Bitcoin was riding high around ,900 before dumping below ,500 following the controversial BitMEX news from yesterday. Most alts have copied the move downwards, resulting in a billion loss for the market cap.Bitcoin Tumbles On BitMEX NewsAs CryptoPotato reported yesterday, the US Commodity and Futures Trading Commission charged the owners of one of the largest Bitcoin derivatives exchange, BitMEX, for illegally operating the platform and anti-money laundering violations.Being such an important part of the cryptocurrency ecosystem, the BitMEX news immediately impacted prices within the industry.Following a few positive days, Bitcoin was hovering around ,900, but it vigorously dropped by about 0. In just minutes, the asset bottomed at ,450 (on Binance).BitMEX quickly issued

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, Bitmex, BNBBTC, bnbusd, BSVBTC, BSVUSD, BTCEUR, BTCGBP, btcusd, btcusdt, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, SXPBTC, SXPUSD, SXPUSDT, Total Market Cap, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

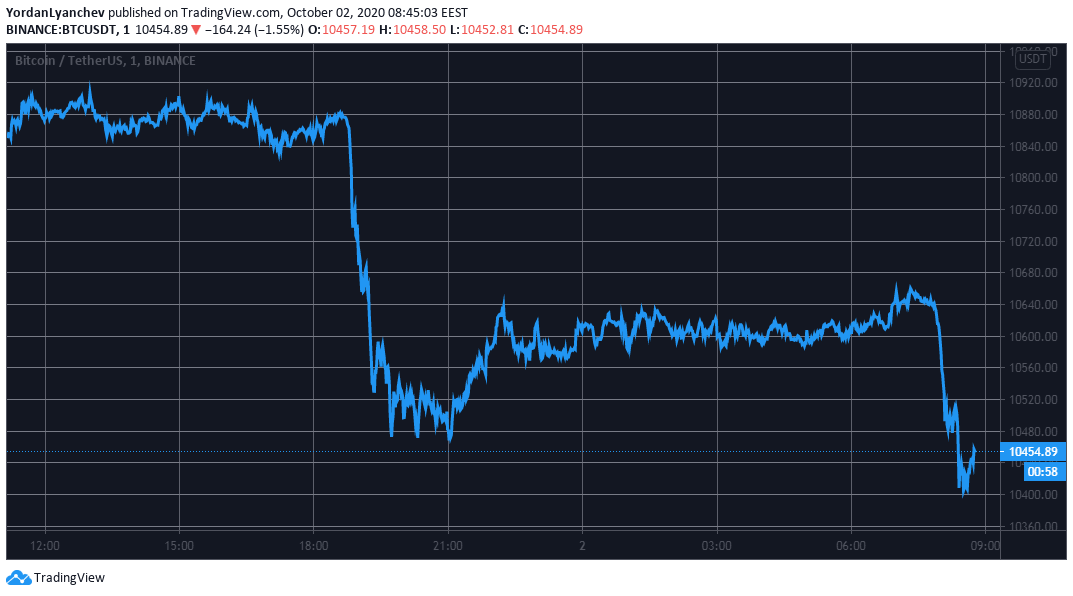

Bitcoin was riding high around $10,900 before dumping below $10,500 following the controversial BitMEX news from yesterday. Most alts have copied the move downwards, resulting in a $15 billion loss for the market cap.

Bitcoin Tumbles On BitMEX News

As CryptoPotato reported yesterday, the US Commodity and Futures Trading Commission charged the owners of one of the largest Bitcoin derivatives exchange, BitMEX, for illegally operating the platform and anti-money laundering violations.

Being such an important part of the cryptocurrency ecosystem, the BitMEX news immediately impacted prices within the industry.

Following a few positive days, Bitcoin was hovering around $10,900, but it vigorously dropped by about $450. In just minutes, the asset bottomed at $10,450 (on Binance).

BitMEX quickly issued an official response, claiming that the exchange has “always sought to comply with the applicable US laws.” Furthermore, BitMEX reassured that it will continue operating “entirely as normal” and that all funds are safe.

It seemed as the statement returned some confidence in the market as Bitcoin jumped back to $10,650. However, in the past few hours, the primary cryptocurrency has been losing even more value. At the time of this writing, BTC trades at $10,450 following a brief dip to $10,400.

Alts Mimic Bitcoin

As it typically happens in the cryptocurrency industry, when Bitcoin falls hard, so do alternative coins. This time was no different, and red dominates the entire market.

After exceeding $360 yesterday, Ethereum has tumbled by 4% and is down below $350. Ripple and Bitcoin Cash have lost 4% of value as well. XRP fights to stay above $0.23, while BCH is beneath $220.

The most substantial price drops from the top 10 come from Binance Coin (-7.5%), Polkadot (-6%), Chainlink (-7%), and BitcoinSV (-8%).

The situation among lower and mid-cap alts is even worse. Swipe leads this adverse trend with an 18% drop. Energy Web Token (-16%), Yearn.Finance (-15%), Arweave (-14%), Algorand (-13%), UMA (-13%), Decentraland (-12%), Synthetix Network Token (-12%), DFI.Money (-11%), and Enjin Coin (-10%) follow.

Overall, the total market cap has plummeted from $350 billion to $335 billion.