,000.

This will be a massive psychological barrier for bullish traders to overcome, and will need considerable momentum to break it successfully.

Just above this area, we also have the upper resistance line of a broadening wedge pattern that bitcoin price has been tracking inside of since April 27, 2020, on the weekly chart (yellow lines). This currently sits around the $14,000 level. It’s possible that we could see a reaction at this trend line if prices managed to break through the aforementioned red zone.

From there, the most obvious daily resistances above this are the $14,600, $15,400, and $15,800 levels, before we get to the 0.786 Fibonacci level at $16,150.

Looking at potential supports, we have a key S/R zone (green shaded area) between $11,950 and $12,300, which should create some buying pressure to push back against a bearish decline.

Underneath that, we have the 0.5 Fibonacci level at $11,400, the daily 50 EMA (blue) at approx $11,170, and the support line of the broadening wedge pattern at around the $10,900 area.

With Bitcoin now dangerously close to breaking into the overbought region on the weekly RSI for the first time since July 2019, it’s possible that we could see a sharp decline as trading bots are triggered by the indicator before a new leg of the uptrend begins.

Total market capital: $395 billion

Bitcoin market capital: $ 237 billion

Bitcoin dominance: 60.1%

*Data by Coingecko.

Bitstamp BTC/USD Weekly Chart