Most of the cryptocurrency market is retracing on a 24-hour scale despite increasing in value intraday. Bitcoin surged to nearly ,500 but is back below ,300, while Ethereum dips to 0.Bitcoin Stopped At ,500The positive news for the primary cryptocurrency is that its price remains in the five-digit territory. In fact, Bitcoin even increased towards its previous 2020 high at ,500 yesterday. However, the bears stopped it before having the chance to conquer it. Ultimately, BTC retraced to its current level of ,280.From a technical perspective, ,000 remains a critical support line. If it can’t sustain Bitcoin, the asset could decrease towards ,800 and potentially closing the CME gap at ,650.Alternatively, BTC has to overcome the first resistance at ,420 before

Topics:

Jordan Lyanchev considers the following as important: AA News, AMPLBTC, AMPLUSD, AMPLUSDT, BCHBTC, bchusd, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, defi, DOTBTC, DOTUSD, DOTUSDT, ERDBTC, ERDUSD, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

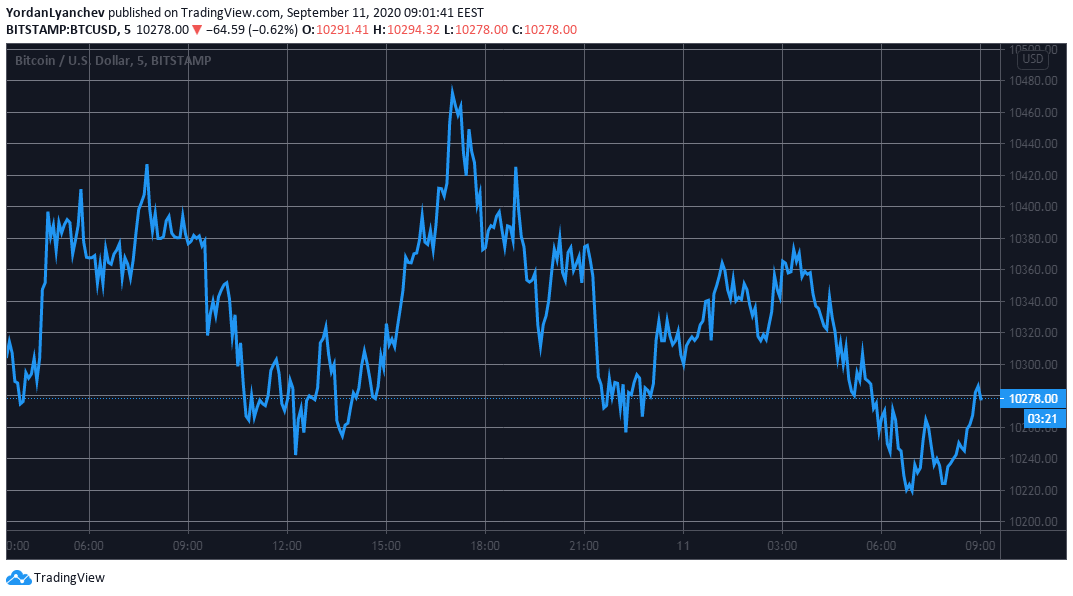

Most of the cryptocurrency market is retracing on a 24-hour scale despite increasing in value intraday. Bitcoin surged to nearly $10,500 but is back below $10,300, while Ethereum dips to $360.

Bitcoin Stopped At $10,500

The positive news for the primary cryptocurrency is that its price remains in the five-digit territory. In fact, Bitcoin even increased towards its previous 2020 high at $10,500 yesterday. However, the bears stopped it before having the chance to conquer it. Ultimately, BTC retraced to its current level of $10,280.

From a technical perspective, $10,000 remains a critical support line. If it can’t sustain Bitcoin, the asset could decrease towards $9,800 and potentially closing the CME gap at $9,650.

Alternatively, BTC has to overcome the first resistance at $10,420 before potentially challenging once again $10,500.

Bitcoin’s price developments yesterday resembled that of gold again. The precious metal traded $1,950 per ounce and surged to its intraday high of nearly $1,970. However, similarly to what transpired with Bitcoin, gold retraced to $1,940.

As reported recently by CryptoPotato, the two asset’s 60-day correlation has reached a new all-time high. On a lower scale, they displayed brief signs of decoupling, but it appears that gold and Bitcoin are charting similar moves again.

Altcoins Decrease In Value

After yesterday’s highly positive trading day, most alternative coins are in the red today. Ethereum is down by about 2% to $360, and Ripple (-2.5%) to $0.24.

The three coins fighting for the 5th spot in the past few weeks, namely Chainlink, Bitcoin Cash, and Polkadot, are also retracing. LINK is down by 6%, BCH by 2.5%, and DOT loses the most (-9%).

Further losses are evident from lower-cap alts, and particularly DeFi-related tokens. SushiSwap leads this adverse trend with a 25% drop, and Ampleforth follows with -22%.

Armweave (-14%), Kusama (-12%), Ren (-11.5%), Serum (-11%), Compound (-11%), Elrond (-11%), Solana (-10.5%), and THORChain (-10.5%) – all decrease by double-digit percentages.

Nevertheless, several coins are also increasing in value. IOST (13%) leads the way, Celsius follows by a 12% increase, and Yearn.Finance is next with 11% on a 24-hour scale.

It’s worth noting that the leading US-based exchange Coinbase Pro will list YFI on its platform. The asset price surged to $35,000 following the announcement but has retraced slightly to $33,000.